Retail sales retreat 2.5% in March

May 13, 2020 09h00 AM | Last Updated: May 15, 2020 11h38 AM

In the seasonally-adjusted series, the retail sales retreated 2.5% in March 2020 over February. After decreasing 0.4% in the quarter ended in February, the quarterly moving average declined 1.1% in the quarter ended in March.

In the seasonally-unadjusted series, the retail trade retreated 1.2% in relation to March 2019, against an increase of 4.7% in February. It was the first drop after 11 consecutive months of positive changes in this comparison.

The retail recorded a cumulative rise of 1.6% in the year and of 2.1% in the last 12 months.

In the extended retail, which includes the activities of Vehicles, motorcycles, parts and pieces and Construction material, volume of sales declined 13.7% in relation to February – the most intense drop since the beginning of the time series, started in 2003 – against a rise of 0.5% in the previous month. As a result, the quarterly moving average of March (-4.2%) was lower than that in February (0.1%).

The extended retail trade retreated 6.3% over March 2019, the first drop after 11 consecutive months of positive changes, and remained stable (0.0%) in the cumulative index in the year.

The cumulative index over the last 12 months increased 3.3%. The results of March 2020 were influenced by the beginning of the social distancing due to the Covid-19 pandemic. Of all the enterprises collected by the Monthly Survey of Trade, 14.5% reported that their revenue was impacted by social distancing, which began in some capitals in the second half of March.

| Retail | Extended Retail | |||

|---|---|---|---|---|

| Volume of sales | Nominal revenue | Volume of sales | Nominal revenue | |

| March / February* | -2.5 | -1.0 | -13.7 | -12.0 |

| Quarterly moving average* | -1.1 | -0.4 | -4.2 | -3.5 |

| March 2020 / March 2019 | -1.2 | 2.6 | -6.3 | -2.8 |

| Cumulative in 2020 | 1.6 | 5.6 | 0.0 | 3.3 |

| Cumulative in 12 months | 2.1 | 5.3 | 3.3 | 4.5 |

| *Seasonally-adjusted series Source: IBGE, Diretoria de Pesquisas, Coordenação de Indústria |

||||

To explain the change detected in the sales revenue in March, 43.7% of the enterprises mentioned the coronavirus as the major cause. Compared with March 2019, the drop in volume of sales of those enterprises that reported that Covid-19 impacted their activities was -23.0%, whereas the retraction of those that did not report any impact of the quarantine in their revenue grew 1.5% in the same comparison.

The retail trade retreated 1.2% in relation to March 2019 and the influence of the revenue of the enterprises that reported some impact due to Covid-19 on this indicator was -2.6 p.p., whereas the influence of those that did not report any impact was 1.4 p.p.

In the extended retail, the drop in volume of sales of the enterprises impacted by Covid-19 was -26.8%, while that of those that did not report any impact declined 3.1%. The influence of the sub-group of impacted enterprises on the change of the extended retail in relation to March 2019 (-6.3%) was -3.7 p.p., whereas the other sub-group influenced -2.6 p.p.

Six of eight activities surveyed retreated in March

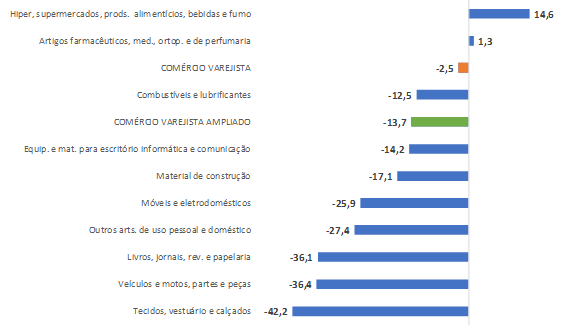

Social distancing due to the pandemic resulted in distinct impacts. Six out of the eight activities surveyed registered a drop in volume of sales of the retail trade, especially those that had their physical stores closed in some cities of the country from the second half of March onwards. These recorded negative figures: Fabric, apparel and footwear (-42.2%), Books, newspapers, magazines and stationery (-36.1%), Other articles of personal and domestic use (-27.4%), Furniture and household appliances (-25.9%), Office, computer and communication material and equipment (-14.2%) and Fuels and lubricants (-12.5%).

On the other hand, Hypermarkets, supermarkets, food products, beverages and tobacco (14.6%) and Pharmaceuticals, medical and orthopedic articles, toiletries and cosmetics (1.3%), activities considered essential during the quarantine period, increased their sales over February 2020.

Volume of Sales of the Retail Trade and Extended Retail - month/immediately previous month

Seasonally-adjusted series - March 2020

Considering the extended retail trade in the seasonally-adjusted series, volume of sales retreated 13.7% in March over February 2020, showing a reversal in relation to the previous month (0.5%). In this same comparison, Vehicles, motorcycles, parts and pieces and Construction material dropped 36.4% and 17.1%, respectively, after positive changes of 0.1% and 0.2% in the previous month.

Compared with March 2019, the retail trade fell 1.2%, with negative rates in six out of the eight activities surveyed: Fabric, apparel and footwear (-39.6%), Other articles of personal and domestic use (-17.9%%), Fuels and lubricants (-11.2%), Furniture and household appliances (-12.1%), Office, computer and communication material and equipment (-23.2%) and Books, newspapers, magazines and stationery (-32.9%)

On the other hand, Hypermarkets, supermarkets, food products, beverages and tobacco (11.1%) and Pharmaceuticals, medical and orthopedic articles, toiletries and cosmetics (12.1%) were the sectors that increased their sales.

After declining 6.3% against March 2019, the extended retail trade interrupted 11 months of consecutive positive rates that have been noticed in the inter-annual indicator. The main negative contribution to the overall rate of the extended retail came from the strong drop registered in Vehicles, motorcycles, parts and pieces (-20.8%), besides the decline seen in Construction material (-7.6%).

The sector of Fabric, apparel and footwear (-39.6%) was the major negative influence on the national retail trade rate, compared with March 2019, being the most intense negative change for this segment since the beginning of the time series in January 2001. In the cumulative index up to March, this sector dropped 12.4% in volume of sales, reversing the trend noticed until February (1.7%). Having changed from -0.2% in February to -2.5% in March, the cumulative indicator over the last 12 months stepped up the downward trend started in February, after a series of eight positive changes before. It is worth highlighting that the strong retreat in volume of sales of this activity was due to the closure of physical stores as of the second half of March in some major Brazilian cities.

The segment of Other articles of personal and domestic use (-17.9%), which comprises department stores, glasses shops, jewelry shops, sporting goods stores and toy stores, among others, interrupted a series of eight positive results started in July 2019, also recording the worst performance in the series for the inter-annual indicator, started in January 2004. The drop in volume of this activity in March 2020 was also strongly impacted by the strategy to mitigate the effects of the pandemic in the health system and, as a result, the sector had the second sharpest negative contribution to the overall retail. In the cumulative index in the year, the decrease of 0.6% put the sector on the negative side for the first time since August 2017. As a result, the cumulative indicator over the last 12 months (5.0%) lost pace in relation to February 2020 (6.1%).

| Table 1 - BRAZIL - INDICATORS OF VOLUME OF SALES OF THE RETAIL TRADE AND EXTENDED RETAIL TRADE, BY GROUP OF: March 2020 | ||||||||

| ACTIVITIES | MONTH/PREVIOUS MONTH (1) | MONTH/SAME MONTH IN THE PREVIOUS YEAR | CUMULATIVE | |||||

|---|---|---|---|---|---|---|---|---|

| Change Rate (%) | Change Rate (%) | Change Rate (%) | ||||||

| JAN | FEB | MAR | JAN | FEB | MAR | IN THE YEAR | 12 MONTHS | |

| RETAIL TRADE (2) | -1.4 | 0.5 | -2.5 | 1.4 | 4.7 | -1.2 | 1.6 | 2.1 |

| 1 - Fuels and lubricants | 0.0 | -0.5 | -12.5 | -0.6 | 0.4 | -11.2 | -3.9 | -0.3 |

| 2 - Hypermarkets, supermarkets, food products, beverages and tobacco | -1.8 | 1.5 | 14.6 | -2.7 | 4.0 | 11.1 | 4.1 | 1.6 |

| 2.1 - Supermarkets and hypermarkets | -0.7 | 0.6 | 16.3 | -3.0 | 4.1 | 12.0 | 4.3 | 1.8 |

| 3 - Fabric, apparel and footwear | 0.3 | 1.5 | -42.2 | 2.6 | 0.8 | -39.6 | -12.4 | -2.5 |

| 4 - Furniture and household appliances | -1.7 | 1.6 | -25.9 | 11.0 | 11.8 | -12.1 | 3.6 | 5.0 |

| 4.1 - Furniture | - | - | - | 9.8 | 7.7 | -10.4 | 2.6 | 6.4 |

| 4.2 - Household appliances | - | - | - | 11.8 | 12.1 | -12.4 | 3.8 | 4.3 |

| 5 - Pharmaceuticals, medical and orthopedic products, and toiletries | 0.2 | 0.7 | 1.3 | 7.1 | 7.8 | 12.1 | 9.1 | 7.4 |

| 6 - Books, newspapers, magazines and stationery | -0.2 | -3.8 | -36.1 | 3.6 | -7.5 | -32.9 | -8.6 | -13.6 |

| 7 - Office, computer and communication material and equipment | -2.5 | -2.4 | -14.2 | -6.7 | -12.8 | -23.2 | -14.4 | -3.7 |

| 8 - Other articles of personal and domestic use | 0.0 | 1.4 | -27.4 | 7.6 | 8.7 | -17.9 | -0.6 | 5.0 |

| EXTENDED RETAIL TRADE (3) | 0.5 | 0.5 | -13.7 | 3.5 | 3.0 | -6.3 | 0.0 | 3.3 |

| 9 - Vehicles and motorcycles, parts and pieces | 8.5 | 0.1 | -36.4 | 9.9 | 0.0 | -20.8 | -3.6 | 7.0 |

| 10- Construction material | -0.3 | 0.2 | -17.1 | 2.3 | -1.9 | -7.6 | -2.3 | 2.8 |

| Source: IBGE, Diretoria de Pesquisas, Coordenação de Serviços e Comércio. (1) Seasonally-adjusted series (2) The retail trade indicator comprises the figures of the activities numbered 1 to 8. (3) The extended retail trade indicator comprises the figures of the activities numbered 1 to 10 |

||||||||

The sector of Fuels and lubricants (-11.2%) gave the third strongest negative contribution to retail. In the month against same month of the previous year comparison, this result was the highest negative one since June 2018, when it was -11.6%. Although the companies of this sector have not suspended their operations to the public due to the pandemic, their sales revenue was strongly impacted by the current Covid-19 outbreak, since the circulation of people was strongly reduced and the consumption of fuels dropped as of the second half of March. The cumulative indicator in the year, which has already been registering negative figures in 2020, stepped up this trend, closing March with a drop of 3.9%. The cumulative rate over the last 12 months reversed the signal: -0.3% in March against 0.2% in February.

The sector of Furniture and household appliances (-12.1%) had the fourth highest negative impact on the retail trade rate in March, the most intense result in negative terms since October 2016, after the increase of 11.8% in February. In regard to the cumulative index in the year, the change from February to March showed the effects of the quarantine in the activity: 11.4% up to February to 3.6% up to March, with a strong loss of pace. Having changed from 5.5% in February to 5.0% in March, the cumulative indicator over the last 12 months decreased its growth rate.

The segment of Office, computer and communication material and equipment (-23.2%) accelerated the downward trend that has been occurring since January 2020. In this comparison, the result retroacted to January 2016 as the most negative one, when it registered -24.9%. The cumulative indicator in the year up to the reference month changed from -9.9% in February to -14.4% in March, also reflecting the influence of the pandemic. The cumulative indicator over the last 12 months (-3.7%) dropped for the second month in a row; in February, the sector retreated by 1.7%.

The activity of Books, newspapers, magazines and stationery (-32.9%) stepped up the drop in February (-7.5%). The cumulative index in the year changed from -1.3% in February to -8.6% in March. Having changed from -14.7% to -13.6%, the cumulative indicator over the last 12 months recorded its less intense drop since November 2018 (-12.6%).

The sector of Hypermarkets, supermarkets, food products, beverages and tobacco (11.1%) exerted the highest positive influence on the retail trade in March, being the highest change in the inter-annual indicator since March 2018 (15.4%). Social distancing had an impact on this activity opposed to that in the sectors that had their operations suspended as of the second half of March. Considered an essential sector, hypermarkets and supermarkets concentrated the expenditures of the families in this period, causing a strong positive change. As a result, the cumulative index in the year for this sector, which dropped in January (-2.7%) and registered a poor performance in February (0.5%) accrued an increase of 4.1% until March. The cumulative indicator over the last 12 months rose 1.6% in March, increasing in relation to February (0.2%).

The activity of Pharmaceutical, medical, orthopedic and toiletry articles (12.1%) exerted the second highest positive contribution to the overall retail trade rate, being the 35th consecutive positive change in the comparison with the same month last year. In relation to the cumulative rate in the year up to March, the change from 7.4% in February to 9.1% in the reference month also gained pace. In terms of the cumulative result over the last 12 months, this sector´s growth rate increased by changing from 6.6% in February to 7.4% in March.

The sector of Vehicles, motorcycles, parts and pieces (-20.8%) interrupted a series of ten positive changes started in April 2019 with the steepest negative change since July 2017 (-21.3%), exerting the highest negative contribution to the result of the extended retail this month. The cumulative indicator in the year up to March declined 3.6%, after growing in February (5.1%). Having risen 7.0% up to March, the cumulative index over the last 12 months lost pace in relation to the cumulative rate up to February (8.7%).

The segment of Construction material (-7.6%) recorded the second consecutive negative rate in this comparison. As a result, the cumulative indicator in the year up to March retreated 2.3%, reversing the signal if compared with February (0.3%). Having changed from 3.4% in February to 2.8% in March, the cumulative indicator over the last 12 months remained on the positive side, though with a loss of pace.

Sales fall in 26 of 27 Federation Units

Between February and March 2020, the national average rate of sales of the retail trade decreased 2.5%, with negative figures prevailing in 26 out of the 27 Federation Units, highlighted by: Rondônia (-23.2%), Amazonas (-16.5%) and Acre (-15.7%). In contrast, only São Paulo pressed positively (0.7%). In the same comparison for the extended retail trade, the change between February and March was -13.7%, with all the 27 Federation Units showing negative figures, highlighted by: Rondônia (-23.8%), Sergipe (-20.0%) and Acre (-19.4%)

Compared with March 2019, the change in the sales of the national retail trade was -1.2%, with negative figures in 23 out of the 27 Federation Units, highlighted by: Rondônia (-25.3%), Ceará (-14.4%) and Acre (-11.8%). The four Federation Units with positive figures were São Paulo (.%), Tocantins (3.4%), Mato Grosso (2.1%) and Paraíba (1.0%). The most intense negative influences on the retail trade came from Rio Grande do Sul (-6.2%), Ceará (-14.4 %) and Santa Catarina (-5.4%). In terms of positive influence, São Paulo (1.7 p.p.) stood out.

In the extended retail trade, the decline of 6.3% over March 2019 caused negative figures in 26 out of the 27 Federation Units, highlighted, in terms of rate magnitude, by: Rondônia (-1.6%), Sergipe (-18.0%) and Piauí (-13.6%). On the other hand, only Tocantins (3,6%) pressed positively. Concerning the share in the extended retail rate, the negative highlights were São Paulo (-1.3 p.p.), Rio Grande do Sul (-1.0 p.p.) and Santa Catarina (-0.8 p.p.).