Annual Survey of Industry

PIA 2021: employment in industry increases by 5.3% but does not make up for losses in the last ten years

June 29, 2023 10h00 AM | Last Updated: July 03, 2023 09h45 PM

Highlights

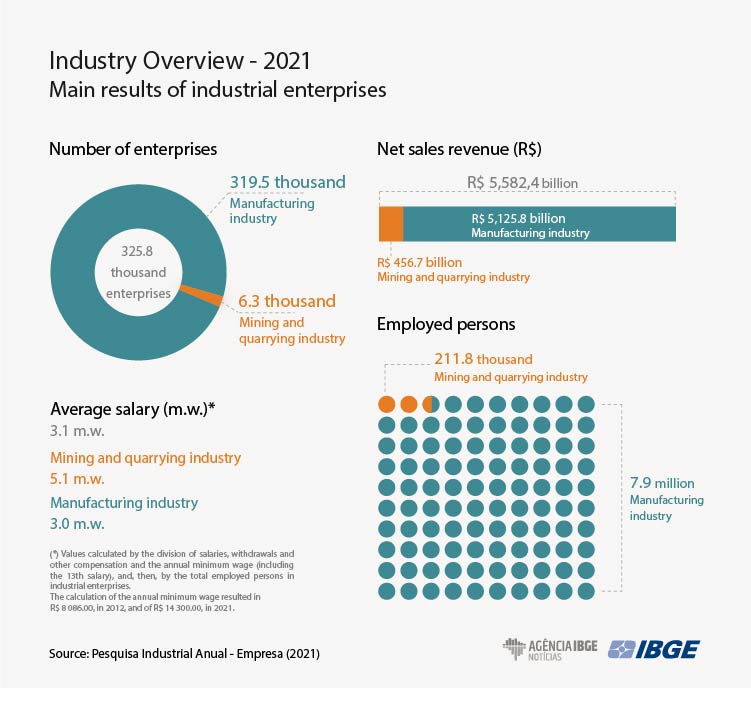

- In 2021, industry employed 8.1 million persons and paid R$ 352.1 billion in salaries. Manufacturing industry held 97.4% of the jobs in the sector.

- Between 2012 and 2021, the average monthly compensation, measured as minimum wages, fell in 25 of the 29 activities.

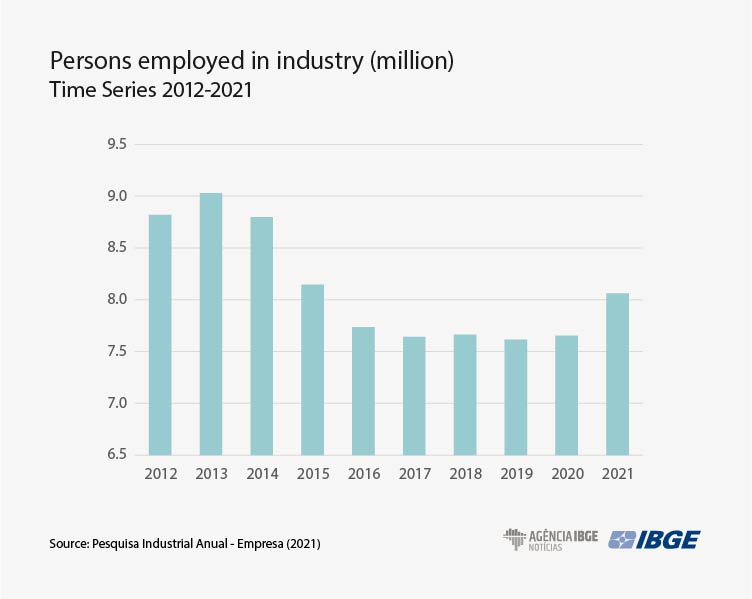

- Since 2012, there has been a drop of 8.6% in employment, by 758.6 thousand vacancies: 9.3 thousand in Mining and quarrying industry and 749.3 thousand in Manufacturing industry.

- Between 2020 and 2021, however, employment increased by 5.3% with 407.7 thousand vacancies more: 11.6 thousand in Mining and Quarrying industry and 396.1 thousand in Manufacturing industry.

- The net revenue of industry reached R$ 5.6 trillion in 2021, being R$ 456.7 billion from Mining and quarrying industry and R$ 5.1 trillion from Manufacturing industry .

- Between 2012 and 2021, considering the activities recording biggest changes in net sales revenue (NSR), the highlight was the drop in car industry (-3.7 p.p.), mainly after 2019.

- In 2012, this activity was in the second position in the NSR ranking, with 10.9%, reaching 7.2% in 2021.

- On the other hand, there was an increase in the share of Extraction of metallic minerals, with strong acceleration after 2016.

- Food industry, the main activity in terms of share of the NSR (21.5%), dropped once more in 2021, after recording an increase in 2020 from 2019.

In 2020, the country had 325.8 thousand enterprises with one or more employed persons, being 6.3 in the Mining and quarrying sector and 319.5 thousand in Manufacturing industry. These enterprises generated R$ 5.6 trillion in net sales revenue (NSR) – R$ 456.7 billion in Mining and quarrying industry and R$ 5.1 trillion in Manuafacturing industry – and paid R$ 352.1 in billion, salaries and other compensation. A total of R$ 2.2 trillion in value added were generated, with 85.8% from Manufacturing industry. These amounts are in current prices of 2021. These data are from the Annual Survey of Industry - Enterprise (PIA Enterprise), which encompasses mining and quarrying and manufacturing industry.

According to Synthia Santana, structural analysis manager, this scenario of industrial production, this scenario reflects macoeconomic aspects: GDP increased by 5.0% in 2021 and inflation registered by the IPCA was 10.06%. The interest rate reached 9.25% in December 2021. The unemployment rate in the fourth quarter of the year, according to Continuous PNAD, amounted to 11.1%, whereas the trade balance had a record surplus, influenced by international prices.

“All these factors contributed to the recovery of the industrial sector in 2021, after the start of vaccination. But recovery was also due to a lower basis for comparison, since 2020 was a year with low industrial activity.

In 2021, industrial activity with a higher weight on the net sales revenue, increased their participation against 2012. The exception was Manufacture of motor vehicles, trailers and bodies, which dropped from the second to the fifth position in the ranking of industrial revenue.

“In 2021, the Brazilian food industry represented 21.5% of the recent net sales revenue, with increase in participation of 2.3 percentage points from 2012. But, in the same period, the participation of car industry fell by 3.7 percentage points, from the second position in the ranking and reaching its lowest share in the series: 7.2% of NSR.”

Among the 29 activitites, beverage industry was the only one to lose employees in 2021

Employment in industry rose for the second consecutive year. In 2021, the industrial sector employed 8.1 million persons, with 9.,4% (7.9 million) in manufacturing industry. This movement, however, was not enough to recover vacancies lost in the 2015-2016. recession. The population employed in industry decreased by 8.6%, a drop of 758.6 vacancies, between 2012 and 2021: 9.3 thousand in mining and quarrying industry and a decrease of 749.3 thousand in manufacturing industry.

The five activities employing most persons in 2021 amounted to 46.4% of the total employed persons. Among those, only food industry and non-metallic mineral products increased their participation thoughout the survey’s time series. The main highlight was the gradual drop in participation of the wearing apparel industry, second main employer, with vacancies reduced by 193.2 thousand.

“In 2021, there was an increase by 407.7 thousand jobs (a 5.3% increase): 11.6 thounsad in mining and quarrying industry and 396.1 thousand in Manufacturing industry. But these increases did not make up for losses in the period 2015-2016. We still have almost 1.0 million persons below the peak of the series, in 2013, when industry had 9.0 million employed persons,” says the manager.

The five activities employing most persons were: Manufacture of food products (2.5%), Manufacture of wearing apparel and accessories (7.0%); Manufacture of metal products, except machinery and equipment (6.0%); Manufacture of motor vehicles, trailers and bodies (5.5%); Manuafacture of non-metallic minerals (5.4%). “The same activities were in the ranking in 2012, showing that industry is very stable in this respect, says Ms. Santana.

Between 2020 and 2021, the main increases took place in Manufacture of wearing apparel and accessories (51.0 thousand), Manufacture of food produtcs (45.9 thousand) and Manufacture of metal products (42.7 thousand). The only loss was observed in the beverage industry (-0.3 thousand).

In ten years, average salary recorded decreases in 25 of the 29 activities

Between 2012 and 2021, in 25 of the 29 activities there was decrease in the average monthly wage, measured as minimum wages. In the period, the average salary paid by Industry fell from 3.4 to 3.1 minimum wages. In spite of paying the highest salaries, mining and quarrying industry recorded a decrease in average salary, with a change from 6.2 minimum wages in 2012 to 5.1 minimum wages in 2021. In mining and quarrying industry, the average salary dropped from 3.3 to 3.0 minimum wages in 2021.

Between 2012 and 2021, the most significant decreases took place in extraction of iron ore and natural gas (-11.0 s.m.), Manufacture of coke, petroleum products and biofuels (-3.7 s.m.) and Extraction of metallic minerals (-1.8 s.m.).

In 2020, against 2021, the average salary had recorded decreases in five of the 29 activities. Changes were most significant in Extraction of petroleum and natural gas (-3.0 minimum wages), Support activities to mineral extraction (-0.8 s.m.) and Extraction of metallic minerals (an increase of 0.9 s.m.).

In 2021, the Southeast Region increases in participation and holds more than 50% of the value added

In a period of 10 years, the highlight was the reduction in the concentration of Value Added in the Southeast, South and Northeast, which dropped, respectively, by 1.5 p.p., 0.8 p.p. and 05 p.p. in this period. On the other hand, there were advances in the two least representative Major Regions: North (1.9 percentage points) and Central West (0.8 percentage points). Against 2021, after 2020, first year of the pandemic, despite the continuation of the ranking, there was an increase in participation (2.7 p.p.) of the Southeast, which still held 58.9% of value added. The other Major Regions recorded decreases in participation: North (1.3 p.p.), South (0.7 p.p.), Northeast (0.4 p.p.) and Central West (0.3 p.p.). The South, which is in the second position in the ranking, fell to its lowest level of participation (18.0%) since 2007.

In the Southeast, São Paulo concentrated 53.0% of value added, followed by Minas Gerais (21.7%), Rio de Janeiro (19.6%) and Espírito Santo (5.8%). Between 2012 and 2021, although there was no change in the regional ranking, the ighlight is the reduced participation of São Paulo (-5.0 p.p.), opposite to the advance in production of industry in Minas Gerais (3.0 p.p.). In 2021, the main activities were extraction of petroleum and natural gas and petroleum refining.

The ranking of value added of the South Region was led by Paraná (36.0%), followed by Rio Grande do Sul (34.9%) and Santa Catarina (29.2%). Between 2012 and 2021, the participation of Rio Grande do Sul in regional value added fell by 2.6 p. p, removing the state from the ranking leadership. Santa Catarina, in turn, increased by 3.6 percentage points and remained in the 3rd position. In 2021, 37.9% of the value added in the Major Region was concentrated in the three main activities. Manufacture of food products (21.9%), Manufacture of machinery and equipment (8.3%) and Manufacture of chemicals (7.7%).

In the Northeast, Bahia had the highest share of value added (39.6%), followed by Pernambuco (19.8%) and Ceará (14.7%). The remaining 26.05 were distributed among: Rio Grande do Norte (7.7%), Maranhão (7.4%), Paraíba (3.2%), Alagoas (3.1%), Sergipe (2.9%) and Piauí (1.7%). The decline of industry in Bahia stands out, as the state share dropped by 3.0 p.p., whereas industry in Mato Grosso increased by 2.6 p.p. between 2012 and 2021. Among the predominant sectors the highlights are food industry, petroleum refining and biofuels and chemistry.

Pará (63.4%) and Amazonas (31.9%) were responsible for 95.3% of value added generated in the North Region. The regional ranking also included: Rondônia (2.2%), Tocantins (1.8%), Amapá (0.3%), Acre (0.3%) and Roraima (0.1%). Between 2012 and 2021, the main structural change was the increase of participation of Pará (19.9 p.p.), due to the potential of mining and quarrying industry surpassing that of Amazonas (17.8 p.p.), which, in spite of the Industry Plant of Manaus, lost its leading position in 2017, when Pará reached the top of the ranking.

In the Central West, Goiás accounted for 46.5% of the regional value added, followed by Mato Grosso do Sul (26.1%), Mato Grosso (24.9%) and the Federal District (2.5%). In 10 years, the only change in the regional ranking consisted of the advance of 6.0 p.p in Mato Grosso do Sul, which surpassed Mato Grosso and was in the second position. The industry of the Central West stood out due to agriculture industry and a major exporting potential, including food industry and biofuels.