Enterprise Pulse Survey

Enterprises report to be less affected by Covid effects in 2nd half of August

October 01, 2020 09h00 AM | Last Updated: October 22, 2020 07h10 PM

In the second half of August, of the 3.4 million enterprises in operation, 33.5% perceived negative impacts caused by the pandemic on their activities. In the previous fortnight, the figure had been 38.6%. But for 37.9%, there was little or no impact; and, for 28.6%, the effect was positive.

The improved perception affects all enterprises, which signaled a higher incidence of small or nonexistent effects in the fortnight than of negative impacts. This becomes evident in large-sized (52.6%) and medium-sized enterprises (43.3%) but also among small-sized ones (37.8%). Medium-sized enterprises were the ones that most felt positive effects (33.8%).

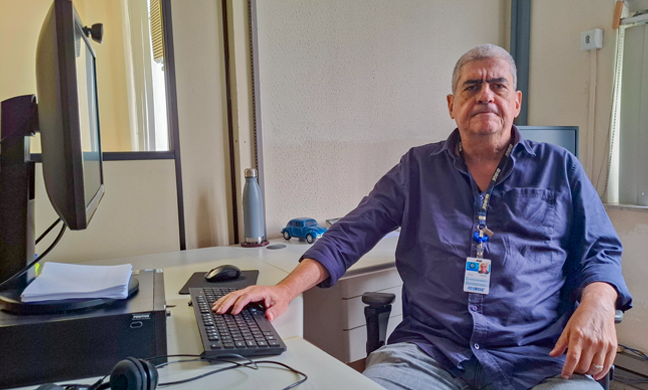

Such information is provided by the last edition of Enterprise Pulse Survey: Impact of Covid19 on Enterprises, released today (Ocobter 1), by the IBGE. Flávio Magheli, coordinator of Enterprise Short-Term Surveys, points out that Pulse initially aimed to assess the situation of enterprises in relation to the pre-pandemic period and then monitor them over the last three months.

“Firstly, we noticed negative impacts related to the demand - sales, production and service - due to the closing of stores and social isolation. Then, the major concerns were those related to the supply, due to the difficulties in reaching suppliers”, analyzes Mr. Magheli.

According to the researcher, there was a process of gradual resumption of activities, influenced by relaxation measures in states and municipalities. As a result, enterprises began to perceive less and less negative impacts. "But the municipalities took diverse actions and, despite the opening trend, many still operate under time and capacity restrictions", explains the coordinator.

Once again, as in the previous fortnight, construction (40.0%) and trade enterprises (36.0%) reported the highest incidence of negative effects in the fortnight. On the other hand, 40.3% of industrial enterprises reported small or nonexistent impacts and, in the services sector, the incidence was 43.2%, specially in the segments of information and communication services (68.7%) and transportation services (48.8%).

“Among the sectors, at the beginning of the survey, there was a strong incidence of difficulties in industry, construction, services and mainly in trade, due to the great dependence of small businesses on physical stores. Over these three months, there was gradual recovery, but at the end of August 33.5% of the enterprises still indicate some difficulty”, says the expert.

Regionally, the general negative impacts lose their predominance over the fortnight to the highest incidence of no or positive effects. In the second half of August, the South was the most negatively impacted region (37.2%), followed by the Southeast (35%). The effects were small or nonexistent for 37.4% of the enterprises in the North region; 37.3% in the Southeast; 42.9% in the South and 40.7% in the Central-West.

“The highlight goes to the greater perception of positive effects by Northeastern enterprises (45.0%). Several activities started to operate in the Northeast: street commerce, intercity transportation, in addition to expansion of hours”, explains Mr. Magheli.

Construction sector is most affected with perception of reduced sales

Regarding sales, there is a balance between perceptions of reduced sales (32.9% of enterprises); small or no impacts (34.7%); and an increase in sales (32.2%). Together with "no" and "positive" effects, the figure reaches 66.9%.

The highest incidence of no effects and/or increased sales reached all sizes of enterprises. Among those medium-sized ones, 79.9% reported no effect and/or increase in sales, while 19.8% reported decrease. Among small-sized enterprises, 66.7% reported no effect and/or increase in sales and 33.1% perceived reduction in sales.

By sectors, construction was the most affected by the perception of reduced sales (42.7%). But for 38.3% of industrial enterprises and 43.6% of service enterprises, the incidence of small or no effects on sales prevailed. For 40.7% of trade enterprises, the highest incidence of positive effects stands out, specially in retail trade (43%) and vehicles, parts and motorcycles (46.6%).

Regionally, sales increased in the North (44%), Northeast (58.6%) and Central-West (40.5%) regions. In the South (40.6%) and in the Southeast (36%) there was a higher incidence of decrease.

More than half of the enterprises do not feel negative impact on manufacture of products or customer service

For 54.4% of the enterprises, there was no significant change in the manufacture products or customer service; while 31.4% had difficulties and 13.9%, found them easy to carry out. In addition, 46.8% had difficulties in reaching their suppliers and 44.1% did not see any change.

About 40.3% of the enterprises had difficulties in making regular payments in the second half of August, while 53.0% considered that there was no significant change in this item.

9 out of 10 enterprises managed to keep jobs

As for employed persons, since the beginning of the series, most enterprises have sought to keep their employees. In the second half of August, 85% of the enterprises in operation (2.9 million) maintained the number of employees in relation to the previous half; 8.1% indicated a reduction; and 6.3% (218 thousand) expanded their staff.

Among the estimated 280 thousand enterprises that laid off workers, 56.8% reported that their personnel decreased by up to 25%, especially in smaller enterprises (55.8%).

The carrying out of information and prevention campaigns, and the adoption of extra hygiene measures continue as the main initiatives to face the pandemic, being adopted by 93.1% of the enterprises. Another 28.6% changed the method of delivering products or services; 25.7% adopted WFH; 20.1% brought vacations forward; and 23.8% postponed the payment of taxes.

“Along these six fortnights (three months) the perception of enterprises has been more positive, but the effect of sales decrease, manufacture and customer service reduction, difficulties in accessing suppliers and inputs and in making payments is still part of the routine of enterprises”, summarizes Mr. Magheli.

In this sixth and last edition of Enterprise Pulse Survey: Impact of Covid19 on Enterprises, which is part of IBGE's Experimental Statistics, Flavio Magheli points out that the survey was planned to have its results timely published as a complement to other short-term indicators, providing relevant additional information to assess business activities and the effects of the pandemic.

“Traditionally, in IBGE short-term surveys, monthly quantitative information is collected to present performance. With Pulse, the IBGE was able to investigate, every fifteen days, the perception of enterprises in relation to the effects of the pandemic, its impact on sales, on customer service, manufacturing of products, regular payments, changes introduced and access to suppliers. In addition, it also revealed the main measures taken to mitigate the effects of the pandemic”, concludes Mr. Magheli.