In January, IBGE expects record harvest of 271.9 million tonnes for 2022

February 10, 2022 09h00 AM | Last Updated: February 16, 2022 10h57 AM

In January, the production of cereals, legumes and oilseeds estimated for 2022 should add up to a record of 271.9 million tonnes, 7.4% above (18.7 million tonnes) that obtained in 2021 (253.2 million tonnes) and 1.9% below (-5.2 million tonnes) in relation to the previous information (277.1 million tonnes).

The Systematic Survey of Agricultural Production (LSPA) also unveiled that the area to be harvested was 71.2 million hectares, 3.8% larger (2.6 million hectares) than the area harvested in 2021 and 0.3% larger (217.2 thousand hectares) that that expected in the previous month.

| JANUARY's estimate for 2022 | 271.9 million tonnes |

| JANUARY 2022 / DECEMBER 2021 change | (-1.9%) - 5.2 million tonnes |

| 2022 harvest / 2021 harvest change | (7.4%) 18.7 million tonnes |

Rice, corn and soybeans were the three major products in this group, which, altogether, represented 93.0% of the production estimate and accounted for 87.8% of the area to be harvested. The area for corn production increased by 5.8% (6.9% in the first crop and 5.4% in the second one), that for upland cotton increased 7.2% and the area for soybeans, by 3.6% against 2021.

On the other hand, the area for rice declined 0.9% and that for wheat, 1.7%.

It was expected that the output of soybeans added up to 131.8 million tonnes, a reduction of 4.7% over the third forecast, released in January, and of 2.3% in the comparison with the production in the previous year. The output of corn was estimated at 109.9 million tonnes, a growth of 0.9% over the previous month and of 25.2% in relation to 2021. The output of rice was estimated at 11.0 million tonnes, a drop of 4.9% over the 2021 harvest.

The January´s report for the national harvest of cereals, legumes and oilseeds in 2022 reached 271.9 million tonnes and a harvested area of 71.2 million hectares. The area to be harvested rose 3.8% (2.6 million hectares) in relation to 2021. It rose 217.2 thousand hectares (0.3%) against the forecast of the previous month.

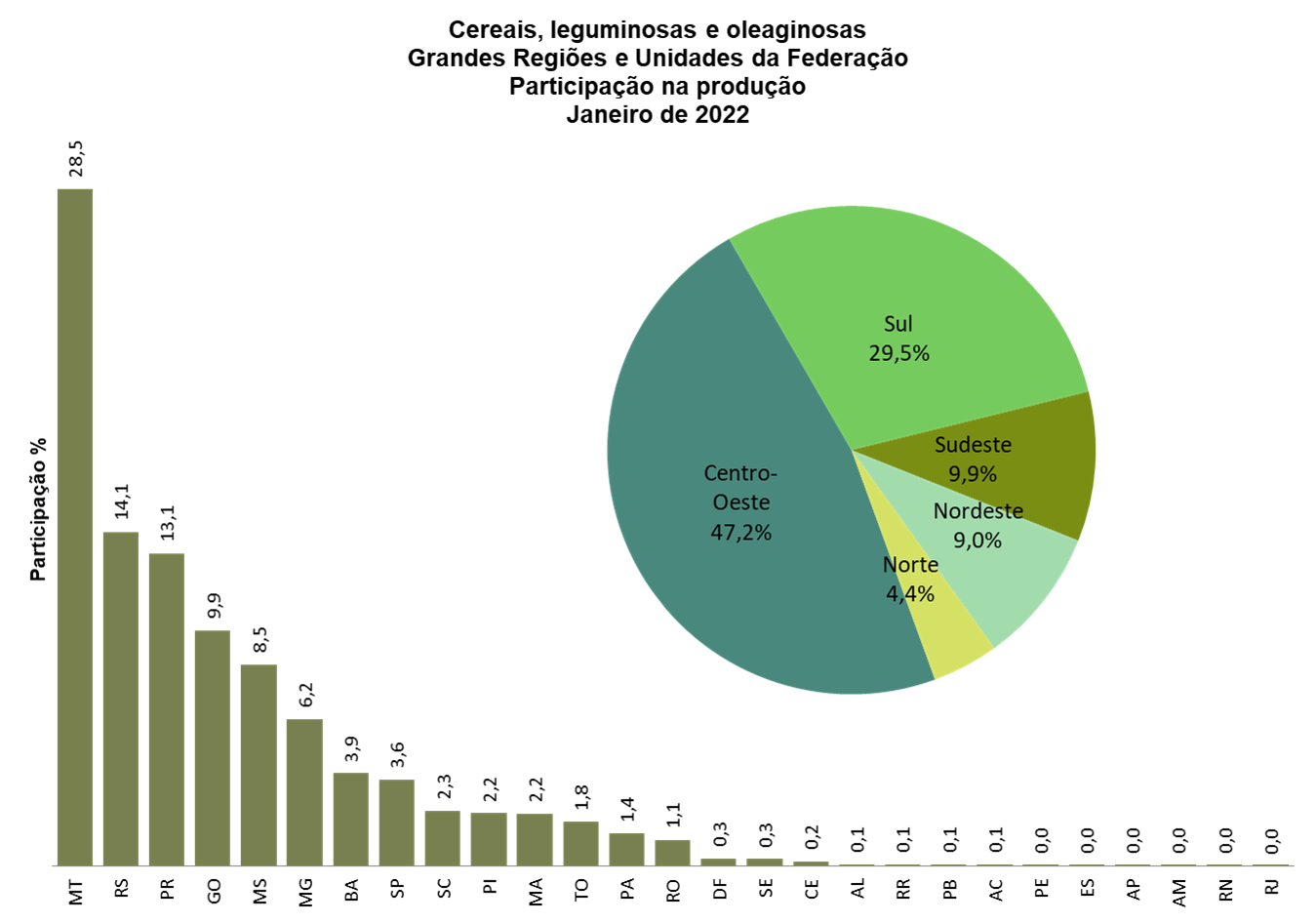

The Northeast was the only to increase (1.1%) its estimate over the previous month. It should produce 24.4 million tonnes (9.0% of the national overall). The greatest drop was recorded in the South (-5.7%), which should add up to 80.2 million tonnes (29.5% of the total). The North dropped 2.6% and should reach 12.0 million tonnes (4.4% of the total), whereas the Central-West, which declined 0.2%, should produce 128.4 million tonnes or 47.2% of the national output. The Southeast should produce 26.8 million tonnes (9.9% of the total).

In the comparison among the Federation Units, Mato Grosso led as the biggest producer of grains, with a share of 28.5%, followed by Rio Grande do Sul (14.1%), Paraná (13.1%), Goiás (9.9%), Mato Grosso do Sul (8.5%) and Minas Gerais (6.2%), which, together, represented 80.3% of the national overall. The major positive changes in the production estimates, over the previous month, occurred in Piauí (267.9 thousand tonnes), Pará (179.5 thousand tonnes), the Federal District (35.3 thousand tonnes), Rondônia (35.0 thousand tonnes), Maranhão (5.4 thousand tonnes) and Rio de Janeiro (424 tonnes).

The major negative changes occurred in Paraná ( -4.0 million tonnes), Santa Catarina (-860 thousand tonnes), Tocantins (-538.4 thousand tonnes), Mato Grosso (-336.3 thousand tonnes) and Ceará (-9.9 thousand tonnes).

Highlights in the January 2022´s estimate in relation to the third forecast

In January, the positive changes of the following output estimates stood out in relation to the third forecast: beans - 2nd crop (20.0% or 214.6 thousand tonnes), corn - 2nd crop (2.9% or 2.3 million tonnes), upland cottonseed (2.6% or 160.4 thousand tonnes), tomatoes (2.1% or 72.5 thousand tonnes) and sorghum (1.4% or 37.5 thousand tonnes).

The production of cashew nuts (-14.7% or -20.0 thousand tonnes), beans - 1st crop (-6.4% or -82.5 thousand tonnes), soybeans (-4.7% or -6.5 million tonnes), corn - 1st crop (-4.6% or -1.3 million tonnes), beans - 3rd crop (-1.4% or -8.1 thousand tonnes), coffea arabica (-0.5% or -11.0 thousand tonnes) and coffea canephora (-0.0% or -2 tonnes) dropped.

UPLAND COTTONSEED - The estimate for the output of cotton was of 6.3 million tonnes, an increase of 2.6% in relation to the third forecast due to the reassessment of the planted area. Having estimated an increase of 3.7% in the output in relation to the previous month, Mato Grosso was responsible for nearly 70.0% of the national production. This growth hit 8.8% in relation to 2021, due to the increase of 7.1% in the planted area.

In Bahia, responsible for 20.7% of the national harvest, an annual rise of 2.5% was expected in the output, though the planted area had grown 8.3%. Even with the recovery of the prices and increase in the foreign demand, a drop of 5.4% was expected in the productivity over the previous year.

COFFEE BEAN - Considering the two species, arabica and canephora, the Brazilian production estimate of coffee was of 3.4 million tonnes, or 55.7 million 60-kg sacks, a growth of 13.6% in relation to the previous year. The average yield of 1,808 kg/ha, in turn, increased 12.5% in the annual comparison.

For coffea arabica, the production estimate was of 2.3 million tonnes or 38.5 million 60-kg sacks, 20.2% above the previous year. In 2022, the harvest of coffea arabica will be of positive biennial bearings, which should result in a significant increase in the output, though the dry and extremely cold weather in the winter of 2021, including the occurrence of frosts in some producing regions, can reduce the potential output.

Concerning coffea canephora, mostly known as conillon, the estimated output was of 1.0 million tonnes or 17.2 million 60-kg sacks, an increase of 1.2% in relation to 2021. The average yield, of 2,521 kg/ha, declined 2.1%.

CASHEW NUTS - The estimated production for 2022 was of 115.9 thousand tonnes, an increase of 4.7% in relation to the previous year with a growth of 4.6% in the average yield. The biggest Brazilian producers were Ceará, Piauí and Rio Grande do Norte. The output of Ceará, of 62.0 thousand tonnes, represented 53.5% of the national overall; that of Piauí, of 25.2 thousand tonnes (21.8%) and that of Rio Grande do Norte, of 17.0 thousand tonnes (14.7%). Comparing the current year with 2021, a decline of 1.7% was estimated for Ceará and a growth of 32.7% for Piauí and of 2.2% for Rio Grande do Norte. The production estimate in Pernambuco, of 2.9 thousand tonnes, should grow 0.9% and that in Maranhão, of 3.9 thousand tonnes, an increase of 7.9% was expected. The estimated production for Bahia, of 2.9 thousand tonnes, declined 18.1% in relation to 2021.

BEAN (seed) - Considering the three crops of the product, the estimate of the output of beans was of 3.1 million tonnes, an increase of 4.2% in relation to the third forecast. The estimate of the area to be harvested reduced 0.7%, though the average yield should grow 5.0%. In this review, the Federation Units with the biggest participation in the production estimate were Paraná (23.2%), Minas Gerais (17.1%), Mato Grosso (10.9%) and Goiás (10.6%).

The first crop of beans was estimated at 1.2 million tonnes, a retreat of 6.4% over the estimate of the third forecast. The estimate of the area to be harvested increased 0.7%, whereas the average yield was estimated with a drop of 7.1%. Concerning the output estimate, the negative highlights were Paraná, with a reduction of 31.1%, and Santa Catarina, with a decline of 16.8%. Those states suffered with the lack of rainfall during the crop cycle, which is very sensitive to the climate conditions. The positive highlights were Mato Grosso, with a growth of 23.9%, and the Federal District (60.0%). The first crop represented 39.1% of the total amount of beans produced in the country.

The second crop of beans was estimated at 1.3 million tonnes, an increase of 20.0% over the estimate of the third forecast. The estimate for the average yield increased 23.2% and the area to be harvested reduced 2.5%. In Paraná, the estimated output grew 81.7% over the previous month, the same expectation for the annual comparison. Many producers who lost money with the summer harvest, due to droughts, should invest more in the crop, aiming at recovering part of the losses. In Mato Grosso, the estimated production registered a monthly decline of 9.8%, mainly due to the reduction in the planting area (-11.6%).

Concerning the third crop of beans, the estimated output was of 583.3 thousand tonnes, a decline of 1.4% over the estimate of the third forecast, due to the reduction of 1.4% in the estimate of the area to be harvested. Of the nine states with information for the third crop of beans, seven of them maintained the estimates of the last survey. The estimated production in Mato Grosso declined 5.1% and that of Tocantins grew 0.2%.

CORN (grain) - The production estimate of corn hit 109.9 million tonnes, representing an increase of 0.9% over the previous month and of 25.2% in relation to 2021. After a significant decrease in the production in 2021, an effect of the delay in planting of the second crop and the lack of rainfall in the main producing units, a year within normal occurrences is expected, which will promote the recovery of the crops, and it must reach a new national record.

For corn - 1st crop, the estimate was of an output of 27.2 million tonnes, a decline of 4.6% in relation to the previous month and an increase of 6.1% in relation to the 2021 harvest. Although rainfall came earlier in most parts of the country, causing the agricultural year to start on time, the lack of rainfall in the South Region since the second half of the crop cycle significantly broke down the potential production of the harvest.

In Paraná, the output was estimated at 2.7 million tonnes, a decline of 25.9% in the month with a drop of 26.4% in the average yield. In Santa Catarina, the output was estimated at 2.4 million tonnes, a retreat of 18.0% over the previous month and an increase of 20.0% in relation to 2021. In Rio Grande do Sul, the biggest producer of corn - 1st crop, the production was estimated at 5.2 million tonnes, the same estimate of the previous month. Nevertheless, declines were expected for the following months as field surveys begin to show the losses due to droughts and high temperatures.

In Minas Gerais, an important producer of corn - 1st crop in Brazil, with a share of 18.8% of the total, the output should hit 5.1 million tonnes, 4.5% above the previous year. In São Paulo, the estimated production was of 1.8 million tonnes, a decline of 19.1% in annual terms. In Mato Grosso, the estimated production was of 377.8 thousand tonnes, a rise of 17.5% over the previous month and of 28.4% in relation to the previous year. In Goiás, the estimated output was of 1.4 million tonnes, a retreat of 8.7% over 2021 and, in Mato Grosso do Sul, of 173.0 thousand tonnes, an increase of 31.9% in the same comparison.

For corn - 2nd crop, the estimate was of an output of 82.7 million tonnes, an increase of 2.9% in relation to the previous month and of 33.1% in relation to the 2021, with a growth of 3.7% in the area to be planted. In most Federation Units important in the production of that cereal, the weather jeopardized the development of the crops in the second harvest of 2021. Moreover, the agricultural year delayed, shortening the “planting window”, which let the crops more exposed to the rainfall restrictions along the cycle.

A more beneficial climate was expected for the second crop of corn in 2022 when compared with that of 2021. The agricultural year did not delay and most of the soybean was planted at the right time, which can favor the “planting window” for corn - 2nd crop. A growth in the production was expected in Mato Grosso (12.5%), Paraná (164.2%), Goiás (14.5%), Mato Grosso do Sul (54.1%), Minas Gerais (51.7%), São Paulo (68.4%), Rondônia (11.5%), Piauí (77.1%), Alagoas (50.2%) and in the Federal District (64.7%), and declines in Bahia (-8.3%), Maranhão (-10.6%), Sergipe (-0.8%), Tocantins (-4.8%) and Pará (-2.8%).

SOYBEANS (grain) - The production of soybeans, estimated in the first month of 2022, added up to 131.8 million tonnes, reducing 4.7% in relation to the third forecast and 2.3% compared with the output in 2021. Although the Brazilian producers invested more in inputs and technology in the production of this grain, allowed by the good profitability of the crop over the last years, the climate effects of droughts in the Brazilian Center-South have negatively affected the performance of the crops, compromising the productivity.

Even expanding by 3.6% the production area, which should add up to 40.4 million hectares, the drop in the average yield was estimated at 5.7%, hitting 3,263 kg/ha and reducing the national output of this legume. Even so, soybeans should account for 48.5% of the total output of cereals, legumes and oilseeds in Brazil in 2022.

As the biggest producer, Mato Grosso, which should account once again for more than one quarter of the national production, estimated a total of 37.5 million tonnes, an increase of 5.1% in relation to the previous year. Rio Grande do Sul estimated the second biggest production, adding up to 21.1 million tonnes, a growth of 3.2% over the previous harvest, mainly leveraged by the expected increase of 4.2% in the planted area. However, that state has been through a strong drought. Up to now, the estimate was of a drop of 1.0% in the average yield, though it should step up.

In Paraná, a drop of 33.7% in the output was expected this year, due to the effects of droughts. With an expected output of 13.2 million tonnes, the retraction of 34.8% in the average yield was the major responsible for the crop failure, since the planted area was expected to grow 1.8%. Even with the expected drop of 0.8% in the average yield in Goiás, the production should grow 3.1% and hit 13.5 million tonnes, as a result of the increase in the cropping areas. In Mato Grosso do Sul, an increase of 6.4% was expected in the area to be harvested, rising to 12.7 million tonnes the estimated output in the state. In Minas Gerais, the estimated production was of 7.2 million tonnes, a growth of 2.6% over the previous year. Among the states in the North and Northeast, the negative highlight were Tocantins, where the drop in the output should hit 15.1%, adding up to 3.0 million tonnes, and Bahia, which should show a retraction of 1.5% in the production, with 6.7 million tonnes.

SORGHUM (grain) - The estimated production for the 2022 harvest was of 2.7 million tonnes, with an increase of 13.0% in relation to the previous year. In spite of the declines in the area to be planted (-1.0%) and in the area to be harvested (-0.2%), the average yield grew 13.2%. In 2021, the weather unfavored the second crops. A regular weather is expected for 2022, especially more rainfall in the major producing Federation Units.

The output in Goiás should hit 1.2 million tonnes, a rise of 8.8% over 2021. The average yield should increase 10.3%. A growth of 38.1% was expected for the production in Minas Gerais, which should hit 780.4 thousand tonnes. The average yield should increase 33.6%. The estimated output of sorghum for 2022 in Bahia was 19.1% smaller and should hit 115.1 thousand tonnes. In Mato Grosso, the output should hit 151.1 thousand tonnes, an increase of 4.9% in annual terms and, in Mato Grosso do Sul, 82.0 thousand tonnes, an increase of 13.7%. In the Federal District, the production was estimated at 48.0 thousand tonnes, 36.8% above the previous year.

TOMATOES - The first estimate of the Brazilian output of tomatoes in 2022 was of 3.6 million tonnes, pointing out to an increase of 2.1% in relation to the third forecast. The planted area and area to be harvested grew 2.7%, whereas the average yield declined 0.7%.

In this estimate, Goiás was the biggest Brazilian producer of tomatoes, expecting a production of 971.4 thousand tonnes, which represented 27.0% of the national overall, followed by São Paulo with 24.3%, Minas Gerais with 14.2%, Paraná with 6.5%, Bahia with 4.9%, Espírito Santo with 4.4% and Rio de Janeiro with 4.1%. Paraná (58.3%) recorded the highest positive change in the estimated production in relation to the third forecast.