Annual Survey of Industry

Number of industrial enerprises shrinks for the sixth consecutive year in 2019

July 21, 2021 10h00 AM | Last Updated: July 29, 2021 12h26 PM

Highlights

- Number of enterprises in the industry reduces 8.5% from 2013 to 2019.

- In the same period, the number of employed persons decreased by 15.6%, totaling 7.6 million persons.

- Driven by the extraction of petroleum and gas, the mining and quarrying sector reaches 15.2% of contribution in the manufacturing value of industry, the largest share in ten years.

- Industry turnover reaches 3.6 trillion in 2019.

- Market concentration in the industrial sector reaches 24.7%, the highest level since 2010.

The number of enterprises in the national industry shrank for the sixth consecutive year in 2019, before the Covid pandemic. The sector totaled 306.3 thousand enterprises, a reduction of 8.5% compared to 2013, peak of the time series, when it had 335,000. This result was mainly driven by the manufacturing industry, which alone holds 97.9% of the sector, and closed 28 thousand companies in six years.

In the same period, the number of persons employed in the industry decreased by 15.6%, from 9.0 million in 2013 to 7.6 million in 2019, with a reduction of 14.8% of jobs in the mining and quarrying industries and 15.6% in manufacturing industries. The data are from the 2019 Annual Survey of Industry (PIA), released today (July 21) by the IBGE.

In ten years the activity that closed most enterprises in manufacturing industry was leather preparation and manufacture of leather goods, travel items and footwear (-36.2%), followed by the manufacture of pharmaceutical products (-21.7%) and basic metals (-20.1%). In mining and quarrying, the greatest reduction occurred in the extraction of mineral coal (-46.2%).

Conversely, in labor force, the growth was in only eight of the 24 activities of the manufacturing industry from 2010 to 2019, with a highlight to the manufacture of coke, petroleum products and biofuels (51.3%). The biggest decreases occurred in the manufacture of other machinery and equipment (-27.7%) , except for computer, electronic and optical products (-27.5%).

In mining and quarrying industries, the extraction of petroleum and natural gas almost five-folded the employed labor force in ten years. That reflects the participation gain in local units of the mining and quarrying industries in the valued added to industry as a whole. The local unit is where the economic activities of an enterprise are developed. In ten years, the increase was of 3.5 percentage points (pp), going from 11.7% in 2020 to 15.2% in 2019, which represented the greatest value in this period. In one year, the increase was of 0.6 pp.

“We had a great advance in the activity of petroleum and natural gas with the exploitation of pre-salt reserves. IN one decade, the segment increased its share by 3.4 pp and recorded 7.2% of the manufacturing value of the entire industry”, added the survey manager, Ms. Synthia Santana.

The manufacturing industry, in turn, had reduction in the share of the activities due to the dynamism loss in the sector of motor vehicles, trailers and bodies (6.2%), whose decrease by 3.8 pp was the greatest one in the sector between 2010 and 2019. As a result, the activity fell from 3rd to 6th in the ranking of the segments with the highest manufacturing values of industry.

The industry generated R$ 1.4 billion in industrial manufacture in 2019, which is the difference between the gross value of industrial production (R$ 3.3 trillion) and the cost of the industrial operations (R$ 1.9 trillion).

Industry revenue reaches 3.6 trillion in 2019

Although the number of enterprises and persons employed by the industry shrank, the sector’s revenue kept on growing, reaching R$ 3.6 trillion in 2019. Mining and quarrying industries accounted for 6.1% of industry’s revenue, which corresponds to an increase of 1.5 percentage points (pp), reaching the highest percentage value in ten years, although it still represents the lowest share of industry.

Petroleum and natural gas extraction stands out, as it increased its participation by 1.6 pp and achieved 1.7 pp of the total industrial revenue. The most relevant mining activity was, however, the extraction of metallic minerals, which concentrated 3.6% of the national industry as a whole.

Among the activities in the manufacturing industries, in turn, the manufacture of food products stands out (20.5%), as its has become the activity with the greatest revenue share in the ten-year series and the one that has advanced the most generating a participation gain of 3.3 pp in the period.

On the other hand, the manufacture of motor vehicles, trailers and bodies had the greatest loss of representativeness in industry (3.1 pp), going from the 2nd to the 4th position and concentrating 9.2% of the total industrial revenue in 2019.

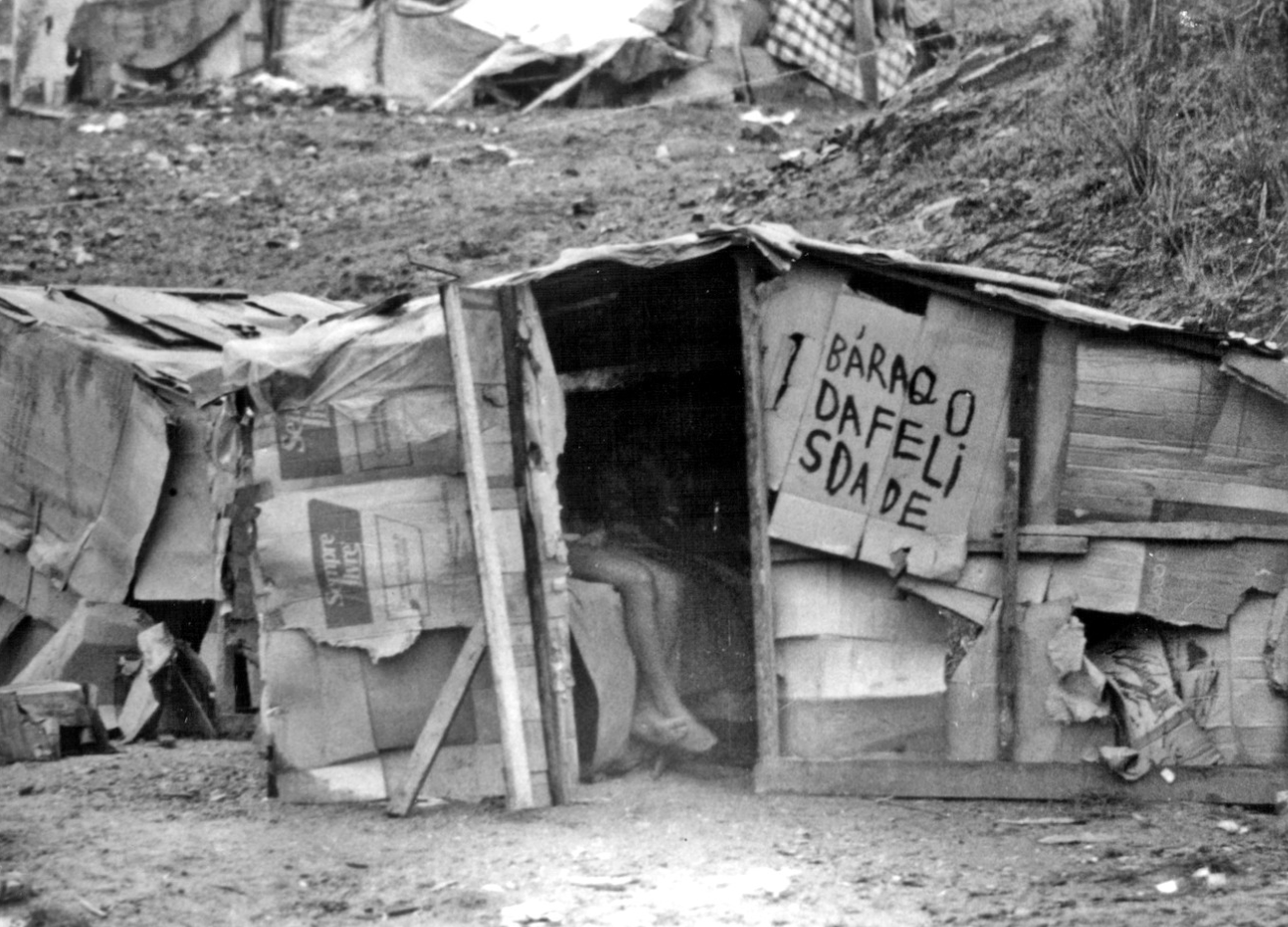

“This decline of the car industry comes from several crises in a row in the sector, causing important regional impact, since some plants have been either transfered to other areas or shut down. Even with countercyclical policies, as IPI reduction, some assemblers did not resist”, explains Synthia Santana.

Industry concentration reaches the highest level since 2010

Market concentration in the industrial sector in Brazil increases 2.4 percentage points in 2019, reaching 24.7%, the highest level in the series started in 2010. The index measures the percentage of the industrial manufacturing level generated by the eight larger enterprises in the sector.

Between 2010 and 20191, the mining and quarrying industries had a small reduction in the concentration, from 75.5 to 74.0%. On the other hand, the manufacturing industry, although with a smaller concentration, increases from 19.6% to 23.0%. IN the period, the concentration increases in the manufacture of computer, electronic and optical products, from 33.5% to 46.1%, and in the manufacture of pulp, paper and paper products, from 46.2 to 56.6%.