IBGE expects record harvest of 258.9 million tonnes in 2022

April 07, 2022 09h00 AM | Last Updated: April 25, 2022 11h47 PM

|

MARCH estimate for 2022 |

258.9 million tonnes |

|

March 2022 / February 2021 change |

(-1.0%) -2.7 million tonnes |

|

2022 harvest / 2021 harvest change |

(2.3%) 5.7 million tonnes |

In March, the production of cereals, legumes and oilseeds estimated for 2022 is expected to exceed the record figure of 258.9 million tonnes, 2.3% above (5.7 million tonnes) that obtained in 2021 (253.2 million tonnes) and recorded a decline of 1.0% (-2.7 million tonnes) in relation to the February estimate (261.6 million tonnes). As a result, production must exceed the record of 2020 when the overall output amounted to 255.4 million metric tons. The Systematic Survey of Agricultural Production (LSPA) also unveiled that the area to be harvested was 71.8 million hectares, being 4.7% (3.2 million hectares) bigger than the area harvested in 2021 and 0.8% (555.6 thousand hectares) bigger than expected in the previous month.

Rice, corn and soybeans were the three main products in this group, and, together, accounted for 92.2% of the output estimate and for 87.7% of the area to be harvested. Rice, corn and soybeans were the three main products in this group, and, together, accounted for 92.2% of the output estimate and for 87.7% of the area to be harvested.

On the other hand, the area for rice declined 1.2% and that for wheat, 2.9%.

The soybean output must amount to 116.2 million tonnes, with a decrease of 13.9% in relation to the amount produced last year. The output of corn was estimated at 111.9 million tonnes, an increase of 27.4% in relation to 2021. The output of rice was estimated at 10.7 million metric tons, a drop of 8.0% over the amount produced last year.

The March´s report for the national harvest of cereals, legumes and oilseeds in 2022 reached 258.9 million tonnes and a harvested area of 71.8 million hectares. The area to be harvested rose 4.7% (3.2 million hectares) in relation to 2021. Against the estimate in the previous month, there was an increase of 555.6 thousand hectares (0.8%).

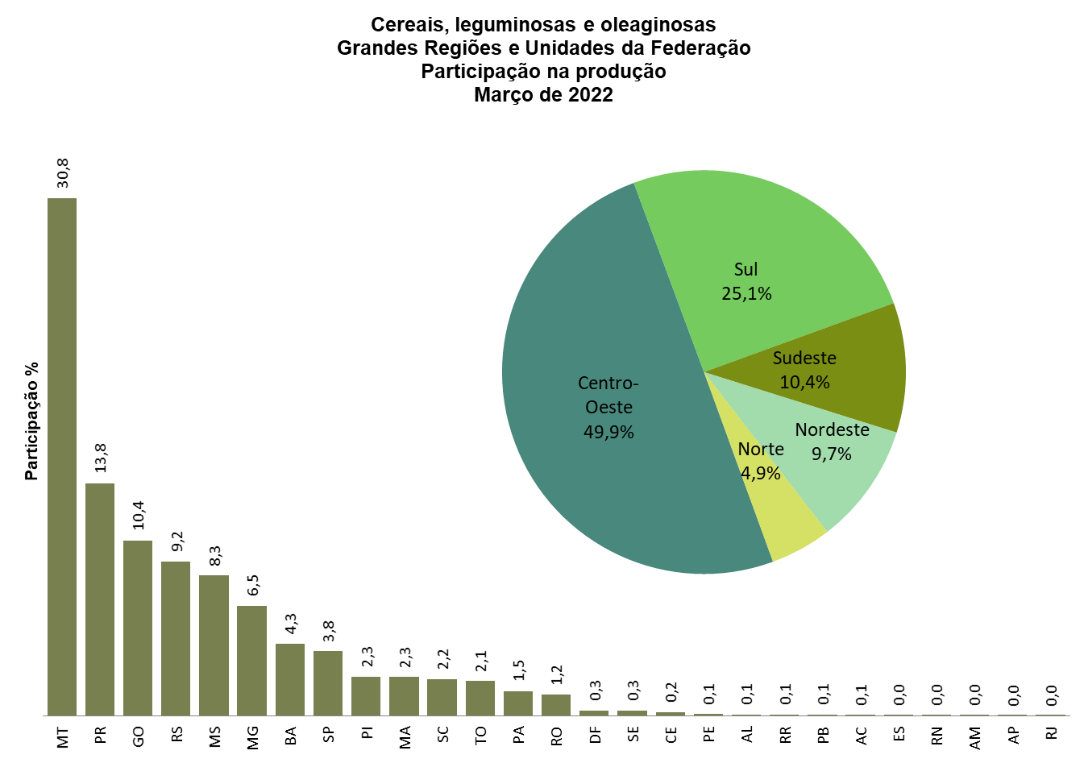

Only the South Region recorded a decrease (-5.9%) against the estimate of the previous month. It must produce 65.1 million tonnes (25.1% of the national overall). The other Major Regions recorded increase: Having increased by 2.2% against the previous estimate, the North is expected to reach 12.7 million tonnes (4.9% of the total). The Northeast recorded an increase of 1.6%, and amounted to 25.1 million tonnes. It is expected represent 9.7% of the national output. The estimate for the South, in turn, increased by 0.4% and production must reach 26.9 million tonnes (10.4%), whereas theat for the Central West, having increased by 0.5%, was estimated at 129.1 million (49.9% of the total).

Among the Federation Units, Mato Grosso led as the main producer of grain, with a share of 30.8%, followed by Paraná (13.8%), Rio Grande do Sul (9.2%), Goiás (10.4%), Mato Grosso do Sul (8.3%) and Minas Gerais (6.5%), which, together, accounted for 79.0% of the national overall. The main positive changes in output estimates, in relation to the previous month, were those of Mato Grosso (2.2 milllion tonnes), Paraná (1.0 million tonnes), Bahia (223.7 thousand tonnes), Rondônia (166.1 thousand tonnes), Pernambuco (149.8 thousand tonnes), Minas Gerais (110.1 thousand tonnes), Pará (109.5 thousand tonnes), Rio Grande do Norte (18.3 thousand tonnes ), Maranhão (12.9 thousand tonnes), Espírito Santo (2.5 thousand tonnes) and Rio de Janeiro (1.9 thousand tonnes). The main negative changes were registered by Rio Grande do Sul (-4.5 million tonnes), Mato Grosso do Sul (-1.5 million tonnes), Santa Catarina (-640.2 thousand tonnes), Federal District (-30.8 thousand tonnes) and Ceará (-789 tonnes).

Highlights in the March estimate in relation to February 2022

In May, the following positive changes in output estimates from February stood out: barley (11.4% or 46.4 thousand tonnes), wheat (9.6 % or 697.6 thousand tonnes), corn 2nd crop (4.9% or 4.1 million tonnes), beans - 2nd crop (4.5% or 58.8 thousand tonnes), upland cotton seed (3.7% or 231.7 thousand tonnes), oat (3.3% or 32.4 thousand tonnes), beans - 1st crop (2.0% or 23.7 thousand tonnes), beans - 3rd crop (1.7% or 9.9 thousand tonnes), coffea canephora (1.7% or 17.1 thousand tonnes) and coffea arabica (0.6% or 14.3 thousand tonnes).

On the other hand, there were decreases in the production of grapes (-9.5% or -155.6 thousand tonnes), of soybean (-5.6% or -6.8 million tonnes), of corn - 1st crop (-3.8% or -965.6 thousand tonnes) and of tomato (-1.9% or -69.5 thousand tonnes).

UPLAND COTTON SEED - With heated demand, producers increased planted are with cotton. Against the previous month, there was an increase of 3.6% and, in the year, it reached 11.1%. As a result, the estimated output reached 6.6 million tonnes, with an increase of 3.7% agains the previous month nd of 12.3% against 2021. Last year, soybean planting was delayed due to the scarcity of rain in some areas and, since many cotton areas are planted after this crop, some producers reduced it in order to minimize climactic risks. In 2022, planting took place within the ideal period, and that facilitated the development of this crop.

Having estimated an increase of 3.7% in the output in relation to the previous month, Mato Grosso was responsible for nearly 70.0% of the national production. In relation to 2021, production is expected to increase by 13.9%, having as the main reason the increase of planted area (12.6%). As most of the areas for this product in the state is planted in the 2nd crop, and, since the advance of soybean harvest led to the planting of cotton at the ideal time, crops had its development facilitated. However, in some areas of the State, the excess of rain reduced the pace of soybean harvest, and damaged the implementation of cotton crops.

In Bahia, responsible for 21.0% of the national harvest, the output estimate increased by 2.1% against the previous month due to the expected increase in productivity. The recovery of cotton lint and the increase of international demand must encourage producers to expand planted area.

COFFEE BEAN Considering the two species, arabica and canephora, the Brazilian production estimate of coffee for 2022 was of 3.4 million tonnes, or 56.1 million 60-kg sacks, a growth of 0.9% in relation to the previous month and an increase of 14.4% from 2021. The average yield of 1,824 kg/ha, in turn, increased 13.5% in the annual comparison.

The estimated production of coffea arabica, was of 2.3 million tonnes or 38.7 million 60-kg sacks, an increase of 0.6% against the previous month, and of 20.9% from the previous year. In 2022, the harvest of coffea arabica will be of positive biennial bearings, which should result in a significant increase in the output, though the dry and extremely cold weather in the winter of 2021, including the occurrence of frosts in some producing regions, can reduce the potential output.

Concerning coffea canephora, mostly known as conillon, the estimated output was of 1.0 million tonnes or 17.4 million 60-kg sacks, an increase of 1.7% in relation to the previous month and of 2.3% in relation to 2021. The planted area and the area to be harvested grew by 1.8% and 1.9%, respectively. Average yield, 2 586 kg/ha, recorded an increase of 0.4% against the result of 2021.

WINTER CEREALS - The main winter cereals produced in Brazil are wheat, white oat and barley. The estimated production of wheat was 7.9 million tonnes, a growth of 9.6% against the previous month and of 1.5% against the previous year, and the average yield is expected to increase 2 939 kg/ha, with an increase of 4.5%.

The output estimate of oatwas 1.0 million tonnes, a decrease of 3.3% against the previous month and a decrease of 4.9% against 2021. The main producers of the cereal are Rio Grande do Sul, with 709.2 thousand tonnes and Paraná, with 236.7 thousand tonnes, and the South Region accounts for 96.7% of the total to be produced in the country in 2022.

As for barley, the estimated output (453.4 thousand tonnes) increased by 11.4% in relation to the previous month and by 3.8% in relation to 2021. The biggest producers of this cereal were Paraná, with 344.2 thousand tonnes, and Rio Grande do Sul, with 94.5 thousand tonnes, which, together, represented 96.7% of the national overall. The amount produced by São Paulo and Santa Catarina was estimated at 12.7 thousand tonnes and 3.0 thousand tonnes, respectively. The harvest of this cereal is usually associated with contracts with national beer companies, which has stimulated production in the country as an alternative to imports of this product.

BEAN SEED - The estimated production of beans, considering the three crops was of 3.2 million tonnes. This estimate is 3.0% above that in the previous month, due to the increases of 1.7% in area to be harvested and of 1.3% in average yield. In this review, the Federation Units with the biggest participation in the produciton estimate were Paraná (24.7%), Minas Gerais (16.5%), Goiás (10.2%) and Mato Grosso (9.4%).

In relation to the annual change, the estimate for area to be harvested increased 2.7%, with an increase of 11.0% in average yield. The production estimate increased 13.9%.

The first crop of beans was estimated at 1.2 million tonnes, an increase of 2.0% against the February estimate. The estimate of the area to be harvested increased 1.9%, and average yield remained unchanged. With negative results are Santa Catarina (-19.0%), Rio Grande do Sul (-11.2%) and Rio de Janeiro (-4.8%). Mato Grosso (48.8%), Pernambuco (115.8%) and Rio Grande do Norte (63.3%\0 stood out with positive results. Lack of rain was responsible by the reduction of harvests in Rio Grande do Sul and in Santa Catarina, as well as in Paraná, which, in the first month revised its output of the 1st crop (4.9%) upwards, and interrupted a sequence of decreases due to the dry period. The first crop represented 38.2% of the total amount of beans produced in the country.

The second crop of beans was estimated at 1.4 million tonnes, a retreat of 4.5% against the April estimate, also with increases of 3.0% in the estimated average yield and 1.4% in the estimated area to be harvested. Negative results came from Rio Grande do Norte (-67.7%), Espírito Santo (-1.4%), Minas Gerais (-1.3%) and Mato Grosso (-22.7%) and positive results were those of Pernambuco (97.9%), Paraná (9.0%), Santa Catarina (32.9%), Rio Grande do Sul (5.0%) and Mato Grosso do Sul (12.9%). The second crop represented 43.0% of the total amount of beans produced in the country.

As for the 3rd crop, the estimated production was 593.8 thousand tonnes, an increase of 1.7% against the estimate in February, with increase in harvested area by 1.4% and average yield 0.3% bigger. Among the nine states with data for the third crop of beans, six of them kept the estimates of the last survey. There was an increase in the output estimate of the Federal District (133.3%), and decline in the estimate of Mato Grosso (-1.3%) and of Espírito Santo (-42.0%). This harvest represents 18.8% of the national output of this grain.

MILHO - The production estimate of corn hit 111.9 million tonnes, representing an increase of 2.9% against the previous month and of 27.4% in relation to 2021. After a significant decrease in the production in 2021, an effect of the delay in planting of the second crop and the lack of rainfall in the main producing units, a year within normal occurrences is expected, which will promote the recovery of the crops, including a possible new national record.

For corn 1st crop, the estimated output is 24.7 million tonnes, a decline of 3.8% in relation to the previous month and of 3.9% in relation to the 2021 crop, despite the increase of 6.9% in the area to be harvested. Average yield recods a decrease of 10.1%. Although rainfall came earlier in most parts of the country, causing the agricultural year to start on time, the lack of rainfall in the South Region since the second half of the crop cycle significantly broke down the potential production of the harvest.

For corn 2nd crop, the estimated output hit 87.2 million tonnes, an increase of 4.9% in relation to the previous month and of 40.4% in relation to the 2021, with a growth of 6.8% in the area to be planted. In most Federation Units important in the production of that cereal, the weather jeopardized the development of the crops in the second crop of 2021. In addition to the harsh weather, the agricultural year was delayed, shortening the “planting window”, which further helped reduce production, since it left the crops more exposed to rainfall restrictions during the production cycle. A more beneficial climate was expected for the second crop of corn in 2022 when compared with that of 2021. The agricultural year did not get delayed and most of the soybean was planted at the right time, which can favor the “planting window” for corn - 2nd crop. Production is estimated to increase in the main producing states.

SOYBEAN SEED - The estimated output of soybean, based on data for the month of March, recorded a monthly adjustment with a decrease of 5.6% in the volume produced in the country, fostered by the confirmation of productivety observed in the southern states. A total 116.2 million tonnes have been produced, indicating a decrease of 13.9% against the previous year. Effects of the dry period led a a worse performance of summer crops in the central-southern states of Brazil.

As a result, even if a 4.0% increase in planted areas is confirmed, which should amount to 40.5 million hectares, there is an estimate of a 17.0% drop in the average soybean yield in 2022, reaching the level of 2 873 kg/ha, bringing the national production down. The participation of soybean in the total volume of cereals, legumes and oilseeds produced in the country must fall to 44.9% and still remain as the most relevant grain in the group.

Mato Grosso, main national producer of cereals, legumes and oilseeds and that must account for almost one thirds of the national production, a new increase of 0.3% in the month led to an estimate of 37.6 million tonnes. As a result, soybean production in the state must be 5.4% above that in the previous year, with a new record in the IBGE’s time series.

With the expected crop failure in southern states, Goiás must account for the second largest volume of soybeans produced in the country this year. Even with the expected drop of 0.8% in the average yield, the production should grow 3.1% and hit 13.5 million tonnes as a result of the increase in the cropping areas, which should grow 3.9% in the year.

In Paraná, with crop failure tnis year, the volume produced must be 41.1% smaller than in the previous harvest, also due to the effects of the dry period, made worse by the extreme heat. With an expected output of 11.7 million tonnes, the retraction of 41.8% in the average yield was the major cause of the drop in the state production. Rio Grande do Sul, whcih went through another adjustment, now with a 27.5% drop in output, confirming crop failure, estimated, for 2022, a production of 9.5 million tonnes, a decrease of 53.5% from the harvest a year ago.

TOMATO – The estimated output of tomatoes in 2022 was of 3.5 million tonnes, pointing out to a decrease of 1.9% in relation to February. Planted area recorded a decrease of 1.3% and average yield, a decline of 0.7%. In this estimate, Goiás was the biggest Brazilian producer of tomatoes, with an expectdd production of 971.4 thousand tonnes, which represented 27.5% of the national overall, followed by São Paulo with 24.8%, Minas Gerais with 14.5%, Paraná with 6.0%, Bahia with 5.0%, Espírito Santo with 4.2% and Rio de Janeiro with 4.2%.

The main drops, against the previous month, in terms of production volume, were observed in Paraná (-6.6%), Santa Catarina (-29.0%), Rio Grande do Sul (-2.4%) and Espírito Santo (-5.1%). In relation to 2021, the output estimate was 9.2% smaller, with drops of 3.0% in the average yield and of 6.4% in the are to be harvested.

GRAPE – The output estimate for grapes was 1.5 million tonnes, with a decrease of 9.5% against the previous month and of 13.2% against 2021. In Rio Grande do Sul, the country's largest producer, with 49.3% of the total, the production estimate was reduced by 17.5% in relation to February, to 728.3 thousand tonnes, falling 23.4% in relation to 2021. The dry period had direct effects on this crop, and it may affect the coming one, including physiological development, because that makes the maintenance of leaves more difficult and accelerates the numbness of plants, leading to reduced cumulative photoassimilation.

São Paulo production must reach 146.9 thousand tonnes, a decline of 0.3% in relation to the previous year, while production in Paraná (56.2 thousand tonnes and Santa Catarina (55.2 thousand tonnes) must record a decline of 1.4% and 7.5%, respectively, in the same comparison. In the Northeast, Pernambuco and Bahia, also importatn producers, with a contribution of 27.0% and 4.1%, respectively, are expected to produce 399.1 thousand tonnes and 60.8 thousand tonnes, respectively. While in the South most grapes are directed to juice production, in the Northeast the majority is consumed without being processed.