IBGE forecasts record harvest of grains in 2020

January 08, 2020 09h00 AM | Last Updated: January 13, 2020 10h56 AM

In the third forecast for the 2020 harvest, the production of cereals, legumes and oilseeds was estimated at 243.2 million tonnes, 0.7% above the 2019 harvest, which represented more 1.7 million tonnes. The initial estimates pointed out to a reduction of 7.2% in the output of corn and an increase of 7.8% in the output of soybeans.

| DECEMBER estimate for 2019 | 241.5 million tonnes |

| December 2019 / November 2019 change | (0.2%) 582.4 thousand tonnes |

| 2019 harvest / 2018 harvest change | (6.6%) 15 million tonnes |

| DECEMBER estimate for 2020 | 243.2 million tonnes |

| 2020 harvest / 2019 harvest change | (0.7%) 1.7 million tonnes |

The analysis of the five most important products for the next harvest showed that only corn - 2nd crop registered a lower production estimate than in 2019 (10.4%). Upland cotton (2.7%), beans - 1st crop (3.3%), rice (0.9%), corn - 1st crop (1.8%) and soybeans (7.8%) recorded a positive change. The estimates for the production of soybeans and cotton were a record in the IBGE´s time series.

On the other hand, the 12th estimate for 2019 added up to 241.5 million tonnes, 6.6% higher than that obtained in 2018 (226.5 million tonnes), an increase of 15.0 million tonnes. The previous record was registered in 2017, when 238.4 million tonnes were produced. The estimate for the output of soybeans in 2019 was of 113.5 million tonnes, whereas corn (100.6 million tonnes) and cotton (6.9 million tonnes) posted a record estimate. The production estimate for rice was of 10.3 million tonnes.

This information came from the Systematic Survey of Agricultural Production - LSPA.

The estimate for the harvested area for 2019 was of 63.2 million hectares, representing a growth of 3.7% against the area harvested in 2018, an increase of 2.3 million hectares. Rice, corn and soybeans represented 92.8% of the estimated output and accounted for 87.0% of the harvested area. In relation to 2018, the area for corn increased 7.0%, the area for soybeans rose 2.6% and the area for upland cotton increased 41.9%, whereas the area for rice reduced 9.3%. Concerning the output, soybeans dropped 3.7% and rice, 12.6%, whereas corn increased 23.6% and upland cotton, 39.8%.

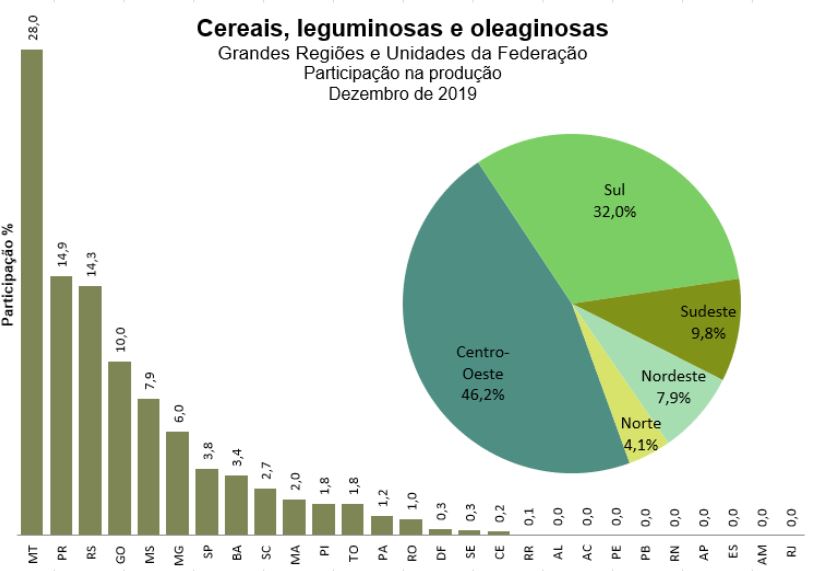

In regional terms, the volume of the production of cereals, legumes and oilseeds showed the following distribution: Central-West, 111.5 million tonnes (46.2%); South, 77.2 million tonnes (32.0%); Southeast, 23.7 million tonnes (9.8%); Northeast, 19.2 million tonnes (7.9%) and North, 9.8 million tonnes (4.1%). All the Major Regions reported an increase in the output: Central-West (10.4%), North (9.7%), Central-West (10.4%), South (3.6%), Northeast (0.4%) Southeast (3.7%). Mato Grosso leads the national production of grains with a share of 28.0%, followed by Paraná (14.9%), Rio Grande do Sul (14.3%), Goiás (10%), Mato Grosso do Sul (7.9%) and Minas Gerais (6.0%). These states together accounted for 81.1% of the national forecast.

For 2020, third forecast estimates harvest 0.7% bigger than that of 2019

In this third forecast, the Brazilian harvest of grains, cereals and legumes should be a record in 2020 and add up to 243.2 million tonnes, more 1.7 million tonnes (0.7%) over 2019. The initial estimates pointed out to a reduction of 7.2% in the output of corn and an increase of 7.8% in the output of soybeans. Of the five most important products for the next harvest, only corn - 2nd crop registered a lower production estimate than in 2019 (10.4%). Upland cotton (2.7%), beans - 1st crop (3.3%), rice (0.9%), corn - 1st crop (1.8%) and soybeans (7.8%) recorded a positive change.

UPLAND COTTONSEED - The third forecast of the harvest for 2020 estimated an output of 7.1 million tonnes, an increase of 2.7% compared with the 2019 harvest, marking a new record in the IBGE´s time series. The planted area (1.7 million hectares) should grow 7.1%. It is estimated that the 2020 harvest obtain an average yield of 4,058 kg/ha, a retreat of 4.1% in relation to the harvest last year. Due to the increase of 0.8% in the planted area, the production estimate of cotton grew 0.7% over the previous month. The average yield retreated 0.1%. The production estimates in Tocantins (31.0% or 2,475 tonnes), Piauí (31.9% or 17,627 tonnes), Mato Grosso do Sul (5.2% or 8,366 tonnes), Mato Grosso (0.4% or 17,340 tonnes) and Goiás (7.2% or 12,132 tonnes) increased. In Bahia, the production estimate of cotton declined (-0.5% or 7,050 tonnes).

PADDY RICE - The third estimate for the national harvest of 2020 was a production of 10.4 million tonnes, representing an increase of 0.9% in relation to 2019. The average yield should rise 3.6%, to 6,266 kg/ha, whereas the planted area should decline 3.4%. In relation to the previous month, the production estimate retreated 0.7%, having the planted area and the average yield decreased 0.1% and 0.5%, respectively. As the largest producer of rice in Brazil, Rio Grande do Sul should account for 70.5% of the total to be harvested in 2020. The output of Rio Grande do Sul was estimated at 7.3 million tonnes, an increase of 1.8% in relation to 2019. The estimated planted area declined 3.4%, whereas the average yield was estimated with a growth of 3.9%, or 7,706 kg/ha. As the second national producer, Santa Catarina estimated an output of 1.1 million tonnes and an average yield of 7,470 kg/ha, increasing 0.6% over the 2019 harvest.

COFFEE (IN GRAIN) - The first IBGE estimate for the harvest of coffee was of 3.4 million tonnes or 56.4 million 60-kg sacks, representing an increase of 12.9% in relation to 2019. The production estimate of coffea arabica was of 2.5 million tonnes or 42.2 million 60-kg sacks, representing a growth of 22.1% in relation to 2019. The average yield recorded a growth of 16.2%, whereas the planted area and the area to be harvested increased 4.2% and 5.0%, respectively. The 2020 harvest of coffea arabica is of biennial positive bearings, i.e., a year in which the plants are physiologically recovered, since the production was smaller in the previous year. In addition, the prices of the product recovered by the end of 2019, which should encourage the producers to increase the investments in farming and fertilization. No news of problems with the climate in the major coffee areas in Brazil appeared up to now, which should be reflected in the output in 2020. As the largest producer of coffea arabica in Brazil with 74% of the overall output, Minas Gerais estimated to harvest 1.9 million tonnes or 31.2 million 60-kg sacks, a growth of 26.2% in relation to 2019. In Espírito Santo, the production estimate was 33.4% higher than in 2019. The output in Espírito Santo should reach 202.0 thousand tonnes or 3.4 million 60-kg sacks.

For coffea canephora (conillon), the estimated production was of 852.0 thousand tonnes or 14.2 million tonnes, representing a retraction of 7.7% in relation to 2019. In Espírito Santo, the largest Brazilian producer with a share of 66.3% of the total, the output was estimated at 564.5 thousand tonnes or 9.4 million 60-kg sacks, representing a retraction of 11.4%. In Rondônia, the production was estimated at 150.9 thousand tonnes or 2.5 million 60-kg sacks, an increase of 4.1%. Another important producer of conillon coffee, Bahia estimated a production of 106.6 thousand tonnes or 1.8 million 60-kg sacks. Conillon coffee was traded for a relatively low price throughout 2019, causing a poor profitability to its producers. Unless the prices recover within the next months, investments in farming and fertilization are not expected, which should compromise the performance of the crops along the year.

BEAN SEED - The third production estimate for beans for the 2020 harvest was of 3.0 million tonnes, a retreat of 2.8% in relation to the crop harvested in 2019. The first crop should produce 1.3 million tonnes; the second crop, 1.2 million tonnes and the third crop, 468.0 thousand tonnes. The area to be harvested in the summer harvest (first crop) should reach 1.6 million hectares, an increase of 2.1% in relation to 2019, whereas the average yield, of 852 kg/ha, should rise 1.2%.

CORN (grain) - The third forecast of corn grain for 2020 estimated an output of 93.3 million tonnes, a decline of 7.2% over the 2019 harvest, which represented a reduction of 7.3 million tonnes. The trend to produce a higher volume of corn in the second crop was maintained, accounting for 71.7% of the national production for 2020, against a share of 28.3% of the first crop of corn. The forecast for the first crop of corn was of 26.5 million tonnes, 1.8% higher than the same period in 2019. A growth of 0.5% in the area to be planted, an increase of 1.9% in the area to be harvested and a retraction of 0.1% in the average yield were expected. For corn - 2nd crop, the estimated production was of 66.8 million tonnes, a decline of 10.4% in relation to 2019.

SOYBEAN GRAIN - The third production estimate for 2020 added up to 122.4 million tonnes, an increase of 7.8% in relation to 2019 and a record in the IBGE´s time series. The area to be planted was 36.6 million hectares, representing an increase of 2.2%. The average yield was estimated at 3,340 kg/ha, an increase of 5.4%. It should be highlighted that excessive heat and rainfall restrictions in Paraná, São Paulo and Mato Grosso do Sul affected the 2019 harvest, jeopardizing the national average yield. Mato Grosso, one of the largest producers, which should account for 26.9% of the overall production in Brazil in 2020, estimated to harvest 33.0 million tonnes, a growth of 2.2% over 2019, due to the increase of 2.2% in the area to be planted. Paraná estimated to produce 19.8 million tonnes, an increase of 22.6%, while Rio Grande do Sul estimated a production of 19.3 million tonnes, a growth of 4.2% in relation to 2019. In relation to the previous month, the estimate for the production of soybeans grew 1.3%, with increases in the production estimated in Tocantins (2.5%), Maranhão (1.0%), Piauí (16.6%), Minas Gerais (1.0%), São Paulo (14.3%), Paraná (0.1%), Rio Grande do Sul (0.6%), Mato Grosso do Sul (3.8%) and Goiás (2.0%). Of the largest producers, only Bahia reported a retraction in the production estimate, being of only 2.0%.

Highlights of the December estimate for the 2019 harvest

In December, the changes in the following production estimates compared with November stood out: coffea canephora (1.1% or 10,415 tonnes), beans - 2nd crop (0.6% or 6,969 tonnes), sorghum (0.6% or 14,333 tonnes), corn - 2nd crop (0.4% or 278,362 tonnes), corn - 1st crop (0.3% or 80,012 tonnes), soybeans (0.3% or 320,468 tonnes), sugarcane (0.2% or 1.0 million tonnes), and upland cotton (0.0% or 2,876 tonnes). The negative highlights were wheat (-0.5% or 26,937 tonnes), oranges (-0.6% or 106,035 tonnes), rice (-0.6% or 65,606 tonnes), coffea arabica (-0.8% or 15,710 tonnes), beans - 1st crop (-0.9% or 11,666 tonnes), and cassava (-5.5% or 1.1 million tonnes).

The steepest changes in the production estimates were in São Paulo (264,520 tonnes), Mato Grosso do Sul (182,614 tonnes), Pará (98,378 tonnes), Minas Gerais (62,513 tonnes), Bahia (49, 732 tonnes), Goiás (38,281 tonnes), Maranhão (2,407 tonnes), Rio de Janeiro (2,066 tonnes), Mato Grosso (1,722 tonnes), Paraíba (98 tonnes), Espírito Santo (68 tonnes), Pernambuco (-483 tonnes), Ceará (-9,360 tonnes), Rio Grande do Sul (-52,109 tonnes) and Tocantins (-58,037 tonnes).

UPLAND COTTONSEED - The output of cotton was of 6.9 million tonnes, with a positive change of only 2,876 tonnes (0.0%). The production of cotton was 39.8% above that in the previous year, due to the increase of 41.9% in the planted area.

PADDY RICE - The production estimate fell 0.6% in relation to the previous month, corresponding to a reduction of 65.6 thousand tonnes. The average yield retreated 0.9%. The output reached 10.3 million tonnes. The output of rice fell 12.6% in relation to the previous year, with declines of 8.8% in the planted area and of 3.6% in the average yield. In Rio Grande do Sul, the production was 14.6% smaller in 2019, with declines of 8.1% in the planted area and of 5.8% in the average yield. As a result of the unsatisfactory prices over the last years, the are planted with irrigated rice has been reduced and replaced by other crops, especially soybeans, due to the higher profitability. The rotation system has been introduced in some crops of irrigated rice, leading to the improvement of the soil and thus to the increase in the productivity.

COFFEE GRAIN – The Brazilian production of coffee was of 3.0 million tonnes or 49.9 million 60-kg sacks, representing a reduction of 16.6% in relation to 2018. The production was 0.2% smaller in relation to the previous month. For coffea arabica, the production estimate was of 2.1 million tonnes or 34.5 million 60-kg sacks, a drop of 0.8% in relation to the previous month. The output of coffea arabica fell 23.1% over the previous year, representing a "low year" due to the negative biennial period. As harvesting advanced in the countryside along the last months and they had a more reliable picture of the production of arabica, the producers faced a smaller output than that originally estimated. The coffee crops suffered with high temperatures and lack of rainfall during an important period of their development, causing the estimates of average yield to be smaller. The prices were not so attractive during the first semester and the production costs relatively high, especially inputs and acquisition of extra workforce, very demanded when the product is harvested. As a result, many producers reduced the investments in fertilization and cropping, also contributing to the reduction of the productivity.

Concerning coffea canephora, better known as conillon, the output was of 922.8 thousand tonnes or 15.4 million 60-kg sacks, growing 1.1% in relation to the previous month, due to the production in Bahia, which was revised with an increase of 12.6%. The production was of 108.1 thousand tonnes or 1.8 million 60-kg sacks. Despite the retraction of 15.2% in the planted area in relation to the previous year, the production of coffea canephora rose 2.6% and the average yield, 6.0%. In this comparison, the output was bigger in Espírito Santo (7.8%) and Rondônia (4.2%), and smaller in Bahia (-23.0%). The production in Espírito Santo and Rondônia benefited from the climate this year.

SUGARCANE – The Brazilian output was of 667.5 million tonnes, representing a growth of 0.2% in relation to the previous month. São Paulo remained the biggest national producer with 341.8 million tonnes, accounting for 51.2% of the production. Goiás was the second biggest producer with 75.7 million tonnes and a share of 11.3%. Minas Gerais was the third biggest producer of sugarcane, accounting for 11.1% of the total and representing 74.3 million tonnes. The output decreased 1.0% in relation to 2018, with reductions of 5.9% in the planted area and of 2.6% in the area in production, whereas the average yield increased 1.7%. The smaller area in production this year was due to the bigger renovation of sugarcane crops.

BEAN SEED - The production was estimated at 3.0 million tonnes, remaining virtually unchanged in relation to the previous month. The total output of beans was 2.2% higher than the 2018 harvest, due to the increase of 9.2% in the average yield, since the planted area was reduced by 5.4%. On the whole, the climate in 2019 was better to the crops of this legume, especially the second crop, whose average yield grew 20.2% in relation to the previous year. The first crop of beans was of 1.3 million tonnes. The Northeast Region posted a decline of 9.4% in the production over the previous year. The Southeast and South Regions registered a decline of 19.9% and 18.6%, respectively. The prices of the product were relatively low at planting time, discouraging the producers to crop this legume.

The output of the second crop, of 1.2 million tonnes, was 16.4% higher than that in 2018, despite the retraction of 4.2% in the planted area. A number of Federation Units reported an increase in the production estimate. The prices practiced at planting time were higher than those of the first crop, which explained the greater interest of the producers to crop this legume in this period, considered drier. In addition, the climate benefited the crops when compared with 2018. The states with the biggest share in the national output were: Paraná (31.2%), Minas Gerais (17.2%), Mato Grosso (10.5%) and Bahia (10.1%). The third crop of beans was expected to grow 1.0% in the production over the November´s estimate, with São Paulo reporting an output of 103.2 thousand tonnes, 4.2% higher than that in the previous month. Having recorded 588.4 thousand tonnes, the output of the third crop was 28.8% higher than in the previous year, as a result of more attractive prices, which encouraged the producers to improve the planted area and the investments in the crops.

ORANGES – The output was of 17.6 million tonnes or 431.7 million 40.8-kg boxes, representing a growth of 5.6% in relation to the previous year. Accounting for 77.5% of the national output, São Paulo, the major state in the citrus sector, estimated a production of 13.7 million tonnes or 334.6 million 40.8-kg boxes, an increase of 8.5% in relation to 2018. The citrus belt in São Paulo stands out, due to high technological level of the orchards, where most of the production of oranges is destined to process and produce juice, an important product in the Brazilian exports.

CASSAVA (root) - The production of cassava was of 19.0 million tonnes, representing a decline of 5.5% over the previous month. The production was adjusted in Bahia due to the data raised in the IBGE´s Census of Agriculture. The output in this state was of 963.0 thousand tonnes, a decline of 48.2% in relation to the previous month and a reduction of 37.0% in relation to 2018. The output retreated 2.1% in relation to the previous year, due to the reduction of 8.3% in the harvested area and of 33.0% in the planted area. Less attractive prices have been discouraging the planting and the harvesting of the roots, remaining more time in the soil.

CORN (grain) - The output rose 0.4% in relation to the latest information, adding up to 100.6 million tonnes, a new record of production in the IBGE´s time series. The production was 23.6% higher over the last year, with increases of 15.5% in the average yield, 6.3% in the planted area and 7.0% in the harvested area. In the first crop of corn, the production reached 26.0 million tonnes, an increase of 0.3% over the previous month. Despite the decrease of 1.6% in the area, the output was 0.9% higher in relation to 2018. Not so attractive prices by the time of the sowing period and competition with soybeans for available planting areas have reduced the production in this period over the last years. The producers have preferred to plant corn - 2nd crop.

For the second crop, the production was of 74.6 million tonnes, 0.4% higher than in the previous month. This volume in the production of corn - 2nd crop was a record in the IBGE´s time series, having surpassed by 7.0 million tonnes the 2017 harvest, then the biggest production obtained in Brazil, when it registered 67.6 million tonnes. As the planting of soybeans was anticipated in this agricultural year, the "planting window" of corn had a longer period. This decreased the risk for the crops, since it reduced the likelihood of dry periods during the cycle, which positively affected the average yield, whose growth was estimated at 20.9% and it should reach 5,859 kg/ha.

SOYBEANS (grain) - The production was estimated at 113.5 million tonnes, an increase of 0.3% over the last month. The harvest of soybeans was complete in most Federation Units. In relation to the previous year, the output declined 3.7%, most expressively in Bahia (-15.0% or 935.4 thousand tonnes), Minas Gerais (-5.0% or 269.8 thousand tonnes), São Paulo (-11.5% or 392.1 thousand tonnes), Paraná (-16.1% or 3.1 million tonnes), Mato Grosso do Sul (-11.9% or 1.2 million tonnes) and Goiás (-4.4% or 495.3 thousand tonnes). Although the planting was anticipated in this agricultural year, the crops were jeopardized by the lack of rainfall and high temperatures in the end of the cropping cycle in these Federation Units, which compromised the average yield, causing it to decline 6.2% at national level. On the other hand relevant increases in the output were reported in Mato Grosso (2.0% or 642.2 thousand tonnes) and in Rio Grande do Sul (5.5% or 956.6 thousand tonnes).

SORGHUM (grain) - The estimated production reached 2.6 million tonnes, an increase of 0.6% in relation to the previous month. The planted area increased 1.0%, the area to be harvested, 1.1%, and the average yield dropped 0.5%. In relation to the previous year, the output grew 15.3%, highlighted by Goiás (20.3%), Minas Gerais (5.0%), São Paulo (99.3%), Piauí (170.8%), Tocantins (36.4%), Mato Grosso do Sul (48.3%) and Pará (223.2%). Mato Grosso (-16.3%), Bahia (3.8%), the Federal District (-20.6%), Maranhão (-62.5%) and Rio Grande do Sul (-7.8%) declined. Together, Goiás and Minas Gerais accounted for 74.8% of the Brazilian production of this cereal. Sorghum is much cultivated in Cerrado areas in the second crop due to its tolerance for drought, having a wider "planting window" than corn in this biome. As the harvest of soybeans was anticipated in some Federation Units, the second crops benefited from a larger period of rainfall.

WHEAT (grain) - Wheat is the major Brazilian winter crop. The planted area was of 2.1 million hectares. Its output dropped 0.5% in relation to the previous month, reaching 5.2 million tonnes, reflecting the reduction of 0.9% in the average yield. In December, Rio Grande do Sul reduced by 1.3% the production reported in the previous month. The output in 2019 was 1.4% lower than that in 2018, a decline of 26.9 thousand tonnes. In 2019, the production in Paraná was jeopardized by the excess of cold and occurrence of frosts during the winter, hitting the crops on a later phenological phase and, therefore, more sensitive. The cropping cycle in Rio Grande do Sul is later than in Paraná, which benefited the development of the crops this year. The output in Rio Grande do Sul was estimated at 2.3 million tonnes, an increase of 32.2% in relation to 2018, making it the largest national producer in 2018.