PIMPMC and PMS

Industry, trade and services surveys are updated to portray economic changes

March 07, 2023 10h00 AM | Last Updated: March 15, 2023 02h42 PM

Highlights

- IBGE will update the Monthly Survey of Industry (PIM) Brazil and Regional, Monthly Survey of Trade (PMC) and Monthly Survey of Services (PMS). New historical series will be released.

- Updatings are expected in the methodology of the surveys and are periodically implemented by the IBGE.

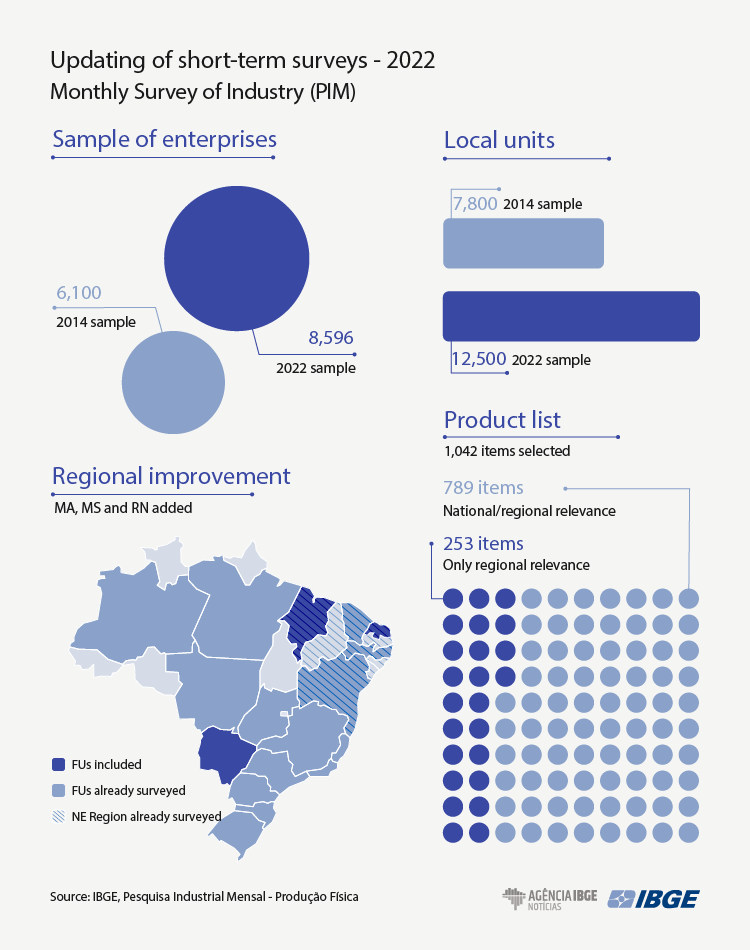

- The sample of PIM will amount to 8,596 enterprises and 12,500 local units, whereas the amount of products surveyed will change to 1,042 items, being 789 for Brazil and more 253 selected due to the regional relevance.

- Another new feature of PIM is the introduction of three new places: Rio Grande do Norte, Maranhão and Mato Grosso do Sul.

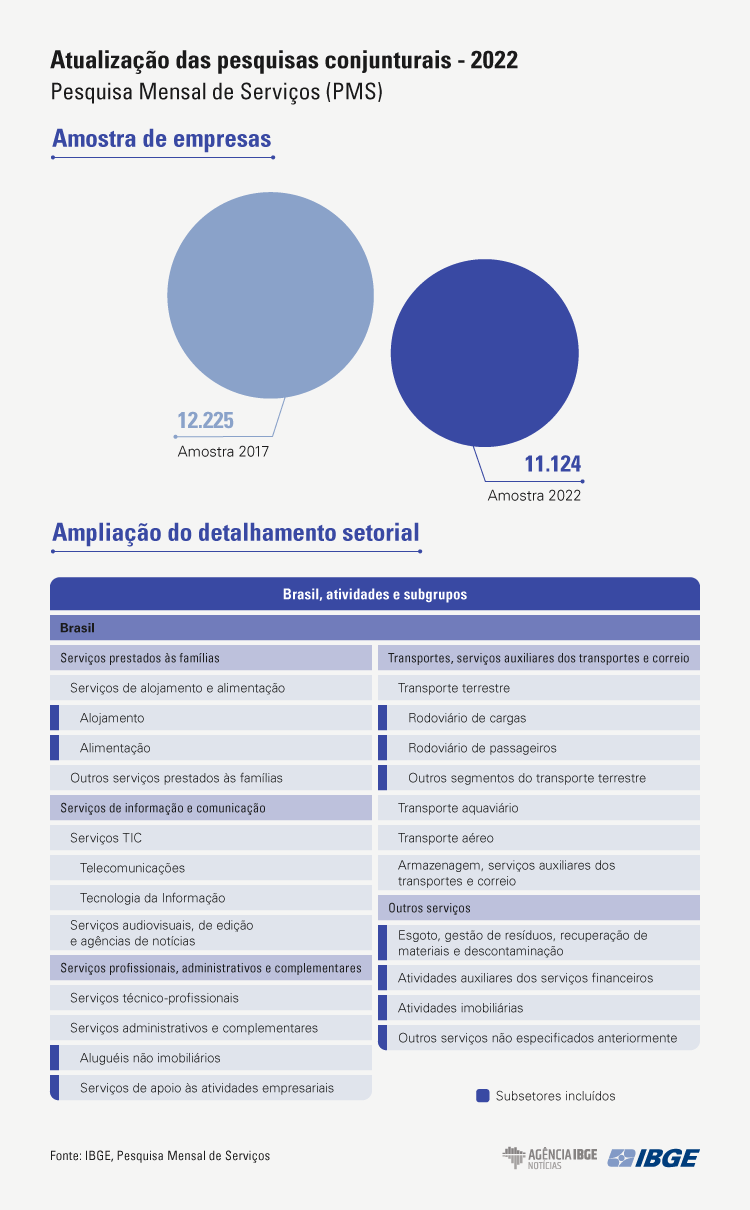

- The 2022 sample of the PMS comprises 11,124 enterprises and that of the PMC, 5,653 enterprises.

- The scope of the PMC changed to include the wholesale activities specialized in food, the so-called wholeretail.

- The PMS also improved the sectoral detailing of the sampling plan and updated the deflators for the metropolitan areas with specific IPCA indicators.

Between the end of March and the first fortnight of April, the IBGE will release the Monthly Survey of Industry (PIM) Brazil and Regional, the Monthly Survey of Trade (PMC) and the Monthly Survey of Services (PMS) for the month of January with new time series. The surveys updated the samples of enterprises and adjusted the weights of products and activities, as well as suffered methodological changes to portray economic changes in the society. These updates are expected to be periodically implemented by the IBGE.

The previous historical series will be chained with the new ones to form long and consistent time series. “Every update with a new sample, structure of weights and another set of products and enterprises breaks the historical series. Chaining is a statistical method aimed at linking data from the old base with the data from the new base and thus maintain the long time series of the surveys,” explains Flávio Magheli, IBGE Coordinator of Short-term Enterprise Surveys.

He adds that, from time to time, the base period should be updated to adopt weights that better reflect the current conditions - related to production technology and changes in the consumption pattern - in order to follow up the scenario closer to reality, producing indicators of better quality.

In the PMS, the final sample comprises 11,124 enterprises, whereas the final sample amounts to 5,653 enterprises in the PMC. In PIM, the sample will amount to 8,596 enterprises and 12,500 productive local units.

Monthly Survey of Industry will bring results for Rio Grande do Norte, Maranhão and Mato Grosso do Sul

In the case of PIM, the sample will comprise 8,596 enterprises and 12,500 local units against 6,100 and 7,800, respectively, in the previous model, whereas the amount of products surveyed will change from 944 to 1,042 items, being 789 for Brazil and more 253 selected due to their regional relevance. The selection of samples, national and regional, are independent. Some products not selected for Brazil might be chosen for a given Federation Unit or Region. Therefore, the set of products that comprise the national index is lower than the total number of products surveyed.

The updating was based on the registry of enterprises and products produced by the 2019 Annual Surveys of Industry Enterprise and Product, also conducted by the IBGE, which allow to pinpoint the structural characteristics of the Brazilian industrial activity. “Although it was not the last edition of the surveys, PIA 2019 was selected as 2020 was a unusual year due to the pandemic,” clarifies Magheli.

Another new feature is the introduction of three new places: Rio Grande do Norte, Maranhão and Mato Grosso do Sul, states that are above the level established to the industrial value added.

“Up to 2014, only states that had, at least, 1% of the industrial value added (VTI) according to PIA Enterprise were included. Due to requirements from state secretariats, we assessed that it would be convenient to reduce that value to 0.5% of the VTI. As a result, those three states were included for the local industrial indicator,” highlights Magheli.

Concerning the chaining of old and new time series, the reference of the survey in terms of weighting changed from 2010 to 2019. In other words, the year in which the weights of the activities are used in the calculation of the indexes changed from 2010 to 2019. The base year of 2012 is also being replaced by 2022.

“The time series released up to December 2022 remain frozen and available in the database of statistical tables called “Sidra”, as closed time series. From January 2023 onwards, new time series will be provided, chained with the previous ones. Chaining means looking for a link between the two time series in order not to lose the long time series. The baskets of products and their relative weights change, though the aggregates remain the same and can be compared,” reinforces the coordinator.

Beyond the increase from 944 to 1,042 products, weights and share changed. Some products left the basket, like sewing machines, antennas, mayonnaise, signal recorders or players, chewing gum, printed newspapers on demand and vinyl records. Other products were included as they gained share: from fruit soft drinks, juices and nectars ready for consumption, frozen fish and coconut water to GPS devices and industrial robots.

“The indicators are the same: index-number and month against immediately previous month change rate, month against same month in the previous year change rate, cumulative index in the year and cumulative index over the last 12 months. In terms of methodology, the fixed-base Laspeyres index remains,” completes the coordinator of short-term surveys. He notes that updates are necessary due to changes in the consumption patterns, evolution of the production technology, structure of the economy over time and evolving development applied in the process of production of short-term indicators.

“Depending on the changes in the economy, it is required to update and bring the reference point of the base closer. In the case of PIM, it is easy to understand when products previously relevant in the industrial output are not anymore and we need to update the basket, quitting the investigation of the production of sewing machines to investigate industrial robots and GPS devices. In the case of the PMC and PMS, the updatings are related, for example, to the changes in the consumption habits of families.

“In the PMS, some activities gained share, like those of delivery enterprises, ridesharing, music and movie streaming and cloud storage. If we do not update these baskets and weights, the indicators lose relevance as they become obsolete,” exemplifies Magheli.

The last time PIM was updated was in 2014, based on information from the 2010 Annual Surveys of Industry. At that time, 944 products began to be investigated, being 805 to comprise the Brazil indicator in nearly 7,800 local units. In the following years, major needs for new information have been pinpointed, due to changes in the economy and a gap in the sampling bases.

Magheli explains that, in the updatings, the places that will have indicators are assessed, which activities will be followed on a monthly basis and which products of these activities have the biggest share in the national economy according to PIA.

“Within each product selected in the new basket to be followed over time, we select enterprises and productive local units with the highest relative share in the generation of production value. We did that work during the pandemic, we produced a sample and showed them to the teams of the IBGE State Superintendencies, which gradually included new informants. The data collected from January to December 2022 will be used in the updating,” tells the coordinator of surveys.

Wholeretail stores will be included in the Monthly Survey of Trade

Concerning the other two short-term surveys, the 2022 sample of the PMS initially comprises 13,305 enterprises and that of the PMC, 6,773 enterprises, selected in October 2019. The data for that sample began to be collected in February 2020 and the initial planning was that 2020 would be the base-year. However, goals and deadlines changed due to the effects caused by the pandemic. The final sample of the PMS comprises 11,124 enterprises and that of the PMC, 5,653 enterprises.

The last update occurred in 2017, using the annual surveys as reference: Annual Survey of Trade (PAC) and Annual Survey of Services (PAS), both of them from 2014. At that time, nearly 6,157 enterprises were selected for the PMC and 12,225 enterprises for the PMS. In the following years, major needs for new information have been pinpointed, due to changes in the economy and a gap in the sampling bases.

In the sector of trade, the major needs are related to the improvement in the scope of the survey to include information from the wholesale of food products, beverages and tobacco, as well as to the updating of the deflators used (sub-items selected from the IPCA and metropolitan areas with indexes available).

“This time we are recovering what was done in previous updatings, before 2017. We created a sample, we collected information of revenue of the enterprises between January and December 2022 and we will calculate the reference base - the value that will be used as the basis - of the year of 2022. The results for January 2023 will be the revenues divided by the average revenue in 2022. That is important as we bring the most recent period, i.e., the reference is very close and it will attribute the weights of the activities. The relative shares of the activities, taking into account the gross revenues collected in the enterprises, will be anchored in 2022,” explains Magheli.

In the PMC, the scope of the survey was changed to include wholesale activities specialized in food, the so-called wholeretail stores. Up to now, the revenues of supermarkets classified as wholesale trade were not investigated, and an important part of the sales in this segment was not identified.

“It is an important change, because they are enterprises that gained strength during the pandemic. When we include them in the survey we have a better picture of the retail and wholesale food activity. It is related to changes in the consumption, because families began to consume or increased the consumption in these enterprises classified as wholesale in an environment of inflation and dropping income,” highlights Magheli.

Monthly Survey of Services will bring information for sectors of lodging and food separately

In the case of the PMS, the sectoral detailing of the table plan was improved and the sample of enterprises, updated. The goal was to reflect the importance losses and gains of certain services, due to technological innovations and changes in the consumption patterns.

“No new activity was included in the PMS. Yet, the sectoral detailing was improved. If the dissemination activity is aggregated today as ‘lodging and food’, we will have two different time series, one only for lodging and another one for food; in the case of administrative and complementary services, support services to business activities will have a dissemination activity and other non-real estate rentals will have another one,” explains Magheli.

Today, the transportation, support services to transportation and mailing aggregate has four branches: land transportation, water transportation, air transportation and storage, support services to transportation and mailing. From the results of January 2023 onwards, land transportation will branch off into cargo road transportation, passenger road transportation and other segments of land transportation.

Lastly, the major group classified as other services will have four branches: sewage, waste management, recovery of materials and decontamination; support activities to financial services; real estate activities; and other services.

Magheli adds that the deflators used in some groups will be updated. For example, the PMS uses an item to deflate the revenue of CNAE´s collective passenger road charter transportation. Currently, the IPCA´s public transportation item is used to deflate these revenues.

In the planning with the team of national accounts, we changed the deflator to a composite between intercity and interstate public bus. Likewise, the CNAE´s cargo road transportation, which is deflated by some IPCA items, will be deflated by toll and diesel fuel. And airport operations, whose revenues are deflated by the item airfare, will be deflated by the IPCA´s services. They are improvements from contributions pointed by users and discussions with the team of national accounts in order to use the same reference,” clarifies the coordinator.

In addition, deflators for the new metropolitan areas like Rio Branco (AC), Campo Grande (MS), Aracaju (SE), Vitória (ES) and São Luís (MA), for which the IPCA provided new specific indicators, were updated. “We are using the updating of the surveys to also update the deflators for those places. In the past, for example, the revenues of Espírito Santo were deflated with the deflator of the metropolitan area of Rio de Janeiro,” says Magheli.

Updating improves revision policy of PMC and PMS

The revision policy of the time series will be another change. Magheli explains that currently every IBGE survey has a revision policy of the data released. In the PMC and the PMS, the policy was to revise only the month before that of reference. He highlighted that, in the case of temporary inactivity or changes in the teams of enterprises that monthly attend the IBGE, and the data are not informed on the page of the survey, the protocol is to carry out a statistical imputation. In the moment that the normal flow is re-established and the IBGE receives the real data, the current policy does not amend the data from previous months.

“Now we can amend more months, in addition to the month before that of reference. In the moment that the information flow is re-established with the company, we will have up to one year to incorporate the new information to improve the time series,” clarifies Magheli.

The legislation establishes that enterprises should provide information and, in return, the IBGE should keep the confidentiality and provide a statistical-only use of the information.

“According to Law no. 5,534, of November 14, 1968, provision of information by enterprises is not only mandatory, but also a matter of social responsibility for the country to know its reality and economic dynamics. In other words, every physical and legal person has its statistical confidentiality guaranteed and should provide statistical information to the IBGE, knowing that every information provided will be used exclusively for statistical purposes. The principles of information security and personal data treatment followed by the IBGE can be checked in the Security Policy of Information and Communications, available on the IBGE portal,” concludes Magheli.