Monthly Survey of Trade

Retail sales up 1.8% in April - highest increase for the month since 2000

June 08, 2021 09h00 AM | Last Updated: June 10, 2021 10h44 AM

Sales in retail trade rose 1.8% from March to April, the biggest increase for the month since 2000, after falling by 1.1% in March. As a result, retail was 0.9% above the pre-pandemic level. The sector has accumulated growth of 4.5% in the year and 3.6% in the last 12 months. The data are from the Monthly Survey of Trade (PMC), released today (June 8) by the IBGE.

The positive result reached seven of the eight activities investigated by the survey. The biggest increase was that of Furniture and household appliances (24.8%). Other positive changes came from the sectors of Textiles, apparel and footwear (13.8%), Office, computer and communication equipment and materials (10.2%), Other personal and household articles (6.7%), Books , newspapers, magazines and stationery (3.8%), Fuels and lubricants (3.4%) and Pharmaceutical, medical, orthopedic articles and toiletries (0.9%).

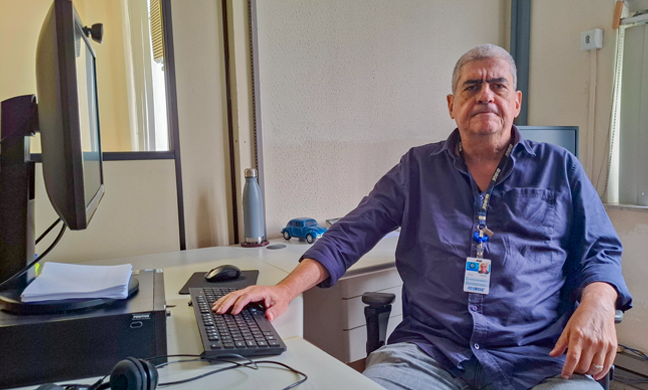

The sector of Hypermarkets, supermarkets, food products, beverages and tobacco (-1.7%) was the only one to have retraction compared to the previous month. This drop meant that the general index was not higher in April, since the sector represents almost half (49.2%) of the sales volume surveyed. “Family consumption changed in terms of structure at the beginning of the pandemic. What has happened is that, in some sectors, consumption has been concentrated at specific times of the year. Previously, these moments were very marked, such as Black Friday and Christmas, now the scenario has changed”, analyzes survey manager Cristiano Santos.

According to the researcher, the sales weeks, already common in the trade calendar, have been losing steam. "This ends up happening because purchases are more digital nowadays, allowing certain sectors to offer sales outside of these seasons and causing a certain wave of purchases in different periods of time." For him, this makes some families stop consuming products from a particular sector to buy them in specific promotional seasons.

Mr. Santos explains that there were many inversions between activities in April. “Some activities that were doing well started to fall and others that were falling started to grow. April was a time when large furniture and home appliance stores ended up focusing on household consumption income”, he says.

In the extended retail trade, which includes, in addition to retail, the activities of vehicles, motorcycles, parts and pieces (20.3%) and construction materials (10.4%), the increase in sales volume was 3.8 %. Both activities had retreated in the previous month.

“What we see is that volatility is increasing month by month. If we look at the latest indices, we will see that trade has been having more gain-loss moves. One month ends up offsetting the other, because in one month there was a higher income and the other month there was a lower income. There are also some advances in promotion seasons in some sectors”, highlights the researcher.

Retail grows 23.8% compared to April 2020

In comparison with April last year, the volume of retail sales grew 23.8%. It is the second consecutive positive rate in this indicator. The extended retail trade registered an increase of 41.0%, the second consecutive growth and the highest in the series in the indicator that compares the result of the month with the same month of the previous year. The record increase is explained by the low base of comparison.

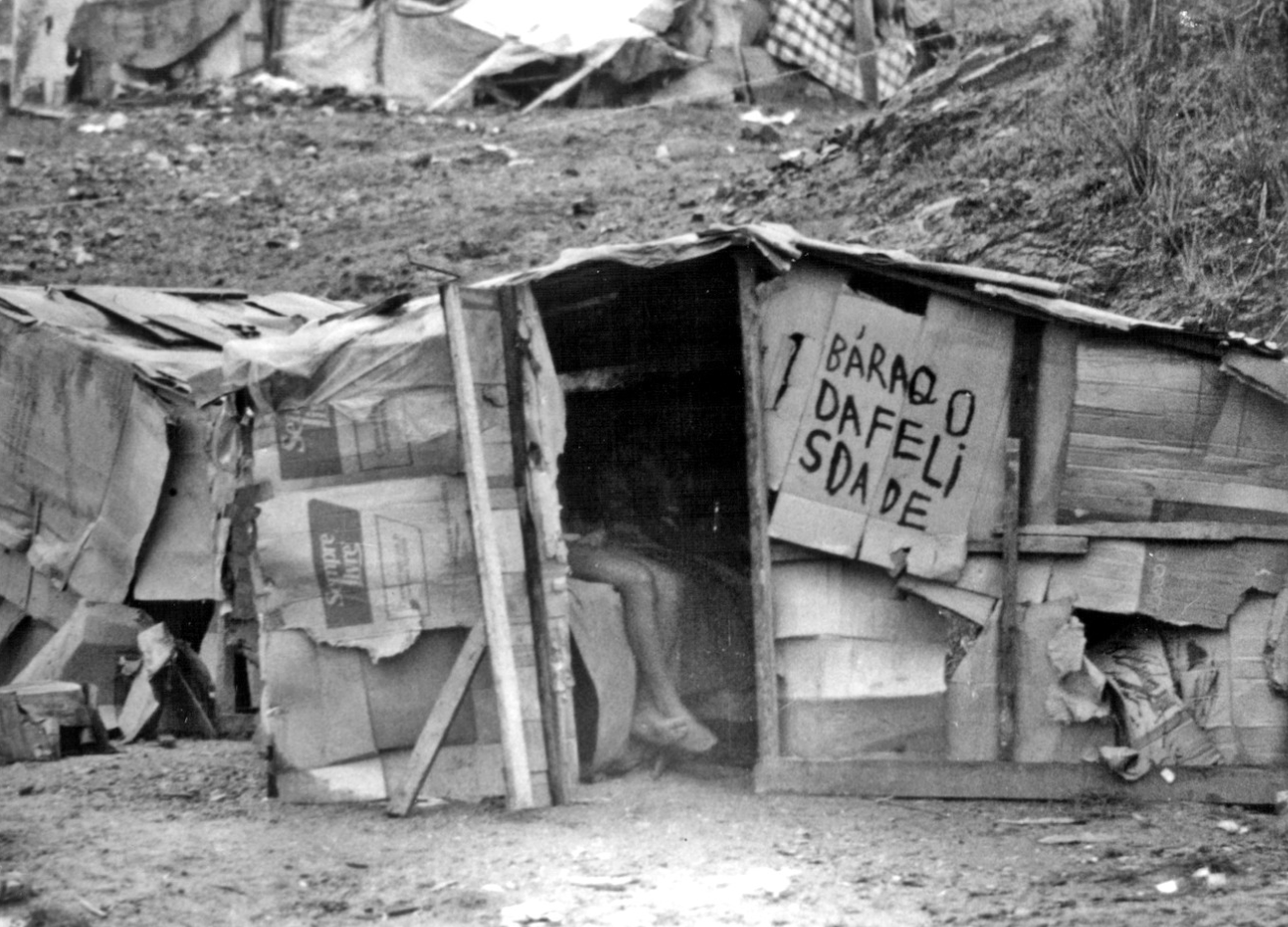

“In April 2020, it was the biggest fall of the index in the time series of the PMC. So when we look at these large changes, we need to remember that many of these stores reported a very large loss of revenue. For example, if a store had a turnover of R$100 thousand and in April it only sold 10%, then, if it grows 100%, it goes from R$10 thousand to R$20 thousand. In other words, the level is still very low compared to the scenario before the pandemic”, explains Mr. Santos.

In this comparison, the activities that had the greatest impact on total retail were: Other personal and household articles (104.4%), Textiles, apparel and footwear (301.2%), Furniture and household appliances (71.3%) , Pharmaceutical, medical, orthopedic, articles and toiletries (34.1%), Fuels and lubricants (19.9%), Office, computer and communication equipment and materials (47.1%) and Books, newspapers, magazines and stationery (95.9%).

As in the comparison with March this year, the sector of Hypermarkets, supermarkets, food products, beverages and tobacco (-1.7%) was the only one to show a drop. It was the third consecutive negative rate for the sector in this comparison.

Retail grows in 21Federation Units

In April compared to the previous month, retail trade grew in 21 of the 27 Fedeation Units. Among the highlights are the Federal District (19.6%), Rio Grande do Sul (14.9%) and Amapá (10.8%). Mato Grosso (-1.4%), Alagoas (-1.1%) and Sergipe (-0.8%) exerted negative pressure. Espírito Santo and Roraima showed stability (0.0%).

In the extended retail trade, there was also a predominance of positive results. Among the 25 Federation Units that had an increase in the sales volume, the highlights were Ceará (18.7%), Bahia (17.7%) and Tocantins (17.2%). The two states that had negative changes were Roraima (-1.5%) and Alagoas (-0.8%).

In comparison with April of last year, the retail registered positive results in the 27 Federation Units. The highlights, in terms of change, were Amapá (86.0%), Rondônia (75.0%) and Amazonas (53.4%). São Paulo (22.8%), Rio de Janeiro (24.9%) and Minas Gerais (22.4%) were the states with the largest participation in the composition of the retail rate.

More about the survey

The PMC produces indicators that make it possible to monitor the current behavior of retail trade in the country, investigating the gross resale revenue of formally incorporated enterprises, with 20 or more persons employed, and whose main activity is retail trade.

Started in 1995, the PMC brings monthly results of the changes in the sales volume and nominal revenue for the retail trade and extended retail trade (cars and construction materials) for Brazil and Federation Units. The collection technique is the Electronic Self-Filled Questionnaire (CASI) and the Personal Interview with a Paper Questionnaire (PAPI). The results can be found at the Sidra database.