PAC

Trade has record drop of 4% in job positions in 2020

August 17, 2022 10h00 AM | Last Updated: December 27, 2022 09h03 PM

Highlights

- In 2020, first year of the pandemic, the Brazilian trade had a record drop in employment (-4.0%) and in number of enterprises (-7.4%).

- Nearly 90.4% of the 404.1 thousand job positions lost in trade (or 365.4 thousand of them) were from retail, the sector that suffered the biggest drop in employment in the time series, started in 2007.

- Among the trade activities, the biggest drop in employment was registered in the retail segment of fabric, apparel, footwear and haberdashery (-15.3% or less 176.6 thousand workers).

- In retail, only two activities slightly gained in employment: that of hypermarkets and supermarkets (1.8 thousand persons) and that of pharmaceuticals, toiletries, cosmetics, and medical, optical and orthopedic articles (318 persons). Both of them were considered essential during the pandemic.

- Among the three major segments investigated in the survey, only wholesale increased in employment (2.2%) and in number of enterprises (1.3%) over 2019.

- The monthly average wage retreated: from 1.9 minimum wages in 2019 to 1.8 minimum wages in 2020.

- For the first time in the time series of PAC, the Southeast represented less than 50% of the gross revenu of resales in Brazil. This region accounted for 49.4% of that revenue in 2020.

In the first year of the pandemic, the Brazilian trade lost 4.0% of employment, 7.4% of enterprises and 7.0% of stores. Of the 404.1 thousand workers who left the sector, 90.4% (or 365.4 thousand of them) were employed in the retail. In this segment, only two activities, considered essential services during the health crisis, increased their personnel: that of hypermarkets and supermarkets (1.8 thousand persons) and that of pharmaceuticals, toiletries, cosmetics and medical, optical and orthopedic articles (318 persons). These data are from the Annual Survey of Trade (PAC) 2020, released today (17) by the IBGE.

It was the greatest drop in employment in trade in a year since the beginning of the time series of the survey in 2007. A record drop was also registered in the number of workers of two out of three major trade segments: -4.8% in the retail sector, which employs 73.7% of the workers in trade, and -8.5% in the segment of vehicles, parts and motorcycles.

Among the activities, the greatest reduction was of a sector highly hit by the social distancing measures adopted to fight against the Covid-19. Within a year, the retail segment of fabric, apparel, footwear and haberdashery reduced 176.6 thousand workers, which represents a loss of 15.3% in the contingent of employed persons. In addition, the number of enterprise in this sector dropped 15.6%. It corresponds to 32.6 thousand trade establishments.

“The significant drop in this sector causes a stir and it significantly represents those stores whose activities were more affected by social distancing, either in the popular trade or in shopping malls. All these establishments where face-to-face sales is very important to experience the goods were more significantly affected by the pandemic in the first year,” explains Synthia Santana, IBGE´s manager of Structural Analysis.

Strong retractions in employment also occurred in the retail sectors of food products, beverages and tobacco (-81.5 thousand workers) and construction material (-59.7 thousand). The former segment includes specialized stores, like emporiums, bakeries and beverage stores.

“Even considered essential in the pandemic, that activity dropped compared with 2019. One of the factors that can explain that result is that going less frequently to trade establishments, due to social distancing, caused consumers to concentrate their purchases in enterprises with a wider range of products, like hypermarkets and supermarkets,” analyzes the researcher.

Among the three major segments investigated by the survey, only wholesale increased in this comparison (2.2% or more 37.9 thousand workers), especially influenced by hirings in three activities: wood, hardware, tools, electrical material and construction material (10.0%), food products, beverages and tobacco (4.4%) and goods in general (6.1%).

This result is related to wholesale enterprises. To be considered a retail in the survey, enterprises should sell their products directly to final consumers, for personal and domestic use. In the wholesale, the negotiation is made with other establishments or with the public administration. In 2020, the wholesale sector was positively impacted by the results of the foreign trade.

“Wholesale was slightly more resilient in the first year of the pandemic. As they directly negotiate with other enterprises or entities, exporters are part of the wholesale. As the foreign trade behaved more expressively in 2020, it also rises the wholesale sector to results that slightly diverge from those of the retail, which reduced the number of enterprises and employed persons,” states Santana.

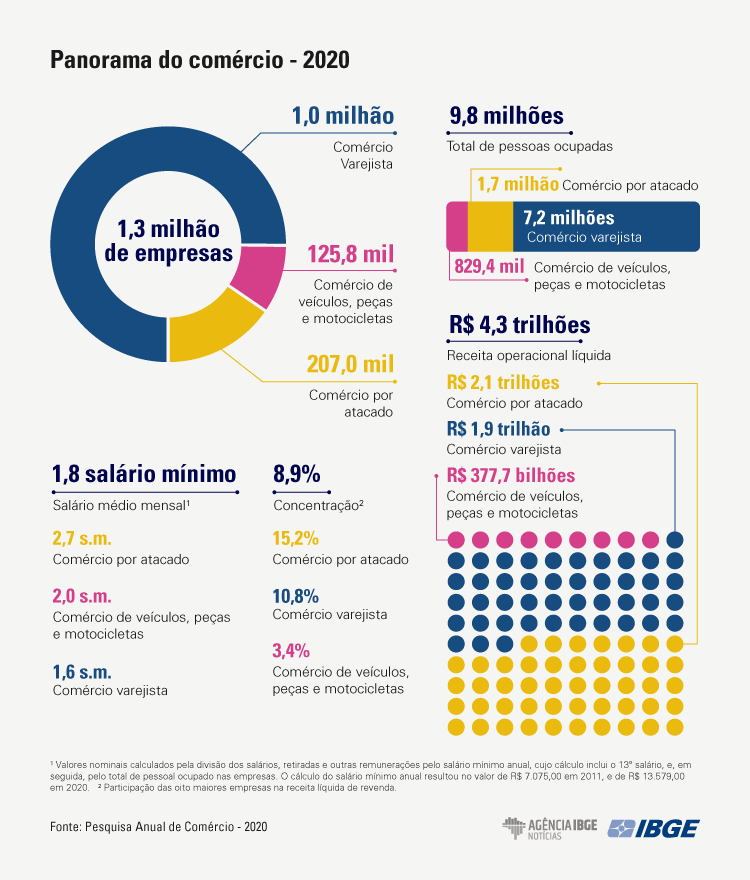

With the retreat in employment, trade employed 9.8 million people in 2020, being 7.2 million in retail, 1.7 million in wholesale and 829.4 thousand in the trade of vehicles, parts and motorcycles. Since 2011, it was the the first time that the trade activity as a whole had a contingent below 10 million workers.

Number of enterprises has a record drop

Like in employment, the retraction in the number of trade enterprises was a record both in percentage terms and in absolute figures. With the drop of 7.4%, 1.3 million trade enterprises remained in Brazil, the second lowest figure since the beginning of the time series of the survey, only behind that recorded in 2007. While many enterprises in the retail (-8.7%) and in the trade of vehicles, parts and motorcycles (-9.9%) closed their doors, the wholesale advanced (1.3%).

“Between 2019 and 2020, a substantial drop of 106 thousand trade companies occurred in Brazil. For the purpose of comparison, the drop was of 16 thousand enterprises in 2015, a year with economic downturn. In the next year, still in the biennium of the crisis, more 25 thousand enterprises closed their doors. What we have during the first year of the pandemic is a four times bigger drop. The number of trade companies has already been reducing according to the strategy of some of them, yet the economic crisis stepped up such behavior,” points out the researcher.

Santana also states that the social distancing measures changed the way enterprises trade their products. “Many of them changed the delivery way, like drive thru delivery and home delivery. Enterprises that could not change it suffered a significant loss, like the segment of fabric, apparel, footwear and haberdashery, which has a purchase experience that requires to touch the product and experience it,” assesses her.

Compensation falls in 2020

The compensation of workers in the trade sector added up to R$241.6 billion in 2020. The monthly average wage changed from 1.9 minimum wages (s.m.) in 2019 to 1.8 s.m. in the following year. The lowest compensation was related to representatives and agents of trade (1.1 s.m.), retail trade of food products, beverages and tobacco (1.3 s.m.) and retail trade of fabric, apparel, footwear and haberdashery (1.3 s.m.).

“It is interesting to note that the trend for reducing the compensation in trade is leveraged by activities that paid higher wages, as the case of the sector of fuels and lubricants, which significantly lost in ten years (-2.3 s.m.) and of machines, devices and equipment (-0.7 s.m.). They are activities that employ a lot and paid higher wages. As a result, they pressed that average downward,” highlights the manager.

In the wholesale, most activities paid higher average wages than the trade average. The sectors of fuels and lubricants (5.1 s.m.), machines, devices and equipment, including IT and communication (4.1 s.m.) and pharmaceuticals, toiletries, cosmetics and medical, optical and orthopedic articles (3.6 s.m.) were among them.

Wholesale sector accounts for most of the net operating revenue

In 2020, trade added up to R$4.7 trillion in gross revenue, of which R$2.3 trillion came from wholesale, R$2.1 trillion came from retail trade and R$394.3 billion came from the trade of vehicles, parts and motorcycles. Discounting deductions, like taxes and rebates, the net operating revenue added up to R$4.3 trillion. Most of that value was produced in wholesale (47.4%), followed by retail trade (43.9%) and trade of vehicles, parts and motorcycles (8.7%).

In ten years, the share of the car sector changed from 14.7% to 8.7% of the net operating revenue. In the same period, wholesale gained 3.6 p.p. of share and retail, 2.4 p.p. Synthia Santana explains that the decline in the share of the sector of vehicles occurred mainly in the downturn period, in 2015 and 2016, and significantly drop again in 2020.

“It is a declining segment, due to the continuous crises faced by the Brazilian economy, as a result from both domestic and external components. In trade, the domestic components manages to more influence these results, as they affect families when planning their budgets and investments in domestic items, as the case of cars, which compromise the income for a long time. The lack of predictability and uncertain revenue quite affect the acquisition of high value items,” says her.

Among the groups of activity, the three with the highest share in the net operating revenue were hypermarkets and supermarkets (13.6%), wholesale of fuels and lubricants (10.1%) and wholesale of food products, beverages and tobacco (8.5%). In ten years, distributors of fuels and lubricants lost 1.1 p.p. in net operating revenue, whereas hypermarkets and supermarkets advanced 3.0 p.p., hitting the first position in the ranking in this period. In 2020, wholesale of food, beverages and tobacco (8.5%) surpassed retail of fuels and lubricants (7.2%).

Trade margin was R$942.7 billion in 2020

The trade margin, difference between the net revenue of resales and the cost of goods sold, was R$942.7 billion in 2020. Most of that value was obtained in retail (R$511.7 billion), whereas wholesale registered R$364.5 billion and trade of vehicles, parts and motorcycles, R$66.5 billion. This indicator is a parameter for the profitability of a given trade segment.

On average, the trade margin rate of the enterprises was 28.8% in 2020

The survey also points out the trade margin rate, which is the division of the trade margin by the cost of goods sold. This percentage shows how much each sector can define its net operating revenue of sales above their costs with the acquisition of goods and change of stocks. The higher the rate, the higher the power to establish prices in a trade segment.

On average, the trade margin rate of the enterprises was 28.8% in 2020. That average was 37.4% in retail, 22.7% in wholesale and 22.4% in trade of vehicles, parts and motorcycles. The five highest rates came from retail activities: fabric, apparel, footwear and haberdashery (80.0%), cultural, recreational and sporting articles (62.8%), pharmaceuticals, toiletries, cosmetics and medical, optical and orthopedic articles (60.7%), unspecified new and used products (52.7%) and computer science, communication and household articles (52.2%).

Compared with 2019, four of those segments reduced this indicator, highlighted by retail trade of unspecified new and used products (-7.2 p.p.).

On the other hand, wholesale of fuels and lubricants (6.8%), trade of motor vehicles (13.0%) and wholesale of agricultural inputs and live animals (15.4%) recorded the lowest trade margin rates, sectors in which the resale prices are close to the acquisition costs of goods.

Share of Southeast in gross resales revenue in Brazil drops

For the first time in the time series of the survey, the Southeast represented less than 50% of the gross resales revenue in Brazil. In 2020, that region accounted for 49.4% of that revenue, 50.7% of the employed persons and 47.7% of the local units of the trade enterprises. Since 2011, that was the region that mostly lost share in each of these components, highlighted by the reduction of 3.5 p.p. in its share in the revenue. That drop was followed by an increase of share of the Central-West (from 9.2% to 11.0%) and South (from 19.4% to 20.9%).

In the case of workforce, the share of all the other regions increased with the reduction in the concentration in the Southeast: South (0.7 p.p.), Central-West (0.4 p.p.), North (0.2 p.p.) and Northeast (0.2 p.p.).

Although the Northeast gathered 17.0% of the workforce in trade in Brazil, the share of this region was only 12.7% in the total wages, withdrawals and other compensation. It was also the region that paid the lowest monthly average compensation (1.4 s.m.), whereas the Southeast paid the highest one (2.0 s.m.). The two regions maintained that status over the last ten editions of PAC.

About the survey

PAC has been conducted by the IBGE since 1996 and deals with structural aspects of the trade sector in the country. Information in this survey is significant for the analysis and planning of companies of the private sector and of the different levels of governmental. Every year, PAC presents the main results of Brazilian trade companies, which are divided into three segments: trade of vehicles, pieces and motorcycles; wholesale trade; and retail trade. In order to identify structural changes, there is a comparison between results of a series in ten years. Results are available for Brazil, Major Regions and Federation Units.