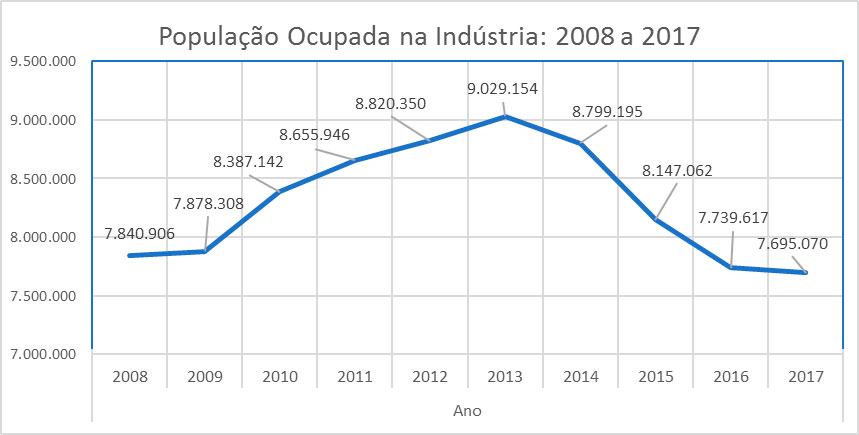

Between 2014 and 2017, the industry lost 1.1 million jobs

June 06, 2019 10h00 AM | Last Updated: June 19, 2019 08h51 AM

The Annual Survey of Industry (PIA) Enterprise revealed that, between 2014 and 2017, the enterprises of the sector lost nearly 12.5% of their job vacancies, representing 1.104 million less employed persons in the sector.

Considering the changes since 2008, the Brazilian Industry kept its participation in employed persons practically unchanged in the period. The manufacturing industry still leads, with 97.5% of the employed persons in 2017. The sector with the greatest representativeness in jobs was Manufacture of food products (23.3%).

The eight industries with the highest values in the industrial manufacturing values (VTI) concentrated 21.1% of those values in 2017. In Mining and quarrying industries, the eight leaders concentrated 71.4% of the VTI whereas in the Manufacturing Industries, the joint participation of the eight biggest enterprises was of 19.2%. The support material of 2017 PIA Enterprise is on the right.

| Summary-Table: Industrial enterprises in 2017 | ||

|---|---|---|

| Number of enterprises | 318,3 | mil |

| Mining and quarrying | 6,4 | mil |

| Manufacturing industries | 311,9 | mil |

| Employed persons | 7,7 | milhões |

| Mining and quarrying | 192,0 | mil |

| Manufacturing industries | 7,5 | milhões |

| Salaries, withdrawals and other compensation | R$ 300,4 | bilhões |

| Mining and quarrying | R$ 11,0 | bilhões |

| Manufacturing industries | R$ 289,5 | bilhões |

| Net sales revenue | R$ 3,0 | trilhões |

| Mining and quarrying | R$ 149,9 | bilhões |

| Manufacturing industries | R$ 2,8 | trilhões |

| Value of industrial manufacturing | R$ 1,2 | trilhão |

| Mining and quarrying | R$ 104,6 | bilhões |

| Manufacturing industries | R$ 1,1 | trilhão |

Brazil had nearly 318.3 thousand active industrial enterprises in 2017

The Annual Survey of Industry located 318,300 active industrial enterprises with 1 or more workers in 2017, which employed 7.7 million persons and paid R $ 300.4 billion in salaries. Their net sales revenue (NSR) was R $ 3.0 trillion.

The industrial activity generated R$1.2 trillion of industrial manufacturing value (VTI), resulting from the difference between a gross industrial production of R$2.7 trillion and industrial operational costs (IOC) of R$1.5 trillion. Manufacturing Industries contributed with 91.3% to the VTI.

Large industrial enterprises, employing 500 or more people, kept accounting for almost 70% of total industry NSR. There were no significant structural changes in the other categories.

Between 2008 and 2017, food increase their participation in the industry

The analysis of the results of the NSR, from the sectorial point of view, shows that the Manufacture of food products increased its relevance in the last ten years, going from 16.1% to 22.9% of participation, remaining as the most important activity in sales. The second place is occupied by the Manufacture of chemical products, that even having lost 0.1 pp in the participation of the result went from the fourth to the second position in the ranking of the period.

| Main changes in the participation of the industrial activities in the NRS | |||

|---|---|---|---|

| Activities | 2008 | 2017 | Change (pp) |

| Manufacture of food products | 16.1 | 22.9 | 6.8 |

| Manufacture of motor vehicles, trailers and bodies | 11.7 | 8.9 | -2.8 |

| Basic Metals | 8.0 | 6.0 | -2.0 |

| Manufacture of coke, petroleum products and biofuels | 11.2 | 9.4 | -1.8 |

| Source: IBGE, Pesquisa Industrial Anual - Empresa 2017. | |||

The third and fourth most relevant activities, on the contrary, had a reduction of participation: Manufacturing of coke, petroleum products and biofuels lost 1.8 pp, covering 9.4% of total NSR in 2017, and Manufacture of motor vehicles, trailers and bodies declined 2.8 pp, and was responsible for 8.9% of participation in the last year. The Basic Metal sector also lost its share (-2.0 pp) in the analyzed period.

Industry lost 12.5% of its job positions between 2014 and 2017

Between 2014 and 2017, the industry dropped by 12.5% the number of employed persons, which is equivalent to 1,104 million fewer jobs in the sector. In the same period, in the mining and quarrying industries, the drop was 15.6%, while in the manufacturing industries, 12.5% of jobs were lost.

The most affected sectors in this period were: Activities to support mineral extraction (-35.4%), Manufacture of other transportation equipment, except motor vehicles (-33.3%), Manufacture of machinery and equipment (-24.8%). The highlights were: Manufacture of food products (1.5%), Manufacture of tobacco products (6.4%).

In comparison to 2008, Brazilian industry lost 145.8 thousand jobs in 2017, which represents 1.9% of the total number of employed persons in the sector in 2008. This was especially true in Manufacturing Industries, with decrease of 2.4% in employed personnel in the period, while Mining and Quarrying Industries grew 22.1%.

Manufacture industries concentrates 97.5% of industrial employment

The Brazilian industry kept its participation in the employed personnel practically unchanged in the period. The Manufacturing Industry continues to be the leader, accounting for 97.5% of the employed staff in 2017. Its most representative segments in employment were the Manufacture of food products (23.3%), followed by the manufacture of wearing apparel and accessories (8 ,2%). Next are: Manufacture of metal products (6.0%), Manufacture of motor vehicles, trailers and bodies (5.7%) and Manufacture of non-metallic mineral products (5.6%). These five activities kept their ranking positions in relation to 2008.

| Main indicators of industrial enterprises | |||

|---|---|---|---|

| Medium-sized (1) | Highest indices | ||

| General Industry | 24 | Manufacture of coke, petroleum products and biofuels | 569 |

| Mining and quarrying | 30 | Metallic minerals extraction | 325 |

| Manufacturing Industries | 24 | Mineral charcoal extraction | 222 |

| (1) Value calculated by the ratio between the number of employed persons and the number of industrial enterprises | |||

| Monthly average salary (2) in minimum wages |

Highest indices | ||

| General Industry | 3.2 mw | Extraction of petroleum and natural gas | 21.3 |

| Mining and Quarrying Industries | 4.7 mw | Support activities to mineral extraction | 9.6 |

| Manufacturing Industries | 3.2 mw | Manufacture of coke, petroleum products and biofuels | 8.8 |

| (2) Values calculated by dividing salaries, withdrawals and other compensation (including Christmas bonus) by the total number of employed persons in industrial enterprises. | |||

| Productivity (3) | Highest indices | ||

| General Industry | R$106,534.43 | Extraction of petroleum and natural gas | R$ 4,750,957.24 |

| Mining and quarrying industries | R$381,103.55 | Extraction of metallic minerals | R$ 588,566.50 |

| Manufacturing industries | R$99,507.18 | Manufacture of coke, petroleum products and biofuels | R$ 458,819.96 |

| (3) Current values calculated by dividing the value of industrial processing by the total number of personnel employed in industrial enterprises. | |||

| Concentration (4) | Highest indices | ||

| General Industry | 21.1% | Extraction of mineral charcoal | 95.5% |

| Mining and Quarrying Industries | 71.4% | Manufacture of tobacco products | 92.6% |

| Manufacturing Industries | 19.2% | Manufacture of coke, petroleum products and biofuels | 92.5% |

| (4) Value calculated by the participation of the eight largest industrial enterprises in the value of the industrial transformation of the activity. | |||

| Source: IBGE, Diretoria de Pesquisas, Coordenação de Serviços e Comércio, Pesquisa Industrial Anual - Empresa 2017. | |||

In Mining and Quarrying Industries, the largest participation still belongs to the extraction of metallic minerals (41.4%) and the extraction of non-metallic minerals (41.1%) in 2017.

In 2017, each Brazilian industrial enterprise employed an average of 24 people, with a monthly average wage of 3.2 minimum wages (mw). The Manufacture of coke, petroleum products and biofuels registered the highest average in the Manufacturing industries: 569 persons in each company with an average salary of 8.8 mw. In Mininga and Quarrying, the activity of Extraction of petroleum and natural gas paid the highest average monthly salary (21.3 mw). The Manufacture of pharmaceutical and pharmochemical products (7.1 s.m.) and the Manufacture of other transportation equipment, except motor vehicles (5.4 mw) are also highlights.

As to productivity in industrial enterprises, calculated as the ratio between the VTI and the employed personnel in the enterprise, in 2017 each worker added about R$106,500 to the production. The productivity of the mining and quarrying segment (R$381,100) was about four times greater than that of the Manufacturing Industries (R$99,500).

The eight largest industries generate 22.1% of the value of industrial manufacturing

The degree of concentration may indicate the existence of barriers to entry of new enterprises. There was a slight decrease in the concentration of total industry, according to the "order 8 concentration ratio" (R8). The eight industries with the highest values of industrial processing accounted for 22.8% of this value in 2008, dropping to 21.1% in 2017.

In Mining and Quarrying Industries, this indicator was 71.4%, highlighting the high concentration of production in the Extraction of coal, which between 2008 and 2017 moved from third to first in the ranking. This activity accounted for 95.5% of all production in the set of 8 enterprises in 2017.

In the Manufacturing Industries, the eight largest enterprises accounted for 19.2% of the VTI in 2017, and the highest concentration was in the Manufacture of tobacco products (92.6%), Manufacture of coke, petroleum products and biofuels (92.5%) and Manufacture of beverages (66.8), with relative changes that practically did not vary between 2008 and 2017. The main structural change in the concentration in this period was in the Manufacture of computer equipment, electronic and optical products: the VTI of its eight largest enterprises went from 33.9% to 49.1%.

Food and petroleum boost VTIs among local branches

Considering the Value of Industrial Manufacturing of industrial enterprises for local branches with 5 or more persons employed, it is possible to verify which activities stand out. Between 2008 and 2017, the Mining and Quarrying Industries increased their importance, going from 9.9% to 13.5% of participation in the VTI. Transformation Industries maintained their predominance, although their share fell from 90.1% to 86.5%.

Among the Mining and Quarrying Industries, the activities that led the ranking over the last ten years were Extraction of petroleum and natural gas (49.9%) and Extraction of metallic minerals (39.1%).

In Manufacturing Industries, food manufacturing was the most important sector, accounting for 20.7% of the VTI among local branches, increasing its share by 7.2 pp over the last ten years. In the second position is the Manufacture of coke, petroleum products and biofuels, with 11.4% of participation in the VTI.

Food and biofuels increase participation of Central-West

Althoug it has lost representativeness in the last 10 years, the Southeast Region accounted for 58.0% of the VTI in 2017, remaining in the lead, followed by the South (19.6%), the Northeast (9.9%), North (6.9%) and Central-West (5.6%). The decline of 4.2 pp in the Southeast occurred in favor of the Central-West, which recorded the highest advance (1.9 pp), followed by the South, which increased its share by 1.3 pp.

This productive shift towards the Central-West was mainly due to the migration of agroindustrial plants that were dedicated to the Manufacture of food products and began to participate in the production of biofuels, making this activity become one of the three most relevant of the region.