Public Finances

Government Net Borrowing drops by 77.5% in 2021

November 23, 2022 10h00 AM | Last Updated: November 24, 2022 02h50 AM

Highlights

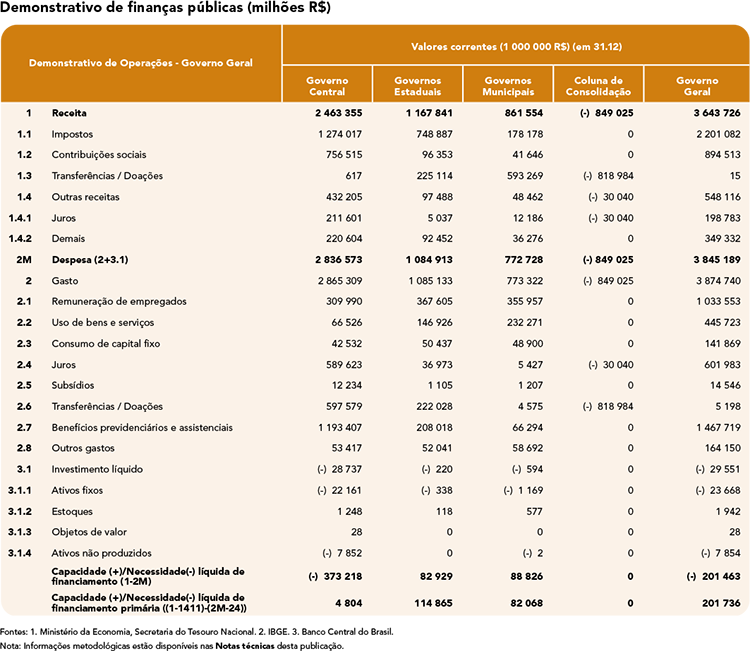

- In 2021, government net borrowing fell by 77.5% from 2020, and amounted to R$ 201.5 million.

- Total revenue increased by 25.8% and government expenditure at the three spheres increased by 1.8%.

- In 2021, there was a decrease of 15.7% in social security and assistance benefits paid, main reason accounting for the increase of only 1.8% in expenditure.

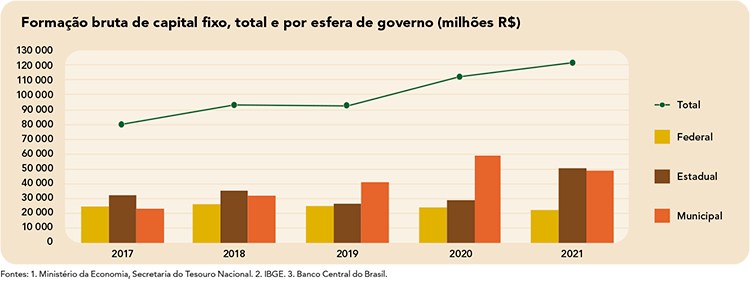

- Gross fixed capital formation was up 7.6%, and hit R$ 121.2 billion.

In 2021, public finances were marked by evolution against the previous year, when they had been severely affected by the COVID-19 crisis. Government net borrowing amounted to R$ 201.5 billion, which represents a decrease of 77.5% from 2020. This result reflects mainly the growth of 25.8% in total revenue in comparison with the increase of 1.8% in expenditure at the three levels of government. Information comes from Public Finance Statistics, released today (23) by the IBGE.

The performance of revenue was due to the positive change in all its components: tax revenue (28.2%), social contributions (12.1%) and other revenue (43.9%).

The manager of Public Administration for the Coordination of National Accounts, Douglas Moura Guanabara, assessed some points affecting the drop in net borrowing in 2021. “That was a combination of two factors: a significant increase in revenue, mainly due to the recovery of economic activity in the post-pandemic period, and reduction of expenditure, mainly of resources used in the year to face the pandemic.”

As for taxes, all the items recorded positive changes

All the items in relation to taxes, with a highlight to taxes on trade and international transactions (35.7%), taxes on income profit and capital gains (32.6%) and taxes on goods and services (27.2%). Taxes on property increased by 17.8%, whereas taxes on payroll increased by 12.7% in relation to 2021.

In the case of taxes on trade and international transactions, the increase of revenue is related to the growth by 38.2% in value of imports (dollar). As for income taxes, the highlights are increases by 71.2% in the revenue from Legal Persons Income Tax (IRPJ) and 45.4% in that from Net Profit Social Contribution (CSLL), due to both increases in monthly revenues and of the presumed profit, and to unusual payments, which amounted to approximately R$ 40 billion in 2021.

“Recovery of economic activity had a direct impact on revenue, and that can explain the significant increase in tax collection mainly on company profits, although there are also factors that account for this performance. The resumption of IOF collection, which had been zero for credit operations in 2020, the significant increase in collection of dividends in federal government and financial compensation for production of oil and gas listed in the pre-salt contract are some of them,” Mr. Guanabara analyzes.

Among other relevant forms of contribution for total revenues is equity income, which increased by 85.3% in the period. This result was due to the rise of 54.5% in revenue with interest and the pronounced increase of collection of dividends (384.2%), as a result of positive financial results of federal government companies, and of the collection of grants from non-produced assets (99.1%), mainly originated from oil royalties, in the federal sphere, and of privatizations in the state sphere, having the auction for the purchase of CEDAE-RJ as the main example.

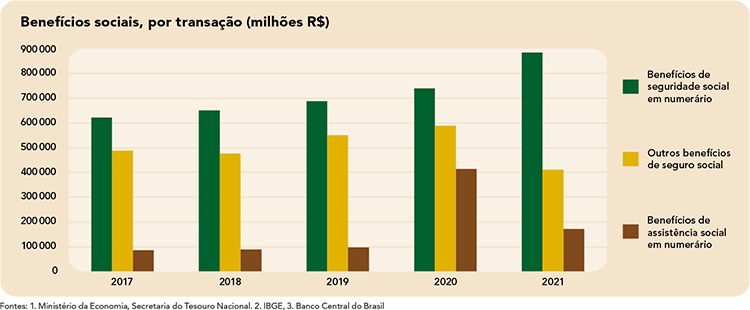

Drops in social security benefits paid stop expenditure increase

From the perspective of expenditure, in Public Finance Statistics, the decrease of 15.7% in payment of social security and assistance benefits was the main reason for the increase of expenditure by 1.8% only, and, consequently, for the reduction of Net lending in relation to 2020. Compensation recorded a positive change of 5.5% and expenditure on goods and services also increased (13.7%). Expenditure on interest, subsidies and other expenses also recorded positive changes of 38.7%, 6.4% and 37.5%, respectively.

“The decrease of 15.7% in social security and assistance benefits paid, an item that concentrated resources used to face the pandemic, represented a huge contribution to control the increase of expenditure in 2021. All the other expenditure items recorded increase, some of them by a high rate, such as the payment of interest, which rose 38.7%,” the manager says.

After outstanding increase in 2020, expenditure on social benefits drops by 58.8% in 2021

The reduction of expenditure on social benefits was due to its enormous increase in 2020, for this category held a significant share of the resources directed to the combat to the pandemic crisis, mainly the emergency aid and the benefit paid for maintenance of employment and income. As a result, the category of Social Assistance Benefits of the classification of Government Intermediate Account, which registered a total expenditure of R$ 415 billion in 2020, had a negative change of 58.8% in 2021, with a total expenditure of 171 billion.

Gross fixed capital formation (GFCF), from Intermediate Government Account, changed from R$ 112.6 billion to R$ 121.2 billion, an increase of 7.6%. This increase was influenced by investments of state governments, which represented an increase of 73.0%, following the trend to increase of 8.6% observed in the previous year.

“Some factors that can help explain the increase of investments at state level are relate to the increase of revenue such as, for example, ICMS collection, the item accounting for approximately 56% of the total state revenue and that recorded a change of 25.8%, and of extraordinary expenses with grants and transfers.”

Municipal administrations, which stimulated gross fixed capital formation in the two preceding years with increases of 28.3% in 2019 and 44.3% in 2020, reversed the trend to increase in 2021 and recorded a decrease of 17.8%. The federal government once again recorded a decrease in investments in 2021, which fell by 8.4%, versus a drop of 3% in 2020.

In 2021, government value added registered in the Government Intermediate Account was R$ 1.2 trillion, with a positive change of 7,1% against 2020. This change was positive at all spheres: 3.9% at federal level, 9.7% at state level and 7.5% at municipal level. With this behavior, the federal sphere lost 1.0 percentage points in participation in total value added of the sector, with a change from 31.0% to 30.0%, whereas state and municipal governments increased their participations by 0.8 and 0.1 percentage points, respectively.