Producer Price Index (IPP) changes 1.63% in March

April 30, 2019 09h00 AM | Last Updated: May 03, 2019 04h56 PM

The prices in industry changed 1.63% in March 2019, a result above that in February 2019 (0.45%). Nineteen out of the 24 activities surveyed registered positive price changes, against 12 in the previous month. The support material of the release of the Producer Price Index is on the right side of this page.

| Period | Rate |

|---|---|

| March 2019 | 1.63% |

| February 2019 | 0.45% |

| March 2018 | 1.08% |

| Cumulative in the year | 1.32% |

| Cumulative in 12 months | 8.98% |

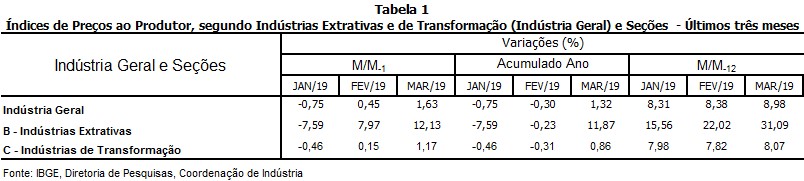

Between February and March 2019, the prices of the mining and quarrying and manufacturing industries – overall industry – changed 1.63%, a figure above that reported in the comparison between February 2019 and January 2019 (0.45%). The four biggest changes occurred among the products of the following industrial activities: mining and quarrying industries (12.13%), oil refining and ethanol products (6.74%), manufacture of wearing apparel and accessories (2.22%) and other transportation equipment (2.19%). The biggest influences were oil refining and ethanol products (0.66 p.p.), mining and quarrying industries (0.51 p.p.) food products (0.16 p.p.) and basic metals (0.05 p.p.).

The cumulative index in the year (March 2019 against December 2018) was 1.32%, against

-0.30% in February 2019. The four biggest price changes occurred in oil refining and ethanol products (12.48%), mining and quarrying industries (11.87%), other chemicals (-4.88%) and manufacture of wearing apparel and accessories (3.48%). The sectors that mostly influenced this indicator were: oil refining and ethanol products (1.16 p.p.), mining and quarrying industries (0.50 p.p.), other chemicals (-0.42 p.p.) and food products (-0.18 p.p.).

In the comparison between March 2019 and March 2018, the prices changed 8.98%, against 8.38% in February 2019. The four biggest price changes were recorded in mining and quarrying industries (31.09%), oil refining and ethanol products (19.25%), other transportation equipment (15.22%) and tobacco (12.51%). As the time series was updated last month, it was still not possible to determine the influence in this comparison.

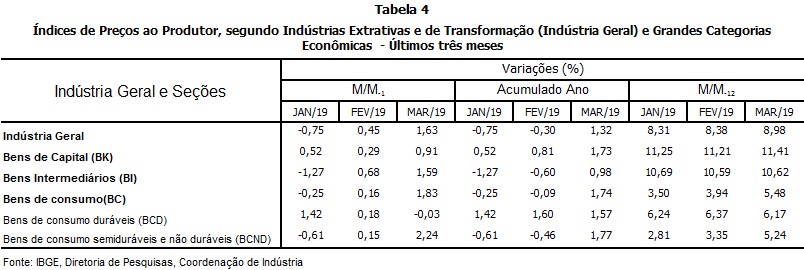

Among the Major Economic Categories, the price change of 1.63% in March was distributed like this: 0.91% in capital goods; 1.59% in intermediate goods; and 1.83% in consumer goods, with -0.03% in durable consumer goods and2.24% in semi and non-durable consumer goods. And the influence of the Major Economic Categories was as follows: capital goods (0.07 p.p.), intermediate goods (0.87 p.p.) and consumer goods (0.70 p.p.), being semi and non-durable consumer goods (0.70 p.p.) and durable consumer goods (0.00 p.p.).

The following sectors stood out:

Mining and quarrying industries: in March, the prices of the mining and quarrying industries increased 12.13%, highlighted by "iron ores and their concentrates, crude or processed, except pelleted or sintered" and "crude petroleum oil". The cumulative rate in the year stayed at 11.87%. It rose 31.09% over the same month last year. The mining and quarrying industries contributed with 0.51 p.p. to the IPP of the general industry in relation to February (1.63%), and with 0.50 pp to the cumulative IPP of the year (1.32%).

Food products: compared with the previous month, the prices in this sector changed, on average, 0.71%, the first positive figure in the year. As a result, the cumulative index in the year stayed at -0.80%. Compared with the same month in 2018, the prices of food products were 6.42% higher in March 2019, the lowest figure since November 2018 (5.90%).

The sector of food products exerted the third major influence on the IPP in relation to March, positive (0.16 p.p. in 1.63%) and the fourth major influence in the cumulative index in the year, negative (-0.18 p.p. in 1.32%). Just in December 2019, when the new series will have 13 pieces of information, it will be possible to calculate the influence in the comparison with the same month a year ago (M/M-12). In terms of change and influence, four products stood out: "fresh or cooled beef", "frozen poultry and giblets", "margarine" and "crystallized sugar", influencing 0.71 p.p. of the 0.71% of this sector. The influence of the other items was null.

Both in the cases of "fresh or cooled beef" and "frozen poultry and giblets", the increase was in line with the devaluation of the Real (of 3.3%, the first one noticed in the year), due to the increase in the demand in the international and domestic markets – particularly for the case of chicken. The domestic market was also the reason for the increase in the prices of "margarine". As to "crystallized sugar", some companies still lowered its price, despite the general rise, explained by punctual market opportunities.

Oil refining and ethanol products: the prices of this sector changed 6.74% in March over February, posting the third consecutive increase and the highest one since September 2018 (7.43%). As a result, the cumulative rate in the year was 12.48%. The change was of 19.25% in the comparison with the same month in 2018, the highest one since October 2018 (35.48%). This sector stood out in every indicator. Concerning the monthly index, it was the second highest in terms of change and the highest one in terms of influence (0.66 p.p. in 1.63%). It was the sector that registered the highest change and influence in the cumulative index in the year (1.16 p.p. in 1.32%). Compared with March 2018, this activity recorded the second highest change and its influence could not still be determined by the new time series.

"Biofuel" was one of the products that posted the highest changes in this sector in March, and the only one negative. In terms of influence, "gasoline, except for aviation", "diesel fuel", "ethyl alcohol (anhydrous or hydrated)" and "aviation kerosene" stood out. The influence of the four products was of 6.63 pp in 6.74% (the remainder of the influence, 0.11 p.p., was due to the change seen in the other six products).

Other chemicals: the chemical industry rose its prices by 0.18% in March over February, after four months of drop, which resulted in a cumulative index in the year of -4.88% – the highest negative change in this indicator among all the 24 activities surveyed – and in a cumulative rate over the last 12 months of 7.04%.

The four biggest price changes in this activity were reported in "fungicides for use in agriculture", "unsaturated buta - 1,3 - diene (1,3-butadiene)", "styrene" and "sodium hydroxide (caustic soda)". The four most influential products this month reported negative figures (-0.05 p.p., i.e., the other 35 products positively contributed with 0.23 p.p.). In addition to "fungicides for use in agriculture", "NPK-based manure and fertilizers" registered a negative influence. On their turn, "herbicides for agricultural use" and "dye and varnish, in water medium, for construction" recorded a positive price change.

Basic metals: comparing March 2019 with February 2019, the prices changed 0.83%, interrupting a sequence of five negative changes. The prices in basic metals are a match of the results of steelmaking groups – linked to steel products – and of non-ferrous material groups – copper, aluminum and gold –, which show a different behavior in terms of prices. The steel group was affected by the need to deliver the Chinese steel, after restrictions to trade it in other countries, as well as by the fluctuation of the values of iron ore. Concerning the non-ferrous materials, the prices used to change according to the international commodity markets, especially the London Metal Exchange.

The rise in the prices in this activity in March 2019 was mainly due to the group of non-ferrous materials, i.e., those that are not steel products. The three products that stood out with positive influence were: "aluminum oxide (calcined alumina)", "copper and copper alloys bars, profiles and rebars" and "gold for non-monetary use". In the steel sector, "carbon steel ingots, blocks, rods or plates" exerted a negative influence. Together, the four products influenced 0.64 p.p., remaining 0.19 p.p. for the other 20 products.

In the cumulative index in the year, this activity recorded the second biggest price reduction in the IPP (-1.61%), and, even so, posted a cumulative change of 7.29% over the last 12 months – 29th consecutive positive change in this type of indicator.