National Accounts

With services affected by pandemic, GDP of 2020 falls 3.3%

November 04, 2022 10h00 AM | Last Updated: November 04, 2022 05h11 PM

Highlights

- The Gross Domestic Product (GDP) hit R$7.6 trillion in 2020, a drop of 3.3% over 2019. The per capita GDP reached R$35,935.74.

- Agriculture grew 4.2%, Industry dropped 3.0% and Services fell 3.7%.

- Household consumption dropped 4.5%. Final consumption expenditure of government fell 3.7%.

- In 2019, Gross Fixed Capital Formation (GFCF) fell 1.7%. The investment rate was 16.6%, growing 1.1 percentage points (p.p.) in relation to 2019.

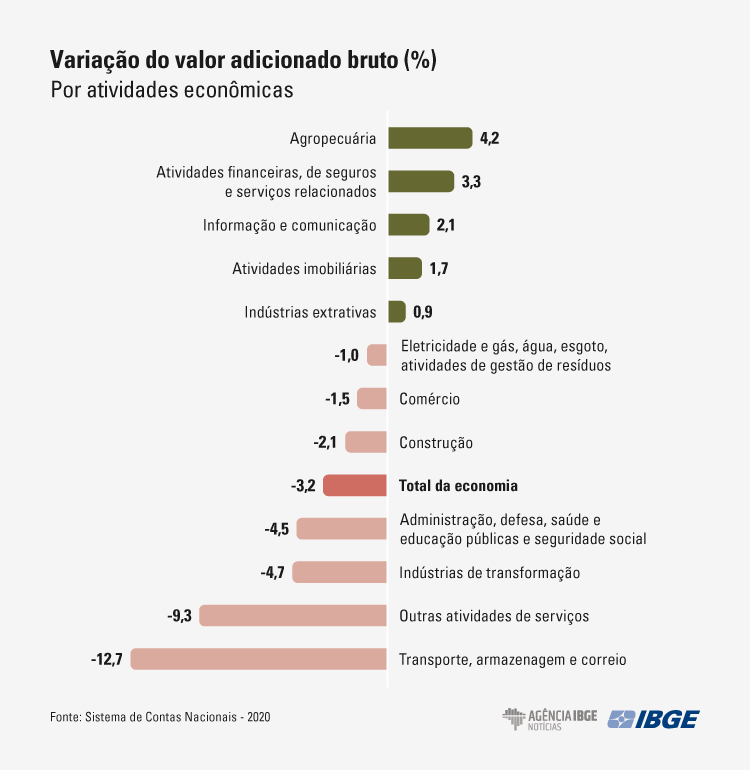

- Gross value added dropped 3.2%. In terms of impact, -2.7 p.p are due to the drop in Services. Industry contributed with -0.6 p.p and Agriculture with 0.2 p.p.

- In 2020, seven out of 12 groups of economic activities retreated, highlighted by the group of other services activities (-9.3%).

- Net borrowing of the Brazilian economy was R$80.5 billion in 2020, a drop of 66.6% in relation to 2019, when it hit R$241.0 billion.

- The share of the compensation of employed persons in the disposable income of households fell 4.7 p.p between 2019 and 2020, changing from 61.5% to 56.8%. Social benefits received by households grew 29.4%.

In 2020, when the COVID-19 pandemic impacted the world economy, the Brazilian Gross Domestic Product (GDP) dropped 3.3% after rising 1.2% in 2019. The gross value added of services fell 3.7%, leveraged by household consumption (-4.5%). At current values, the GDP was R$7.6 trillion and the per capita GDP, R$35,935.74. The data are from the IBGE´s System of National Accounts.

“It was a drop focused on services, especially on the on-site services suspended in the pandemic, like hotels, restaurants, cinema and entertainment, trips and domestic services,” highlights Cristiano Martins, IBGE´s manager of Goods and Services of National Accounts.

The GDP in 2020 was revised from -3.9% to -3.3%. The revision was mainly due to the incorporation of new data on Services, which changed from -4.3% to -3.7%, especially Other services activities (from -12.3% to -9.3%). The drop in Industry was revised from -3.4% to -3.0%, whereas the growth in Agriculture was revised from 3.8% to 4.2%.

“Revisions of preliminary data in relation to the definitive ones, with more information sources, always occurred. However, they can be higher in atypical times, like in the pandemic in 2020, a fact that occurred in the entire world,” points out Rebeca Palis, IBGE´s coordinator of National Accounts.

The drop in the GDP resulted from a decrease of 3.2% in the gross value added. In terms of impact, -2.7 percentage points (p.p.) were due to the Services sector. Industry contributed with -0.6 p.p. Agriculture positively contributed with 0.2 p.p.

In 2020, seven out of 12 groups of economic activities retreated, highlighted by other services activities (-9.3%). Also very impacted by the pandemic, the activity of transportation, storage and mailing fell 12.7%.

“The drop in other services explains most of the drop in the economy. Within that activity, the drops in food services (-27.0%), lodging services (-27.0%), artistic activities (-25.5%) and domestic services (-23.3%) stand out,” explains the manager.

Other highlights are the drops in manufacturing industry (-4.7%), administration, defense, public health and education, and social security (-4.5%) and construction (-2.1%), which dropped once again after showing in 2019 the first positive figure (1.9%) since 2014.

The activities of public health (-14.8%) and private health (-7.2%) also dropped, though the activity of manufacture of pharmochemicals and pharmaceuticals grew 4.2%. “In spite of the increase in medical services oriented to the pandemic, oncological treatments, surgeries and other elective procedures stopped, which caused the activity to drop,” comments the manager.

Household consumption falls 4.4%

In 2020, final consumption expenditures, which encompass consumption expenditures of households, governments and non-profit institutions, dropped 4.4%. Conversely, the final consumption expenditure of the government, which encompasses the expenditures with goods and services supplied by the government to the public, fell 3.7% in 2020, after dropping 0.5% in 2019. Consumption of households, which accounts for 61.8% of the GDP, fell 4.5%. The change in the price of goods and services consumed by households was 4.5%.

The comparison of the share of goods and services in the final household consumption shows that services dropped (-10.2%) quite more than consumer goods (-0.7%) in 2020. Most of the groups of products that comprise the expenditures of the household consumption dropped, with a greater contribution from Transportation (-14.6%), Education (-11.0%) and Food and beverages (-6.6%). Only Housing (0.9%) and Household articles (1.9%) rose.

“In the group of food and beverages, the drop was mainly due to the consumption in bars and restaurants (-29.0%), whereas food at home remained stable. In the group of housing, expenditure with rental fell (-5.1%), though the consumption of electricity (3.6%), water and sewage (4.1%) and cooking gas (5.0%) increased. In the group of household articles, the increase in the final consumption was concentrated on house appliances (5.1%) and computers (13.0%,” comments Martins.

Gross Fixed Capital Formation drops 1.7%

Gross fixed capital formation of the Brazilian economy added up to R$1.3 trillion in 2020, registering a drop of 1.7%. The investment rate, which is the ratio between Gross Fixed Capital Formation and the GDP, was 16.6%, posting a growth of 1.1 percentage points in relation to 2019.

The biggest drop was in machinery and equipment (-4.3%). Products of intellectual property also retracted (-2.3%). On the other hand, the groups of construction (0.6%) and other fixed assets (1.9%) grew.

The group of Construction maintained the biggest weight in gross fixed capital formation, with a share of 44.6%. Machinery and equipment, the second most important group, remains increasing its share, changing from 40.9% to 41.5%. Products of intellectual property is the group with a drop in share in the period, changing from 12.8% to 11.8%.

Share of compensation of employed persons in GDP drops

Under the point of view of income, which shows the parcels of the employed persons (wages and social contributions), gross operating surplus and mixed expenditure of households, as well as taxes net of subsidies on the production and imports related to the share of government, it was noticed that the share of social contributions fell from 9.2% to 8.7% and that of wages, from 34.4% to 33.3%. Therefore, the parcel of compensation of employed persons in the GDP, which hit 42.0%, decreased, whereas the share of the gross operating surplus reached 35.3%, the highest level since 2010.

According to Martins, “jobs without a formal contract were more affected by the pandemic, especially in the services area, and significantly dropped in the total number of jobs (17.5% between 2019 and 2020). In contrast, jobs with a formal contract recorded a smaller drop (1.6%) and thus represented 52.7% of all the jobs in 2020.”

Net borrowing of national economy falls 66,6%

In 2020, net borrowing of the Brazilian economy was R$80.5 billion, a drop of 66.6% in relation to 2019, when it hit R$241.0 billion.

The performance of the foreign trade contributed to that reduction. While the exports of goods and services registered a nominal growth of 20.0% (R$1.25 trillion in 2020 against R$1.04 trillion in 2019), the imports of goods and services rose only 10.5% (R$1.2 trillion in 2020 against R$1.1 trillion in 2019).

“Brazil usually shows a deficit in the services account of the balance of payments. As international trips and transportation dropped with the pandemic, among others, that deficit decreased. So we had a favorable balance, leveraged by the foreign sector,” clarifies Teresa Bastos, manager of Institutional Sectors of National Accounts.

The foreign balance of goods and services registered a positive evolution, changing from a deficit of R$47.6 billion in 2019 to a surplus of R$46.0 billion.

Non-financial enterprises show net lending of 1.6%, the highest in the time series

The sector of non-financial enterprises recorded the highest net lending in 2020 as a proportion of the gross value added in the entire time series started in 2000: 1.6%.

The manager explains that “it happened due to the nominal drop in the compensation of employed persons. Therefore, the share of labor dropped and that of capital grew in relation to the gross value added.”

Gross savings reversed the drop of the previous year, reaching R$727.3 billion in 2020, the highest value at current prices in the time series. Gross Fixed Capital Formation in relation to the gross value added increased 1.3 percentage points, the third year of growth in a row. Despite that recovery, the indicator still remains below its historical average (21.0%).

Net lending of financial enterprises registered a nominal increase of 64.0%, having changed from R$132.3 billion in 2019 to R$216.9 billion in 2020. The reduction in the property income paid (-9.1%) en relation to that received (-3.6%) contributed to that result.

The reduction of taxes on income and assets by 15.3% also contributed to that result. On the other hand, gross fixed capital formation grew 10.2%.

The sector of general government reported a nominal increase of 148.4% in net borrowing of the public sector (PSNB), from R$369.6 billion in 2019 to R$918.0 billion in 2020.

That behavior is explained by the drop of 2.6% in the total revenue against an increase of 9.9% in the total expenditures of the three spheres of government, both of them influenced by the impacts of the COVID-19 pandemic and the measures adopted by the governments to fight against it.

“The total social benefits grew 30.7% in the year against a change of 9.6% in 2019. The social assistance benefits - which incorporate the emergency aid and the Emergency Program of Maintenance of Employment and Income benefit - recorded a nominal growth of 325.7%, changing from R$97.4 billion in 2019 to R$414.6 billion in 2020,” shows the manager.

Social benefits received by households grow 29.4%

The share of compensation of employed persons in the disposable income of households fell 4.7 p.p. between 2019 and 2020, changing from 61.5% to 56.8%. That share hit its peak in 2011 (65.3%).

The consumed income, i.e., the parcel of the final consumption of the households in the disposable income, dropped 6.3 p.p. in relation to 2019. That share dropped between 2015 and 2017, having increased to 89.9% in 2018 and 2019.

Gross savings, which corresponds to the difference between the available gross income and the final consumption of households, plus the adjustment by the change in the pension rights, grew 6.3 p.p. over 2019, having hit 17.3%.

Net lending of households increased 202.3% in nominal terms, reaching the value of R$557.9 billion against R$184.6 billion in the previous year. The growth of 68.8% of savings and the increase of 29.4% of the social benefits received by households in nominal terms contributed to that result.

“Households registered the reverse of what was seen in the government in relation to social benefits. While the government increased its expenditures, households received more benefits during the COVID-19 pandemic. As a result, net lending increased, also helped by the increase in savings,” concluded the manager.