PAS

Over the course of ten years, segment of information and communication has lost ground in the services sector

August 28, 2024 10h00 AM | Last Updated: August 29, 2024 10h09 AM

Highlights

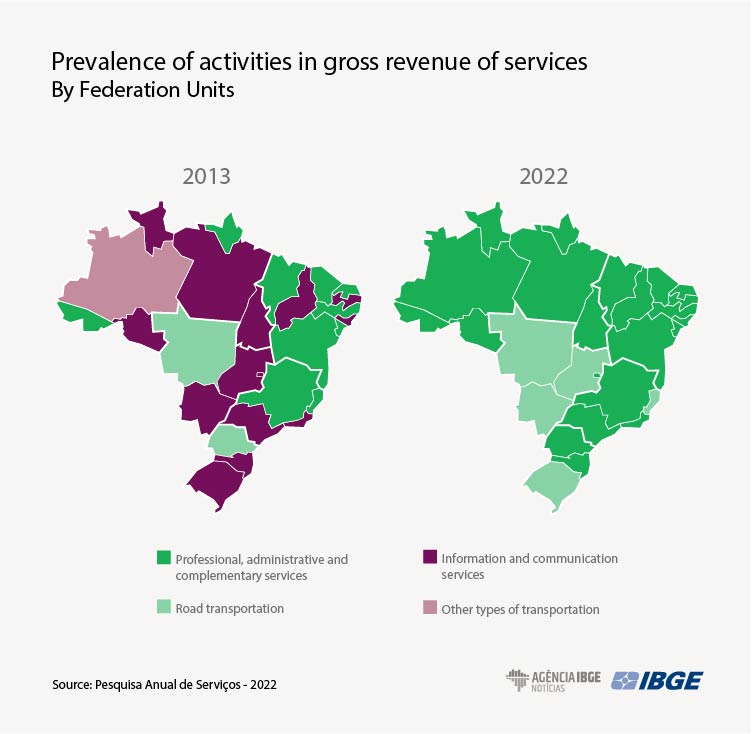

- Information and communication, which in 2013 was predominant in the gross revenue of the services sector of 14 Federation Units, did not represent, in 2022, the biggest share of gross revenue in any of them. That was mainly due to the drop in participation of the telecommunications activity. That was mainly due to the drop in participation of the telecommunications activity.

- Among the 34 disaggregated activities, Information technology, which belongs to information and communication services, recorded the biggest increase in this period of ten years.

- The biggest share in net operating revenue was that of Road transportation of cargo (13.1%).

- In 2022, companies rendering non-financial services in activity in the country amounted to 1.6 million. They employed 14.2 million persons, the biggest number in the time series of the Annual Survey of Services (PAS).

- Between 2013 and 2022, the number of employed persons in the sector grew by 1.7 million, that is, 13.9%. This result was mainly influenced by Technical-professional services (508.0 thousand) and Office and administrative support services (393.5 thousand).

- The number of employed persons in non-financial services exceeded by 10.3% that of the pre-pandemic level, with an increase of 1.3 million employed persons from 2019.

- However, in this same period, there was a drop of 92.4 thousand employed persons in services rendered mainly to families, driven, above all, by food services (-112.5 thousand persons).

Information and communication lost ground in the services sectors in Brazil in ten years. In 2013, this segment was predominant in gross revenue in 14 Federation Units and, but, in 2022, no longer in any of them. These data come from the Annual Survey of Services (PAS) and were released today (28) by the IBGE.

The drop is mainly related to the performance of one of the five activities in this segment: “One of the reasons for that was the loss of revenue by the activity of telecommunications, which is formed by telephone companies. We observe a change in the behavior of people who no longer use the telephone as a means of communication and started using the Internet more often instead, like messaging apps,” says the analyst of the survey, Marcelo Miranda.

On the other hand, in 2022, the segment of professional, administrative and complementary services was predominant in the gross revenue of services in most of (22) the Federation Units. In 2013, that was true for 10 FUs.

The total estimated gross revenue of companies that render non-financial services amounted to R$3.1 trillion, being 97.4% of this amount generated by rendering of services and the remainder, by secondary activities performed by these companies, including industrial operations, construction and resale of goods.

A drop in the share of information and communication was also observed in the net operating revenue (NOR) of services, when cancelled sales, unconditional discounts and applicable taxes, estimated at R$ 2.7 trillion in 2022. “In the beginning of the time series, in 2007, this segment was the most relevant one. It corresponded to 31.2% of the net operating revenue of the services sector in the country and had decreases since then. During the pandemic, it was stable from 2019 to 2020, but fell little by little in the following years,” the researcher explains.

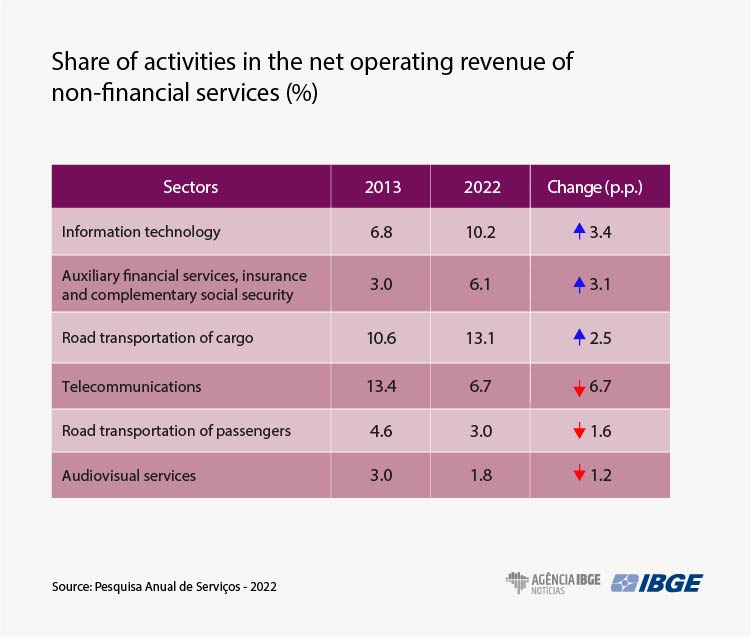

It was a movement similar to that of telecommunications, which, in 2013, had a share of 13.4% in net operating revenue, the biggest among the activities and that has fallen by 6.7 percentage points (p.p.) since then.

In 2022, the segment of information and communication represented 19.4% of the NOR, being in third position as for participation, with Transportation, support services to transportation and mailing (29.8%) and professional, administrative and complementary services (27.8%) in the first and second positions, respectively.

“In the beginning of the time series, Transportation, support services to transportation and mailing accounted for the second main contribution in net operating revenue among the sectors and remained stable over the years. With the drop of information and communication services, the other segments did not grow in terms of participation and it was in the first position due to this stability.”

The analysis of the 34 activities within the seven main segments of Services, information technology, which also belongs to information and communication, recorded the main increase in ten years (3.4 p.p.). In that same period, road transportation of cargo increased by 2.5 p.p., which turned it into the activity with the highest share in net operating revenue (13.1%).

“That is a feature of our infrastructure culture. We use road transportation very often, for trucks. The road network is huge and that has had an influence on the increase of this activity in the last ten years,” Miranda remarks.

In Services rendered mainly to families, there was concentration of the generation of revenue in two of its five activities: Food services (64.7% of the revenue generated in this segment); and Lodging services (13.7%). The segment accounted for the fourth biggest share in revenue (10.7%).

With 14.2 million persons, employment in services hit a record in 2022

In 2022, there were 1.6 million companies rendering non-financial services in activity in the country, which employed 14.2 million persons. This number increased by 5.8% from the previous year and was the highest ever recorded in the time series of PAS. The companies paid R$518.0 billion in salaries, withdrawals and other compensation.

With the increase in occupation, employment in the sector was 10.3% above the pre-pandemic level, which means an increase of 1.3 million employed persons against the figure in 2019. This increase was mainly influenced by the segment of Professional administrative and complementary services, among which Technical-Professional activities (353.8 thousand), Office and administrative support services (248.3 thousand) and Recruitment, agency and rental of workforce (203.7 mil).

On the other hand, there was a drop of 92.4 thousand employed persons in services rendered mainly to families in this period, with the impact of the decrease of the activity of food services (-112.5 thousand persons).

“Services rendered mainly to families encompass, for example, food services and lodging services. In the period of the pandemic, these activities that are more related to in-person participation, such as restaurants and hotels, ended up losing employed persons in a significant way. Despite the increase in the last few years, pre-pandemic levels have not been reached again.”

Over the course of ten years, the publication shows an increase of 1.7 million persons employed in the sector of non-financial services. That means an increase of 13.9%, with an impact from Technical-Professional services (508.0 thousand) and Office and administrative support services (393.5 thousand). Another highlight was Information technology (244.6 thousand).

On the contrary, road transportation of passengers lost 213.2 thousand employed persons over the course of ten years, recording the biggest increase among the activities. A possible explanation to this result if the reduction of the demand by some professions of the sector. “In the past, municipal buses had a fare collector, which is a professional not usually seen nowadays.”

In 2022, workers in the non-financial services sector were mainly concentrated in professional, administrative and complementary services (6.2 million), Services rendered to families (2.8 million), Transportation, support services to transportation and mailing (2.6 million) and Information and communication services (1.3 million).

Among the 34 disaggregated activities, Food services was the one employing most people, concentrating 11.6% of the employed persons. It is followed by Technical-professional services (11.4%), Road Transportation of cargo (8.4%), Services for buildings and landscape activities (8.2%) and Office and administrative support services (7.7%). These five activities accounted for almost half (47.3%) of the employment in the sector.

Average size is higher in companies of the Transportation sector

Also regarding occupation in non-financial services sector, the publication presents the calculation of the average number of companies, measured by the ratio between the number of employed persons and the number of companies. In 2022, there was an average of nine people per company, which indicates stability against 2013, when the average was 10 people.

The activities of some segments recorded significantly higher averages, such as Transportation, support services to Transportation and mailing: Railway and subway transportation (952 people), Pipeline transportation (551 people) and Air transportation (223 people). The sectors linked to Real estate activities and Repair and maintenance services had the lowest figures for average size of companies (between 2 and 4 employed persons per company).

The average salary in the services sector was 2.3 minimum wages (s.m). The companies that paid the highest averages belonged to the segments of Transportation, support services to Transportation and mailing: Pipeline transportation (18.5 s.m.), Waterway transportation (6.9 s.m.) and Air transportation (6.1 s.m.).

The lowest average salaries were paid by Cultural, recreation and sports activities, with 1.3 s.m., and Food services, Services for buildings and landscape activities; Purchase, sale and rent of real estate, Maintenance and repair of vehicles and Maintenance and repair of personal and domestic objects, both with an average wage of 1.4 s.m.

Services sector reaches lowest level of concentration in the time series

Another indicator presented in the publication to analyze the services sector in market concentration. The concentration ratio of level 8 (R8), adopted in the survey, calculated the net revenue of the eight biggest companies in the sector. The highest the R level, the higher the concentration. In 2022, R8 reached 6.8%, with a drop of 2.7 p.p. over the course of ten years, which means the lowest concentration in the time series of this survey.

“The services sector has grown more and more, and, given the increase in the number of companies, the biggest ones end up losing ground to smaller companies. This fragmentation of services may account for the drop in concentration,” the analyst says.

Concentration was bigger in the segment of Information and communication services, with a 30.8% R8, despite showing the biggest drop between 2013 and 2022 (-5.1 p.p.). The Other segments with the biggest concentration were Other service activities (26.3%), Transportation, support services to transportation and mailing (12.7%), Maintenance and repair services (11.5%), Services rendered mainly to families (8.2%), Real estate activities (7.2%) and Professional, administrative and complementary services (5.5%).

Among the 34 activities that form the services sector, the highest levels of market concentration were found in Transportation, support services to transportation and mailing: Pipeline transportation (100,0%), Air transportation (94.4%), Mailing and other delivery activities (82.5%) and Railway and subway transportation (76.9%).

Southeast concentrates 65.4% of the gross revenue of services

In 10 years, the composition of gross revenue of services in relation to the Major Regions was virtually stable, with an increase of 0.4 p.p. in the South, and of 0.1 p.p. in the Central West and in the Southeast. The Northeast (-0.6 p.p.) and the North (-0.2 p.p.) recorded drops. The Southeast accounted for the 65.4% of the total revenue. The other Major Regions recorded the main participations: South (14.7%), Northeast (9.8%), Central West (7.4%) and North (2.6%).

The Northeast concentrated 15.1% of the employed persons in the services sector in 2022, but accounted for only 10.7% of the salaries paid. The Southeast concentrates 56.4% of the employed persons and 64.7% of the salaries.

The Northeast also pays the lowest compensation to the employed persons in the entire time series, against the amount paid in other Major Regions. In 2022, the average salary was 1.6 minimum wages, whereas the national average hit 2.3 minimum wages in the sector. The Southeast paid the biggest compensation (2.7 s.m.), followed by the South (2.1 s.m.), Central West (1.9 s.m.) and North (1,8 s.m.).

More about the survey

The Annual Survey of Services (PAS) 2022 presents the main results for companies that render non-financial services in relation to the characterization of the sector from the perspective of revenue, market concentration and employment profile. The survey covers 34 activities of the sector aggregated into seven segments. It shows data for Brazil, Major Regions and Federation Units. Additional information is available in the survey support material.