POF 2017-2018

72.4% of Brazilians live in households that have trouble paying their bills

August 19, 2021 10h00 AM | Last Updated: August 20, 2021 05h05 PM

Highlights

- Between 2017 and 2018, 14.1% of the population had trouble paying their bills and only 1.1% could do it easily.

- 46.2% of the population were members of households that had at least one overdue bill.

- 83.3% of the population were members of households in which a person had access to one of the financial services surveyed.

- Selected per capita monthly amounted to R$ 124.79.

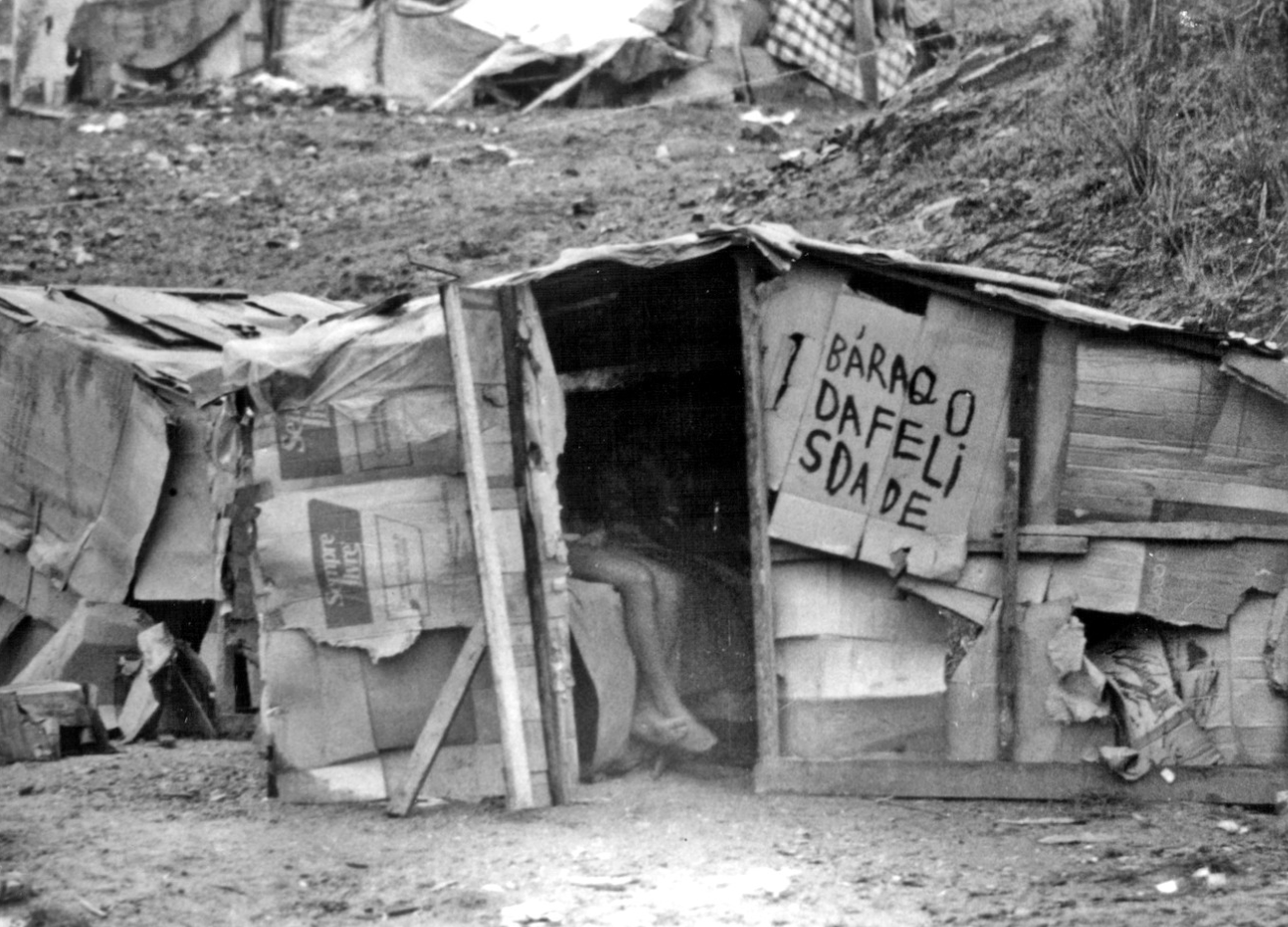

Approximately 72.4% of the Brazilian population lived were members of households that had trouble paying for their monthly expenses, according to the Consumer Expenditure Survey (POF) 2017-2018: Profile of Expenditures. Whereas 58.3% lived in households with some trouble paying bills, for 14.1% that was very hard. For another 26.5% paying bills was easy and only 1.1% were mmebrs of housholds the reported finding it very easy to make it to the end of the month edue to their high household income.

Among the members of households with a black or brown reference person, 9.7% had a lot of trouble and 34.4% had trouble paying their bills, which amounts to a total 44.4% living in households having some trouble and headed by blacks or browns. In the case of a white householder, 4.2% had a lot of trouble paying their bills and 22.8%, some trouble, that is, 27.0% of the country’s population had some degree of trouble.

A comparison between householders, by sex, shows the proportion living in households that reported having a lot of trouble was well-balanced between the two groups, being 7.0% for either male or female householders. Nevertheless, there was a great difference when conditions of making it through the end of the month were analyzed. Households headed by men reporting these results positive results were 17.5%, whereas those headed by women were 9.0%.

““This difference can be seen as a result of a lower per capita income in households with a female householder, and of a bigger number of houselholds headed by men,” says the survey analyst, André Martins.

46.2% of the population lived in households that reported having at least an overdue bill

The survey also shows that, between 2017 and 2018, 46.2% of the population lived in households with at least one overdue bill due to financial difficulties. Households with overdue water, electricity or gas bills held 37.5% of the population; with overdue rendering of goods and services, 26.6% and with rents or installments of real estate, 7.8%.

Among the 46.2% of the population living in households with overdue bills, 26.0%.0% were also members of households whose reference person had finished elementary school and only 3.8% were members of households whose reference person had a higher education degree.

66.2% of the population live in households in which one of the members has a current account

POF 2017-2018 investigated the access of households to financial services too. In the period, 83.3% of the population were members of households in which at least of the members had one of the financial services analyzed. Most of them had access to a acurrent account (66.2%). Another 55.9% of the population were members of households in which at least a person had a savings accounts, a credit card (49.9%) or overdraft protection (19.5%).

The remaining had access to expenditure on insurance (35.3%) and operations with loans and installments of real estate, cars or motorcycles (32.1%).

““The proportion of the population living in households in which none of the members had access to at least one of the aforementioned banking services was 16.7%, with 11.7% members of households with black or brown reference persons and 4.8%, members of households with a white reference person,” says André Martins.

The Southeast had 18.9% of its population living in households in which at least one of the members spent on bank charges, overdraft protection interests and credit cards in the period analyzed. The Northeast (7.9%) was number two in terms of concentration, but the South, with a much smaller population, had a similar percentage (6.8%). In the Central West (4.1%) and in the North (1.9%) these figures did not reach 5% of the population.

In transactions that refer to borrowing or lending of loans, and expenditure on installments of real estate, cars and motorcycles, the Southeast is also the leader, since it concentrated 12.8% of the country’s population living in households with at least one transaction with these services, but the percentage in the Northeast (9.4%) was twice as that in the South (4.7%). The Central West (3.0%) and the North (2.2%) were in the last two positions.

The concentration of the Brazilian population living in households in the Southeast that had expenses or payments from insurance services amounted to 18.0%, to 7.6% in the South, to 5.9% in the Northeast, to 3.0% in the Central West and to 0.8% in the North.

Households with a white reference person spend more on financial services

Per capita household expenditure on selected financial services, in the country, amounted to R$ 124.79. Payment of loans, real estate in installments, cars and motorcycles made up 76.5% of those expenses, or R$ 95.51 per resident.

The contribution of families with a white reference person to per capita expenditure on financial services (R$ 73.62) was significantly higher than that of households with a black or brown reference person (R$ 48.91). The contribution to monthly per capita figures with investments by households with a white reference person (R$ 76.63) was more than three times that of households with a black or brown reference person (R$ 24.69).