Annual Survey of Industry

PIA Product 2021: iron ore remains the major product, food industry leads industrial activities

June 29, 2023 10h00 AM | Last Updated: June 29, 2023 04h51 PM

Highlights

- The ten major products concentrated 22.4% of the net revenue of sales in 2021, a share higher than that registered in 2020 (20.9%).

- After surpassing crude petroleum oil in 2020, iron ore remained as the product with the highest revenue (R$242.1 billion) and share (5.6%) in the Brazilian industry.

- The five major activities concentrated 54.0% of the value of the net revenue of sales (NRS) of products and services of the Brazilian industry in 2021, a share that remained virtually stable in relation to that registered in 2020 (53.9%).

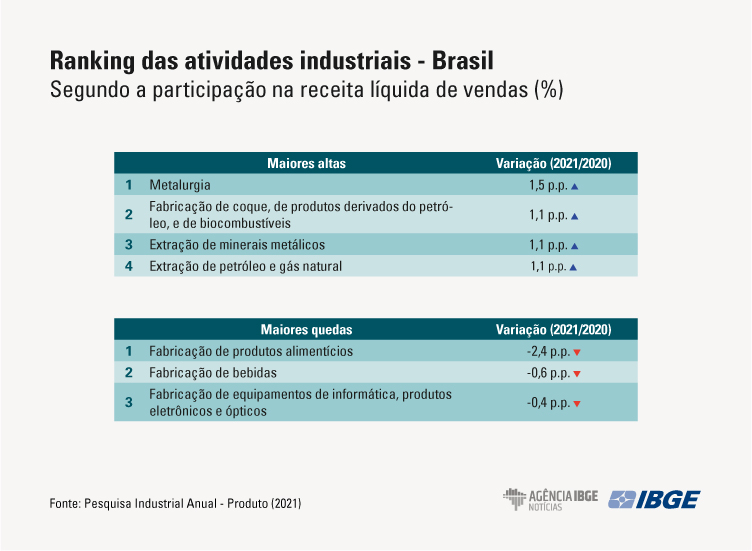

- Between 2020 and 2021, the loss in the share of the food industry stood out, changing from 19.3% to 16.9% of the NRS. Nonetheless, that activity remained in the first position in the ranking.

- On the other hand, the manufacture of coke, petroleum products and biofuels gained 1.1 p.p., and basic metals, 1.5 p.p. in the NRS in 2021.

- Four out of five industrial products with the biggest gains in the share in the NRS belong to basic metals.

- With the deconcentration of the industrial activities in Brazil, the Southeast was the only region to lose share in the NRS in ten years, dropping from 58.9% to 54.2%.

- The regions that mostly gained share in the industrial revenue in ten years were the North (from 6.1% to 8.3%) and Central-West (from 5.5% to 7.1%).

These is some information from the Annual Survey of Industry - Product (PIA Product) 2021, which investigated nearly 3,400 industrial products and services in 32.8 thousand enterprises with 30 or more employed persons and in their 39.3 industrial local units. Those local units generated R$4.4 trillion in net revenue of sales (NRS) in 2021.

Among the largest shares in the NRS in 2021, iron ore was the leader with 5.6%, 0.8 p.p. larger than in 2020. With a revenue of R$242.1 billion, this product was impacted by the increase in the international price and by the dollar valuation, which favored exports, especially to China. Due to the increase in the price of the petroleum barrel, crude petroleum oil also maintained the second position in the ranking, with a net revenue of R$180.0 billion and a total share of 4.1%.

Between 2020 and 2021, fresh or cooled beef exchanged position with diesel fuel, which rose from the fourth to the third position: diesel fuel added up to R$113.1 billion with a share of 2.6% in the NRS, whereas beef hit R$79.8 billion, with a share of 1.8%.

Ethyl alcohol (ethanol) not denatured for fuel purposes (R$70.0 billion and 1.6%) rose to the fifth position, exchanging with cakes, bagasses, crumbs and other residues of soybean oil extraction (R$67.4 billion and 1.5%). “The 2021 results reflect an economic scenario of upturn after the peak of the COVID-19 pandemic,” highlights Synthia Santana, Manager of Structural Analysis.

Ten products concentrate 22.4% of net revenue of sales in 2021

The ten products with the highest revenues added up to 22.4% of the net revenue of sales in 2021 against 20.9% in 2020. Among the 100 major products, those that mostly gained positions over 2020 were impacted by international prices.

“Of the products that mostly gained positions, four were linked to basic metals, which illustrates the advance of this industrial activity. Basic metals products are very tied to international prices, which rose in 2021. As a result, other activities had their costs increased in the domestic market due to the price of steel. There was a chain effect,” says Synthia Santana.

Ten activities concentrate 77.1% of the industrial revenue in 2021

In 2021, the top ten shares in the net revenue of sales were: food products (16.9%), chemicals (10.8%), coke, petroleum products and biofuels (9.8%), motor vehicles, trailers and bodies (8.0%), extraction of metallic minerals (7.0%), extraction of petroleum and natural gas (4.7%), machinery and equipment (4.5%), rubber and plastic products (3.7%) and pulp, paper and paper products (3.2%).

“It is important to highlight the power of the commodities and of the food industry, as the production of cooled beef and poultry meat or giblets is among the ten first activities. The car industry loses share in relation to 2020 in a very specific type of car. The ten major activities concentrate 77.1% of the industrial NRS against 74.7% in 2020,” analyzes Synthia Santana.

Compared with 2020, the industrial activities that mostly gained share in the NRS were basic metals (1.5 percentage points), extraction of metallic minerals (1.1 p.p.), extraction of petroleum and gas (1.1 p.p.), coke, petroleum products and biofuels (1.1 p.p.) and machinery and equipment (0.3 p.p.). In contrast, the sectors that mostly lost share were food products (-2.4 p.p.), beverages (-0.6 p.p.), computer, electronic and optical products (-0.4 p.p.), electrical machinery and apparatus (-0.3 p.p.) and pharmochemicals and pharmaceuticals (-0.3 p.p.).

Southeast is the only region to lose share

In ten years, a reduction in the concentration of the industrial activities in Brazil is noticed. The share of the Southeast drops 4.7 p.p., whereas that of the Northeast remains stable and that of the North increases 2.2 p.p., that of the South rises 0.8 p.p. and that of the Central-West grows 1.6 p.p. “There are two reasons: the displacement of some industrial plants to the Central-West, especially the food industry, and the increase in the share of the North Region, with the price increase of the mining and quarrying industry,” analyzes Synthia Santana.

The concentration of the revenue on the three major products of each region might be an evidence of the specialization of the regional production. The highest levels of concentration occurred in the North (42.2%) and Central-West (26.2%).

The North Region accounts for 8.3% of the NRS in Brazil and its major products are based on the extraction of metallic minerals and on the manufacture of electric-electronic products in the Free Zone of Manaus, though the output of meat has been growing over the last years.

In the Northeast, responsible for 9.7% of the Brazilian industrial revenue, the highlights were diesel fuel (3.4%), fuel oils (3.1%) and carbon-steel ingots, blocks, billets or plates (2.8%) which, together, account for 9.3% of the total revenue. “Basic metals products were not included in this ranking in 2012 and gained more space in 2021,” says Santana.

The Southeast concentrates 54.2% of the industrial sales and has the largest petroleum basins in Brazil, the major petroleum refineries and the ferriferous four-side in Minas Gerais. “Crude petroleum oil (7.5%), iron ore (5.1%) and diesel fuel (2.8%) added up to 15.4% of the NRS of the region,” highlights the manager.

In the South Region, which accounts for 20.6% of the national sales, the highlights came from diesel fuel (3.2%), frozen poultry and giblets (3.1%) and cakes, bagasses and crumbs from soybean oil extraction (2.6%), which reached 8.9% of the sales value in the region.

The Central-West has 7.1% of the industrial revenue in Brazil, highlighted by agro-industry: cakes, bagasses and crumbs from soybean oil extraction (9.6%), cooled or fresh beef (8.8%) and ethyl alcohol (ethanol) not denatured for fuel purposes (7.8%) accounted for 26.2% of the sales in the region.