Semiannual PINTEC

In 2023, innovation rate of industry drops for the second year in a row

March 20, 2025 10h00 AM | Last Updated: March 21, 2025 02h56 PM

Highlights

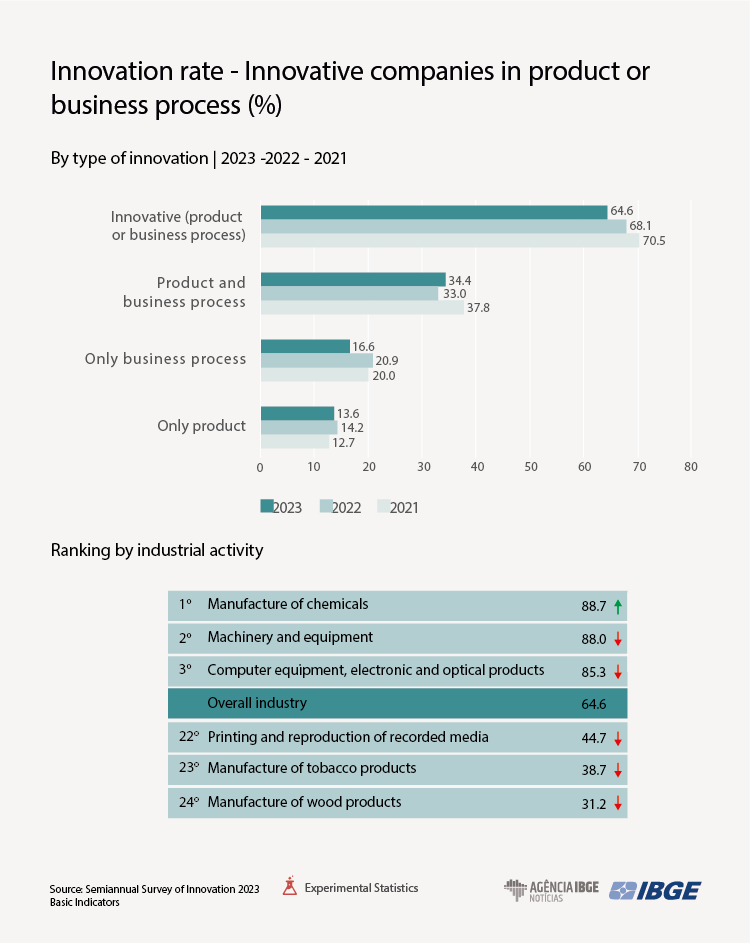

- In 2023, the innovation rate of industrial companies with 100 or more employed persons in Brazil was 64.6%, a drop in relation to 2022 (68.1%) and 2021 (70.5%).

- The innovation rate was higher in large companies, reaching 73.6% in companies with more than 500 employed persons.

- The sector of Manufacture of chemicals (88.7%) led the innovation ranking among the industrial activities, followed by Machinery and equipment (88.0%) and Computer equipment, electronic and optical products (85.3%). Manufacture of wood products (31.2%) was the least innovative sector.

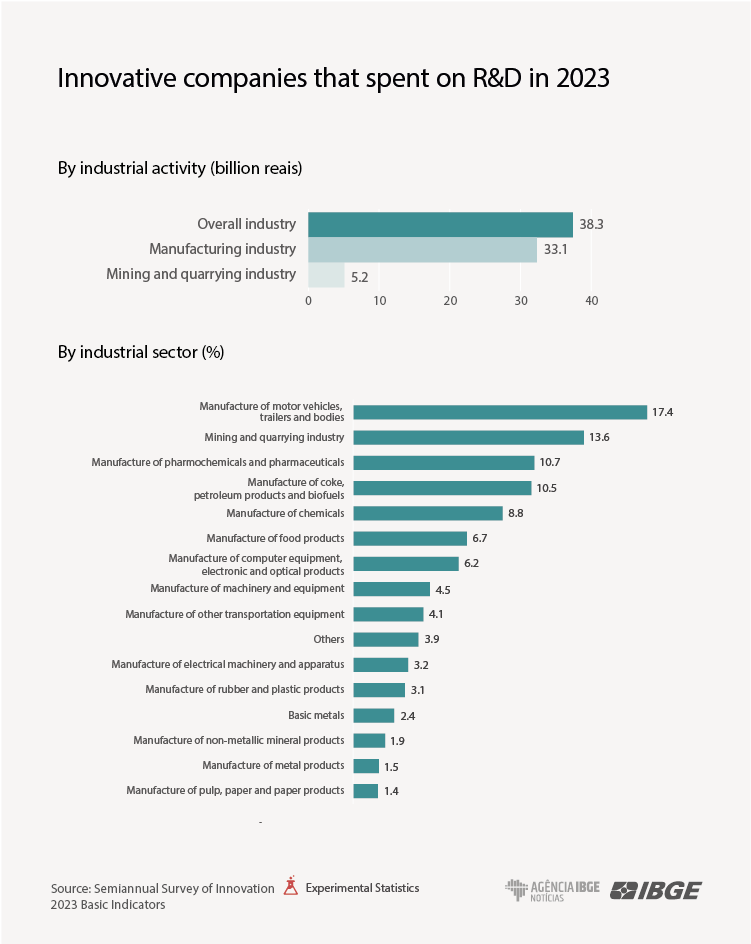

- Expenditure with R&D was around R$38.3 billion in 2023, a value higher than that reported in 2022 (R$36.8 billion) in nominal terms.

- The innovative companies of the Manufacturing industry accounted for 86.4% of that value (R$33.0 billion) and those of the Mining and quarrying industry, for 13.6% (R$5.2 billion).

- In nominal terms, expenditure in the Manufacturing industry increased (they were R$30.7 billion in 2022) and dropped in the Mining and quarrying industry (R$6.0 billion in 2022).

- In 2023, 34.3% of the companies invested in R&D. The rate exceeded 60% in the sectors of Manufacture of pharmochemicals, Manufacture of computer equipment, electronic and optical products and Manufacture of chemicals.

- Innovative companies used less public support in 2023 (36.3%) compared with 2022 (39.0%). Tax incentive to research and development and to technological innovation (26.4%) was the public support proportionally most used in 2023.

- 49.1% of the innovative companies expect to raise the expenditure with R&D in 2025.

The sector of Manufacture of chemicals (88.7%) led the innovation ranking among industrial activities in 2023 - Picture: Tecpar/Agência Paraná de Notícias

In 2023, the innovation rate of industrial companies with 100 or more employed persons in Brazil was 64.6%. That percentage refers to the companies that introduced a new or substantially improved product and/or incorporated a new or improved business process to one or more business functions. The index in 2023 is 3.5 percentage points lower than that registered in 2022 (68.1%) and 5.9 percentage points lower than that of 2021 (70.5%).

The data released today (20) by the IBGE are from the 2023 Semiannual Survey of Innovation (PINTEC): Basic Indicators, an experimental surveying carried out in partnership with the Brazilian Agency for Industrial Development (ABDI) and the Federal University of Rio de Janeiro (UFRJ). This edition brings information on aspects of the innovative behavior of companies, difficulties and obstacles to innovation, cooperating arrangements established, accomplishment and amount of expenditure in Research and Development (R&D), evolution and expectations on the accomplishment of activities and expenditure in R&D by companies, and public support to innovation.

"As expected, the rate in 2021 was relatively high in the post-pandemic period, since it comes from a depression period. Therefore, the following years might be years of adjustment, within a different macroeconomic scenario. It drops, though with some stability within the context. Another possible explanation is the drop in the investment rate of the economy, from 17.9% in 2021 to 17.8% in 2022 and 16.4% in 2023," highlights Flavio Peixoto, manager of the survey.

The most innovative sectors in product and/or business process in 2023 were: Manufacture of chemicals (88.7%), Manufacture of machinery and equipment (88.0%), Manufacture of computer equipment, electronic and optical products (85.3%) and Manufacture of pharmochemicals and pharmaceuticals (82.4%). On the other hand, the lowest rates of innovative companies were the sectors of Manufacture of tobacco products (38.7%) and Manufacture of wood products (31.2%).

In terms of type of innovation implemented in 2023, 34.4% of the companies innovated both in product and in business process; 16.6% innovated only in business process and 13.6%, only in product.

Innovations in business process were the majority in 2023, though percentage of companies that innovated this way decreased

In general, companies were more innovative in business process (51.0%) than in product (48.0%). The sectors of Machinery and equipment (76.1%), Electrical machinery and apparatus (64.5%) and Pharmochemicals and pharmaceuticals (63%) were the most innovative in processes, whereas the most innovative sectors in products were Manufacture of chemicals (81.5%), Manufacture of pharmochemicals and pharmaceuticals (80.9%) and Manufacture of computer equipment, electronic and optical products (77.7%).

"The analysis of the companies of the most innovative sectors shows that the proportions of product innovations were higher than those of business process," explains the manager.

Even being the majority among the innovative industrial companies in 2023, those that adopted a new or improved business process (51.0%) were proportionally more present in 2022 (53.9%) and 2021 (57.9%). The proportion of innovative companies in all the categories of business process relatively reduced in relation to the previous year. The exception was Production of goods or provision of services, which changed from 27.7% in 2022 to 29.4% in 2023, becoming the second most used category of business process innovation by industrial companies with 100 or more employed persons.

In contrast, innovative companies in product reduced between 2021 (50.5%) and 2022 (47.3%), though they grew in 2023 (48.0%). When the degree of novelty of the major product innovation is analyzed, 68.0% of the innovative products were new only to the company itself in 2023, virtually the same percentage as recorded in the previous year (68.1%). However, the proportion of new products for the domestic market increased (from 26.4% in 2022 to 27.6% in 2023) to the detriment of the companies that reported to have introduced new products to the global market (it dropped from 5.5% to 4.4% between 2022 and 2023). According to Flavio Peixoto, "there was a simplification of the new products available."

Large companies were more innovative

Compared with the years of 2021 and 2022, the number of innovative companies reduced nearly 3.5 p.p. in all the ranges of employed persons in 2023. The Semiannual PINTEC also showed that the innovation rates remain proportional to the size of companies, considering the ranges of employed persons. Small companies (from 100 to 249 employed persons) had an innovation rate (59.3%) lower than that registered in the range between 250 and 499 employed persons (70.8%), which, in turn, was lower than those companies with 500 or more employed persons (73.6%).

Mid and large industrial companies invested R$38.3 billion in R&D in 2023

In 2022, innovative industrial companies with 100 or more employed persons invested 38.3 billion in internal activities of R&D. The innovative companies of the Manufacturing industry accounted for 86.4% of that value (R$33.0 billion) and those of the Mining and quarrying industry, for 13.6% (R$5.2 billion).

In 2022, R$36.8 billion were spent in R&D. In nominal terms, expenditure in the Manufacturing industry increased (they were R$30.7 billion in 2022) and dropped in the Mining and quarrying industry (R$6.0 billion in 2022). "The drop in the mining and quarrying industry might represent a little amount, but it is important since they are few companies that spent nearly R$1 billion less from one year to the other," emphasizes Peixoto.

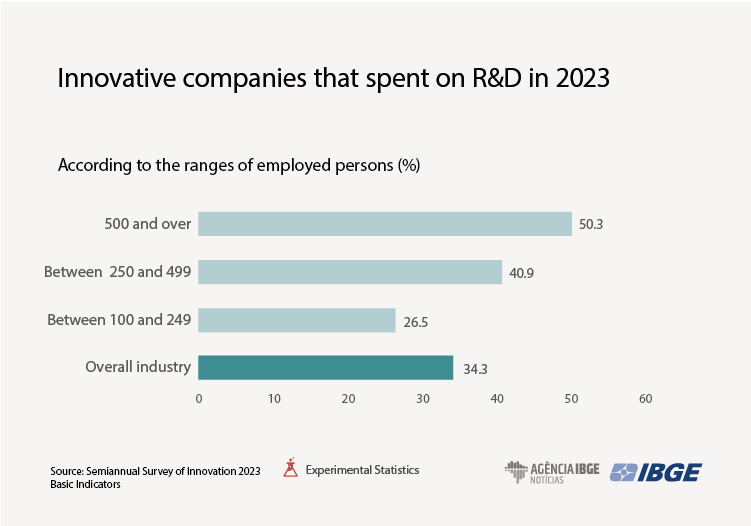

Albeit most of the investment in R&D is concentrated in large companies with 500 or more employed persons (84.6%), a relative loss in the participation in relation to the previous year (86.3%) is perceived. On the other hand, the participation of companies between 100 and 249 employed persons in the distribution of the expenditure in R&D changed from 5.9% in 2022 to 7.9% in 2023. The intermediate companies, between 250 and 499 employed persons, showed a relative stability.

"Historically, large companies always spent more, though the increase in the participation of smaller companies in the expenditure shows that they are engaging more and spending more in R&D. It is not so much, but the characteristics of those companies point out to a very interesting growth that shows a change, yet timid, in the innovative dynamics," analyzes the manager.

34.3% of the companies invested in R&D.

Concerning the proportion of industrial companies that invested in internal R&D in relation to the overall industry, the scenario was stable, changing from 34.4% in 2022 to 34.3% in 2023.

The sectors that mostly stood out in the proportion of companies that invested in R&D were Manufacture of pharmochemicals and pharmaceuticals (67.8%), Manufacture of computer equipment, electronic and optical products (66.9%) and Manufacture of chemicals (63.0%).

"Compared with the rates of innovation in product, the three major segments were the same that showed the highest proportions of innovative companies in product, highlighting the importance of the R&D activities in the development of new and improved products," notes Peixoto.

The analysis of the distribution of the expenditure by sector, the sector that mostly invested in internal R&D were: Manufacture of motor vehicles, trailers and bodies (17.4%), Mining and quarrying industries (13.6%), Manufacture of pharmochemicals and pharmaceuticals (10.7%), Manufacture of coke, petroleum products and biofuels (10.5%) and Manufacture of chemicals (8.8%). Altogether, they represented more than 60% of the total expenditure in 2023.

Public support was less used by innovative companies in 2023

The mechanisms of public support available were less used by innovative companies in 2023: 36.3% used some public support for their innovation activities, a proportion lower than that recorded in the previous year (39.0%).

Like in the other years, the mostly used mechanism of public support in 2023 was the tax incentive to research and development and to technological innovation, established in the Lei do Bem (Law no. 11,196/2005), comprising 26.4% of the innovative industrial companies with 100 or more employed persons.

Among the companies that used that instrument, the larger ones benefited the most (used by 48.6% of the innovative companies with 500 or more employed persons, by 27.6% of the companies between 250 and 499 employed persons and by 16.6% of the innovative companies between 100 and 249 employed persons).

Economic instability, competition and lack of resources were the major obstacles to innovative companies

In 2023, 47.6% of the innovative companies faced obstacles to innovate. For most of them, the major difficulty was economic instability (44.2%), followed by fierce competition (41.4%) and limited capacity of internal resources (42.1%).

Nealy half of the companies expect to increase expenditure with R&D in 2025

In 2025, 49.1% of the innovative companies expect to expand their investments in R&D compared with 2024. On the other hand, 48.8% of the companies expect to maintain their 2024 expenditures in 2025, whereas 2.1% of them expect to decrease their investments.

More about the survey

An experimental survey, carried out in partnership with the Brazilian Agency for Industrial Development (ABDI) and the Federal University of Rio de Janeiro (UFRJ), that investigated mid and large companies - above 100 employed persons - of the manufacturing and mining industries. The survey aims at portraying innovation in Brazil, raising information related to business investments in science, technology and innovation in Brazil.

The Semiannual PINTEC is annual (relative to the year before the data collection), with two semiannual investigations. In the first semester, rotating thematic indicators are investigated and, in the second one, basic indicators of innovation and R&D. The objective of the survey is to complement the IBGE´s traditional Survey of Innovation (PINTEC), with seven editions accomplished every three years since 2000, which will continue to be made.