Demography of enterprises

Balance between open and closed enterprises returns to positive in 2019

October 22, 2021 10h00 AM | Last Updated: October 25, 2021 04h27 PM

Highlights

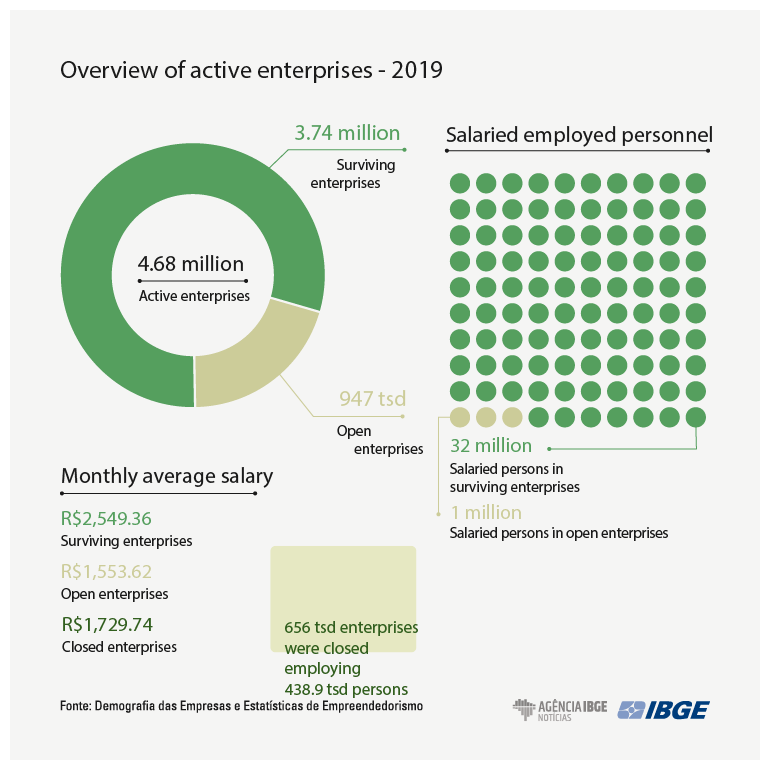

- In 2019, the rate of inbound enterprises was 20.2% (947.3 thousand) and that of exits stayed at 14.0% (656.4 thousand), producing a positive balance of 290.9 thousand enterprises.

- The balance of salaried persons, resulted from the dynamics of entry and exit of enterprises, wa also positive, with an increase of 595.5 thousand job positions.

- The average age of the enterprises was 11.7 years.

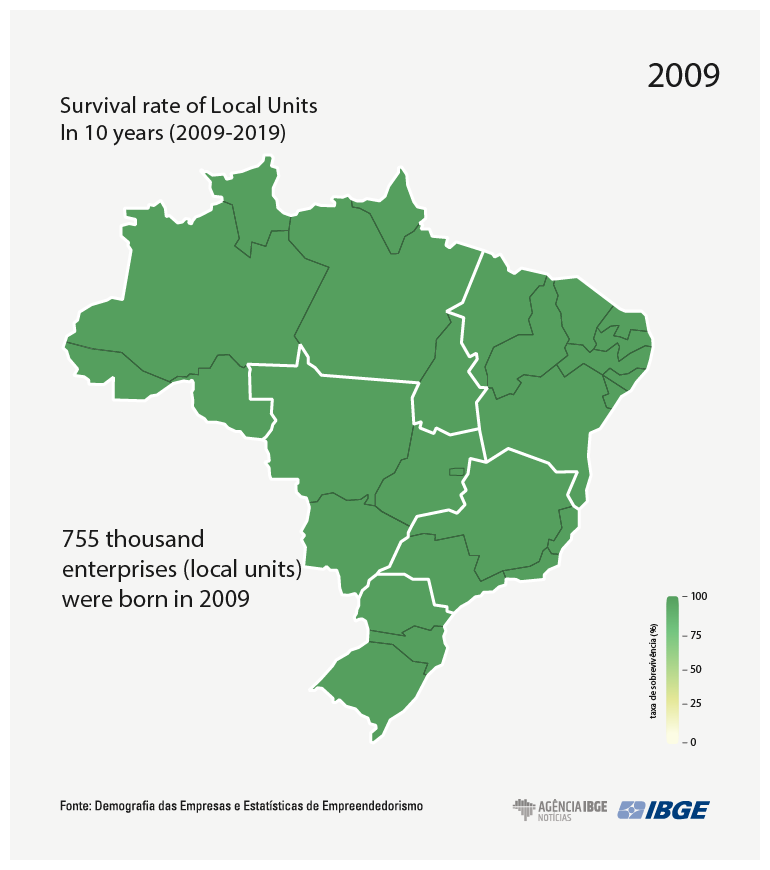

- Only 22.9% of the addresses (local units) of the enterprises complete 10 years of activity.

- Surviving enterprises employed 96.9% of the salaried persons, most of them men (60.7%).

- Number of high-growth enterprises advanced 10.0%, second consecutive year of growth.

- Amapá (13.2%) has the lowest survival rate of enterprises in the 10-year period and Santa Catarina (30.6%), the highest one.

- The "gazelle", high-growth enterprises with up to 5 years oage, added up to 2.8 thousand.

The balance between enterprises that opened and closed in 2019 in Brazil became positive once again at 290.9 thousand. After registering a negative balance of 65.9 thousand enterprises in 2018, the movement reversed in 2019, when 947.3 thousand enterprises entered the market and 656.4 thousand closed their doors. As a result, part of the shrinkage reported between 2014 and 2018 (loss of 382.5 thousand enterprises) reversed. The survival rate was 79.8%. The information is from the Demography of Enterprises and Statistics of Entrepreneurship study, released today (22) by the IBGE.

Thiego Gonçalves Ferreira, manager of the survey, explains that the data should be viewed with caution, especially in the comparison with previous years, since the survey faced a change in the methodology that defines active organizations, due to the new registration system adopted by the federal government.

“The government established a new system of administrative records for bookkeeping fiscal, social security and labor obligations, the so-called eSocial, which is replacing RAIS. Some of the information that exists in RAIS left eSocial and, therefore, the IBGE needed to adjust the selection criteria of active organizations,” explains Ferreira.

He highlights that one of the questions not included in the eSocial system is that where the enterprises declare they exerted or not their activities that year. “It is possible that some enterprises are formally active, though not operating in practice. When the Statistics of CEMPRE was released, we have already pinpointed a unusual rise in the number of active organizations with no persons employed, which was not noticed in the same proportion when one looked at the enterprises with at least one person employed,” highlights him.

In 2019, the Central Register of Enterprises (CEMPRE) added up to 4.7 million active enterprises that employed 39.7 million people, being 33.1 million (83.3%) as salaried persons and 6.6 million (16.7%) as partners or owners. The salaries and other compensation paid by those entities added up to R$1.1 trillion, with a monthly average salary of 2.5 minimum wages, the equivalent to R$2,530.76. The average age of the enterprises was 11.7 years.

The survey only takes into account business entities, excluding micro-businesses (MEIs), public administration offices, non-profit entities and international organizations that operate in Brazil.

Surviving enterprises employ 96.9% of salaried persons

Of the total number of active enterprises, 3.7 million were already active in 2018, which represents a survival rate of 79.8%. 947.3 thousand enterprises became active, of which 15.5% (726.5 thousand) were born that year and 4.7% accounted for re-entries (220.8 thousand). On the other hand, those that left the market added up to 14.0% of the enterprises (656.4 thousand enterprises).

Thiego Gonçalves Ferreira highlights that the surviving enterprises, in general, are bigger, as well as they account for most employments and pay higher salaries. That combination supposedly contributes to attract more professionals with higher education.

“The surviving enterprises stood out in terms of salaried employed personnel (96.9%), salaries and other compensation paid in the year (98.9%), value of monthly salaries (nearly 15% above the average) and for having 14.7% of their workforce with higher education. The inbound enterprises in 2019 had a share of 3.1% of salaried personnel and 8.4% of higher education, whereas those that left the market employed 1.3% of the salaried persons and 7.5% with higher education,” exemplifies him.

In the analysis of the enterprises according to the ranges of salaried employed personnel, smaller enterprises prevailed in relation to entries and exits. Nearly 77.4% of those that entered the market in 2019 had no salaried employed personnel, but only partners or owners, and 20.5% employed between 1 and 9 salaried persons. Concerning the exits, 78.5% did not employ any salaried person and 20.6% employed between 1 and 9 salaried persons, i.e., 97.9% of the entities that entered the market and 99.1% of those that left it in 2019 employed between 0 and 9 salaried persons.

Regarding the surviving enterprises, 42.2% did not employ any salaried person, 45.9% employed between 1 and 9 salaried persons and 12.0% employed 10 or more salaried persons. The biggest ones, with 10 or more employees, accounted for 72.5% of the total number of employed persons and 82.8% of the salaried persons.

Balance of salaried persons was positive, with 595.5 new job positions

With new inbound enterprises, a gain of 3.1% was registered in salaried employed personnel. With the exits, the loss of salaried employed personnel was nearly 1.3%. The final result was a positive balance of salaried persons of 595.5 thousand persons.

While in the dynamics of entries and exits of those entities the shares of employees with higher education were 8.4% and 7.5%, respectively, such share among the surviving enterprises was 14.7%, representing a difference of up to 7.2 percentage points (p.p.) between the events of survival and exit.

Concerning the distribution by sex, men accounted for most employment relationships in the active enterprises: 60.6% against 39.4% of women. The participation of women in the events of survival, entry and exit of those entities were, respectively, 39.3%, 41.3% and 42.7%.

When analyzing the survival of enterprises by range of salaried employed personnel, the bigger the size of the entities, the higher the survival rate. In the first year of observation (2015), the survival rate was 70.7% for the enterprises without any salaried person and born in 2014, 91.9% for the enterprises with 1 to 9 salaried persons and 95.2% among those with 10 or more salaried persons. After five years (2019), the survival rates according to the size were 32.1%, 49.1% and 64.5%, respectively.

Amapá has the lowest survival rate of enterprises and Santa Catarina, the highest one

The Demography of Enterprises unveils that reaching ten years is rather more difficult. Only 22.9% of the local units (branches) of the enterprises born in 2009 were still operating in 2019.

In regional terms, the South stands out with the highest survival rate in 10 years: 26.0%. It was followed by the Southeast (22.8%) and the Central-West (22.4%), which are close to the national average, though slightly below it. The Northeast (20.9%) and the North (19.0%) have the lowest indexes.

Among the states, Amapá (13.2%) has the lowest survival rate of enterprises in the 10-year period. On the other hand, Santa Catarina (30.6%) has the highest one.

“The microeconomic environment in which the enterprise is inserted, the human capital and the capacity to access credit are some of the factors that can explain the difference among the survival rates in each Federation Unit,” analyzes Thiego Gonçalves Ferreira.

High-growth enterprises advance more than 10.0% for the second year in a row

In 2019, the number of high-growth enterprises advanced 10.0% over 2018, rising for the second consecutive year, though still insufficient to recover the losses of the five previous years. 35.2 thousand enterprises were high-growth enterprises in 2012, the peak in the time series. In 2019, those enterprises added up to 25.0 thousand, which employed 3.3 million salaried persons and paid R$94.6 billion in salaries and other compensation, with a monthly average salary of 2.5 minimum wages.

High-growth enterprises are those with at least 10 salaried employees and that registered an average growth of their personnel of at least 20% per year, for three consecutive years. It is considered that part of that growth is related to entrepreneurship.

High-growth enterprises represented 1.1% of the active enterprises and 5.4% of the enterprises with 10 or more salaried persons. They were responsible for absorbing 12.1% of the workforce among the enterprises with 10 or more employees and for paying 9.7% of the salaries and other compensation.

“In spite of the growth recorded in 2019, the national economic scenario remains challenging for the enterprises to meet that criteria, since an average increase of 20% per year of the salaried employed persons for three consecutive years has been restricted to less and less enterprises. Another indicator of the challenge faced by the enterprises to meet that category is the reduction of their share in the contingent of those with 10 or more salaried persons. In 2008, high-growth enterprises represented 8.3% of the entities with 10 or more salaried persons, a proportion that continuously declined up to 2017, when it hit 4.5%. With the increase registered in 2019, that share rose to 5.4%,” comments Ferreira.

Nearly 2.8 thousand enterprises were “gazelles”

Of the total number of high-growth enterprises in 2019, 11.2% (2,805) were the so-called “gazelles”, which have up to five years of age. That share represents a drop of 0.2 percentage points over 2018, when they were 11.4%. In 2019, the “gazelles” absorbed 214.3 thousand salaried persons, being that the third lowest level of the variable since 2008 (the worst were in 2017 and 2018, both with 198.8 thousand salaried persons). The monthly average salary of the gazelle enterprises was 1.9 minimum wages in 2019, below the average value of 2.5 minimum wages reported by the high-growth enterprises.