Annual Survey of Industry

In 2020, iron ore was the major industrial product in Brazil

July 21, 2022 10h00 AM | Last Updated: July 22, 2022 10h13 AM

Highlights

- The top ten industrial products and/or services accounted for 20.9% of net sales revenue (RLV) in the industry (R$3.1 trillion), compared to 21.6% in 2019.

- The top ten products underwent changes in the ranking. Iron ore took the lead with a rise of 1.5 percentage points and a 4.8% share in RLV, replacing crude petroleum, whose share dropped from 3.8% to 3.1%. Beef, which occupied the 5th position, rose to 3rd in 2020.

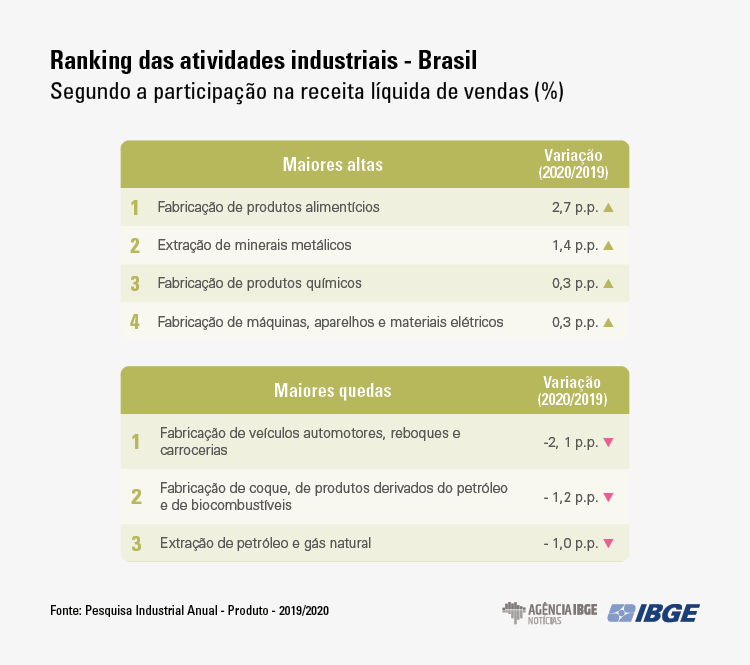

- The five main activities accounted for 54.0% of net sales revenue of the industrial sector in 2020, compared to 54.2% in 2019. The contribution increase in food industry, from 16.6% to 19.3%, stood out as well as the loss of 2.1 pp of the motor vehicle industry, with 8.1% of RLV and falling from the 3rd to the 4th position.

- Among the five items that lost the most positions, the first four refer to activities affected by the pandemic: aviation kerosene (58 positions), aircraft maintenance and repair services (23); trucks with a capacity above 5t (21); and airplanes (20).

- Preparations and mixtures of minerals, vitamins, whether or not containing drugs, for feeding animals, except for animal feed, was the activity that gained the most positions (34).

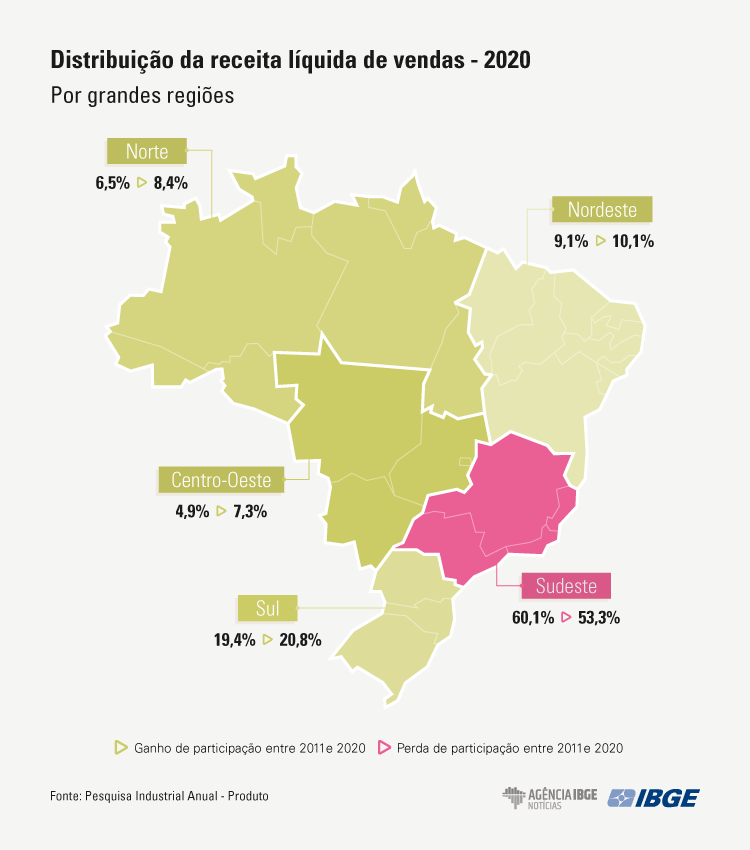

- The Southeast Region still concentrates 53.3% of the RLV, but lost 6.8 pp share between 2011 and 2020. All other Major Regions increased their contributions: South (20.8%, + 1.4 pp); Northeast (10.1%, + 1.0 pp); North (8.4%, +1.9 pp); and Central-West (7.3%, 2.4 pp).

These are some pieces of information from the Annual Survey of Industry (PIA) - Product 2020, which investigated about 3,400 industrial products from 29 sectors. Among the largest shares in sales revenue in 2020, the leader was iron ore: 4.8%, 1.5 pp above 2019, reflecting the rise in international prices. The product surpassed crude petroleum oil, which has led the rank since 2018, and but had a share of 3.1%, or 0.7 pp below 2019.

In third place, fresh or cooled beef climbed two positions, going from 2.1% to 2.4% of contribution. Then comes diesel fuel, which dropped from the third to the fourth position; and undenatured ethyl alcohol (ethanol), with alcohol strength equal to or greater than 80, for fuel purposes, intended to be added to gasoline, which gained a position despite the share having reduced from 1.8% to 1.6%.

Synthia Santana, manager of Structural Analysis, highlights that the pandemic caused the disruption of several production chains, while Brazilian macroeconomic indicators showed a reduction in household consumption, in the investment rate and in credit. The results of PIA Product reflect the impacts of the serious economic and health crisis with consequences for demand and supply in the industrial sector.

“While some sectors have had factory shutdowns and vacation, others have experienced a different environment, especially those related to commodities that are anchored in international prices. An example is iron ore and grains, which benefited during the pandemic from high international prices”, analyzes the manager.

Ten products concentrated 20.9% of net sales revenue in 2020

Added together, the ten major products accounted for 20.9% of the sales value in 2020, a lower share than in 2019 (21.6%). Compared to 2019, all products underwent changes in positions, especially iron ore, which went from 2nd to 1st place.

Among the top 100 products, the ones that gained the most positions compared to 2019 were Preparations and mixtures of minerals, vitamins, whether or not containing medicines for feeding animals, except animal feed (34 positions, from 101st to 67th); Cars with engines between 1500 and 2500 cc (32 positions, from 129th to 97th); Crude soybean oil (26 positions from 60th to 34th); Portable personal computers (25 positions, from 53rd to 28th); and Gold, in raw, semi-manufactured or powdered forms (22 positions, from 47th to 25th).

The ones that lost the most were aviation kerosene (58 positions, from 28th to 86th place); Aircraft, turbine and aviation engine maintenance and repair service, including aircraft painting service (23 positions, from 67th to 90th); Trucks, with diesel engine, with a maximum load capacity of more than 5 t (21 positions, from 27th to 48th); Airplanes weighing more than 15,000 kg (20 positions from 33rd to 53rd) and Tobacco leaves (19 positions from 77th to 96th).

“Electronic products, which were in high demand during the pandemic, gained 25 positions. Among those that with the biggest losses, of the five, we highlight airplane kerosene, which lost 58 positions, aircraft maintenance services (23), trucks (21) and airplanes (20). The main ones are related to the transportation sector, which was greatly affected during the pandemic”, says Ms. Santana.

Five activities account for 54% of industry revenues in 2020

In 2020, the survey investigated 29 sectors. The five major shares in net sales revenue were: food industry (19.3%); manufacturing of chemical products (10.8%); manufacture of coke, petroleum products and biofuels (8.8%); motor vehicle industry in fourth (8.1%); and basic metals (7.0%). The sum of these five industrial activities concentrated 54.0% of the value of net revenue from sales of industrial products and services in 2020, compared to 54.2% in 2019.

Between 2019 and 2020, the increase in the share of the food industry stands out, which increased by 2.7 pp, from 16.6% to 19.3% of RLV. On the other hand, the motor vehicle industry lost 2.1 pp share, reaching 8.1% of RLV in 2020 and falling from 3rd to 4th position.

Extending the ranking to the ten main activities of the industry, the extraction of metallic minerals stands out; the manufacture of machinery and equipment; and the manufacture of rubber and plastic material products, rising one position each in the ranking, compared to 2019. The extraction of oil and natural gas lost 1.0 pp, falling from 6th to 9th position.

Diversification in the Southeast and South and high concentration in the North and Central-West

Among the Major Regions, the Southeast was the only one to lose representation in the composition of net sales revenue in ten years, falling from 60.1% to 53.3%. On the other hand, the Central-West and North Regions gained the most in terms of participation, with an increase of 2.4 pp and 1.9 pp, respectively.

The South Region was the one that presented the biggest changes in the list of the three main products: diesel oil lost the first position compared to 2011 and two new products entered the ranking: frozen meat and poultry offal, in 1st; and pies, bagasse, soybean oil bran, in 3rd.

The Southeast Region, although it remained with the three main products – crude petroleum oil (5.8%), iron ore (4.3%) and diesel fuel (2.1%) – changed the ranking with crude petroleum oil taking the lead previously occupied by iron ore.

The Central-West Region maintained the same three main products – fresh or cooled beef (12.9%); pies, bagasse, soybean oil bran (9.9%); undenatured ethyl alcohol (ethanol) for fuel purposes (5.8%) – and the same ranking.

In the North Region, iron ore still holds the 1st position with 28.9%; followed by a new product, fresh or cooled beef (5.0%); and televisions (4.8%), which lost one position.

In the Northeast, diesel oil maintained its leadership with 4.3%, followed by fuel oils (3.7%) which gained positions; and by chemical wood pulp (2.8%), which entered as a new product in the ranking of the region.